If a management team is any good at running a public company then the numbers contained in a results statement should often be something of a non-event.

It means those at the top have done a good job of setting expectations for revenue and earnings ahead of time – both in the background through briefings with the financial community and in publicly-available trading updates – and there is little for the market to pick over. This is why the focus is so often on the surrounding commentary and outlook, which has the additional bonus of offering forward-looking insights.

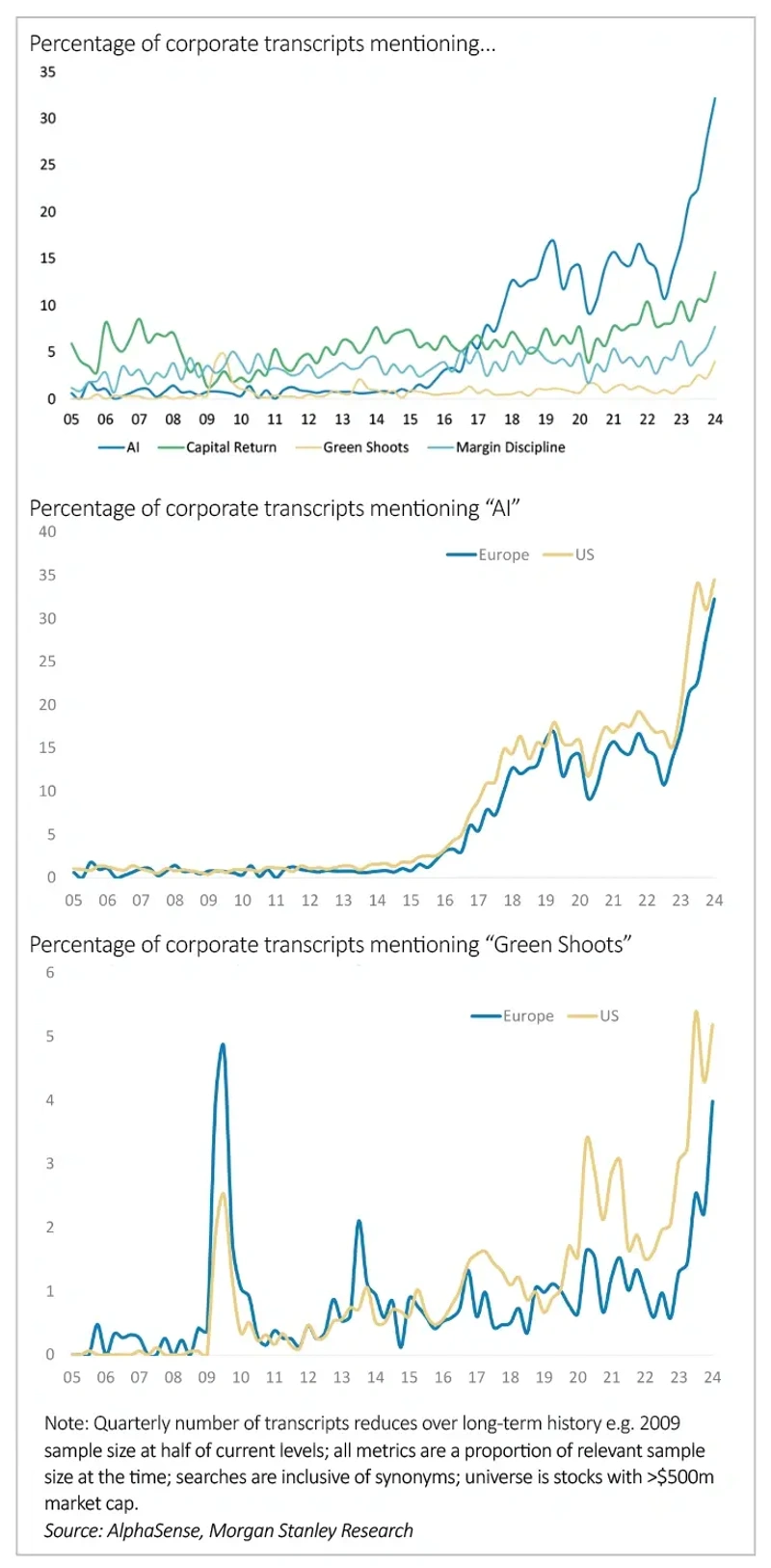

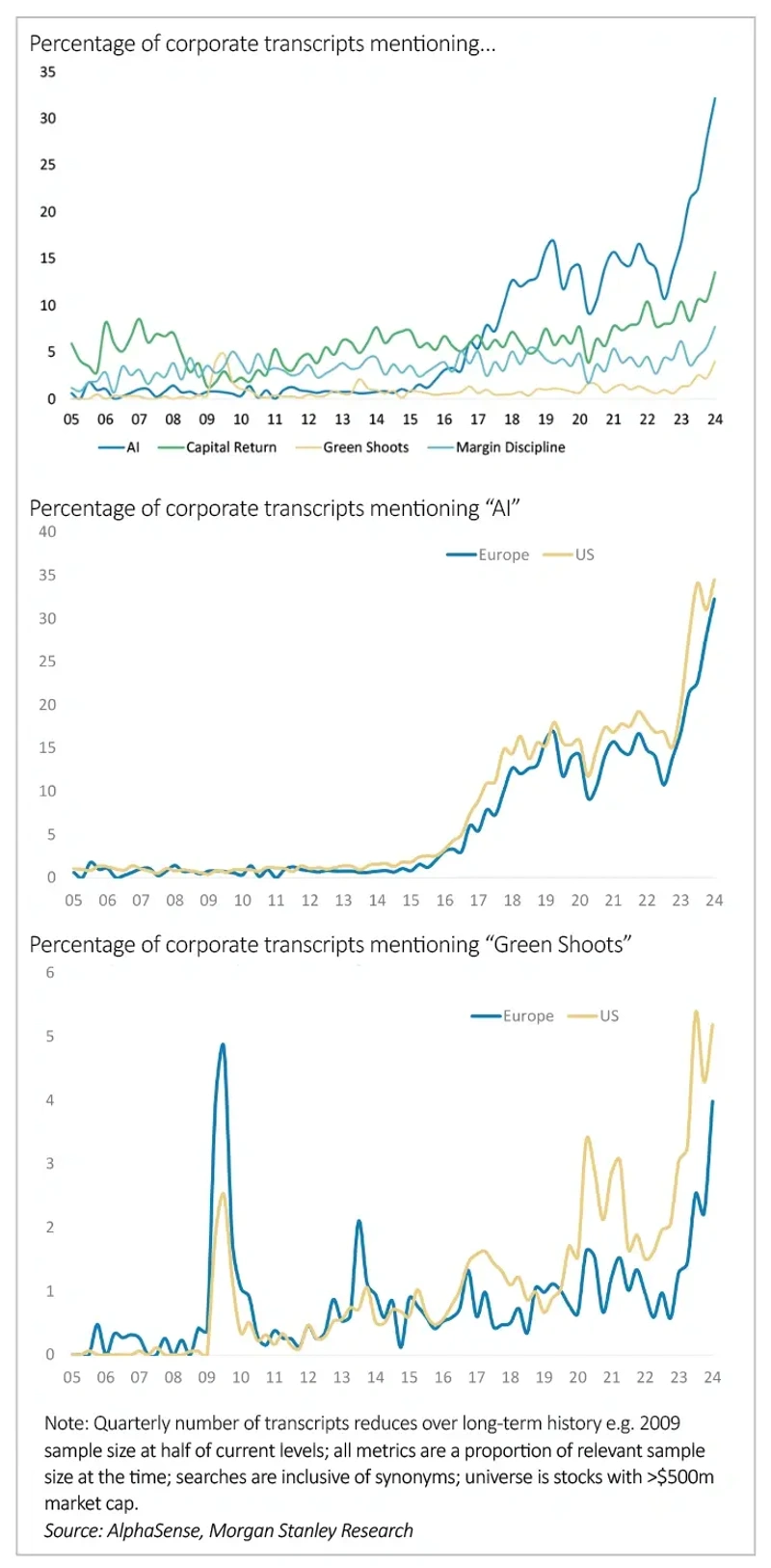

Analysts at investment bank Morgan Stanley have carried out an interesting analysis of company-level commentary across Europe to examine which themes are cropping up most right now, how that compares with the past and the wider story that tells us.

Appropriately enough the top theme, which, surprise, surprise, is AI (artificial intelligence), was used to power Morgan Stanley’s AlphaSense LLM (large language model) technology which parsed more than 300,000 transcripts from the last 20 years.

The results from the current earnings season show 32% of European companies discussed AI, while the number of companies mentioning ‘energy costs’ has dropped from 40% at the at the 2022 peak to 21% and there was a steady rise from lows in the mentions of ‘layoffs’. Encouragingly, the term ‘green shoots’ is also rising in prominence.

The team comment: ‘In most cases, Europe is following the US trend but in several important areas Europe is leading in terms of the proportion of companies mentioning a theme. In addition to ESG and ‘Energy Transition’, we see a higher proportion of European companies mentioning “efficiency”, deleveraging, “capex cuts”, “cost cutting” and M&A. Notable areas where Europe lags are “consumer strength”, “capital returns/buybacks” and AI.’

‹ Previous2024-03-28Next ›

magazine

magazine