Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Buy underappreciated Gaming Realms before the market recognises its true worth

Gaming Realms (GMR:AIM) 31.6p

Market cap: £93.4 million

For the uninitiated, Gaming Realms (GMR:AIM) is a leading business-to-business licensor and distributor of games to the regulated gaming market.

The company owns the IP (intellectual property) to the Slingo brand, one of the most popular formats of games played online.

As the name suggests the format is a mash-up of slots and bingo. The game in its various formats has been played billions of times since its invention in the US in the 1990s.

The company’s other significant asset is an internally-built remote RGS (remote game server) which allows it to distribute and integrate games to third parties.

After purchasing the Slingo IP in 2015, Gaming Realms began to commercialise the game by licensing it to gaming companies.

Starting from a low base, growth has been impressive. Revenue has grown at a CAGR (compound annual growth rate) of 30% per year and is expected to reach £27.3 million in 2024 while net profit has grown at a CAGR of 44% a year.

Shares believes the business is only in the foothills of its global growth journey. Past investment in the SAAS (software-as-a-service) platform and strong relationships with gaming operators provide a solid base to convert an increasing amount of revenue growth into profit and cash flow as costs remain relatively fixed.

Peel Hunt’s leisure analyst Ivor Jones projects revenue to grow around 14% per year and pre-tax profit to more than double over the next three years. The business is forecast to generate almost £30 million of free cash flow from 2023 to 2026.

The shares trade on a lowly 2024 PE (price-to-earnings) ratio of 9.5 times based on Jones’ EPS (earnings per share) estimate of 3.3p which looks like a bargain relative to the growth prospects.

With no debt and an estimated £14.5 million of cash on the balance sheet at the end of 2024, Jones says, ‘it is therefore relatively low risk and well-placed, in our view, to contemplate returning capital to shareholders’.

The cherry on the cake is the roughly £31 million pounds of tax losses carried forward which may tempt a corporate bidder out of the woods.

Gaming Realms’ management is executing its growth plan without seemingly missing a beat and is ably steered by chief executive Mark Segal and executive chair Michael Buckley, joint co-founders of the business.

It is also noteworthy that Mark Blandford, gambling industry veteran and co-founder of SportingBet (now part of Entain (ENT)), is a shareholder and non-executive board director.

MULTIPLE GROWTH DRIVERS

There are three clear growth levers available to the company. The first is developing new games to build on the number of games it currently distributes. In 2023 Gaming Realms grew the number of games by 15% to 75 and the number of unique players increased by 24%.

Not all the games available on the platform have been licensed by all the operators, which represents another layer of growth on top of developing new games.

The second growth lever is to increase the number of gaming operators. From a humble start in 2018 serving four operators, today the company has relationships with 180 operators.

The company added 44 licensees in 2023 including Bet365, and the state lottery in Ontario, Canada.

Most gaming companies run global businesses and this represents the third growth lever as operators introduce Slingo-style games across a greater number of territories.

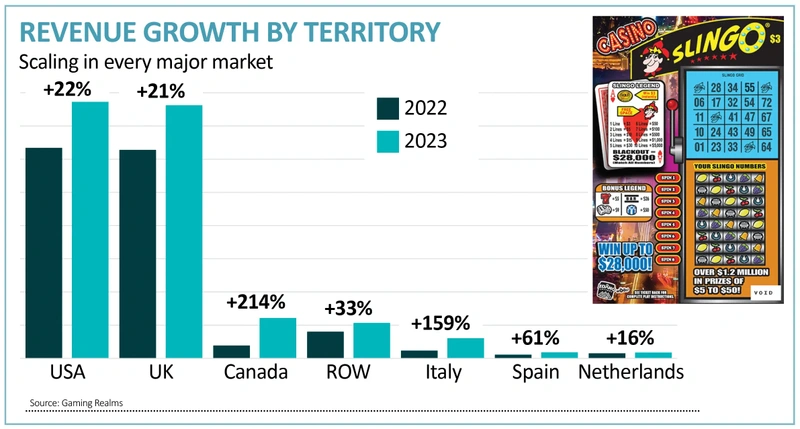

The US market is now the largest territory for the company, and US revenue grew by 22% in 2023. The US is expected to see 61% online casino growth from 2024 to 2028 according to industry consultants Eilers & Krejcik Gaming.

Gaming Realms is starting to scale in multiple markets outside the US and generated 214% revenue growth in Canada and 159% in Italy in 2023.

Looking ahead to 2024, the company is expected to go live in Greece, South Africa, West Virginia and British Columbia among other territories.

In summary, we believe Gaming Realms is entering the sweet spot of its growth trajectory whereby profits and margins expand faster than revenue leading to an increase in shareholder value.

Savvy investors should consider taking advantage before the market fully appreciates this lower-risk investment opportunity.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Daniel Coatsworth

Feature

- Tap into micro caps for a slice of UK innovation

- Chinese manufacturing PMI data needs to be closely watched

- Emerging markets: China rebound, Indian elections and valuations

- Small World: read about Gresham Technologies, T Clarke, REDX Pharma and more

- Are corporate spin-offs a good hunting ground for profitable investments?

- Dividend Machines

- Why Darktrace is getting exciting again

Great Ideas

Investment Trusts

News

- Ocado shares wobble after M&S relationship turns sour

- United Airlines soars on upgrades despite Boeing-related hit

- Retail sales not as bad as reported, while consumer confidence rises slowly

- Warnings from chip giants cast doubt over semiconductor optimism

- FTSE 100 finally joins the new-highs club despite being unloved for years

magazine

magazine