Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Weight loss 2.0: What next for the companies at the forefront of fighting global obesity

Investor excitement surrounding weight-loss drugs has arguably been as great if not greater than that seen for everything AI (artificial intelligence) in the last two years.

Market leaders Novo Nordisk (NOVO-B:CPH) and Eli Lilly (LLY:NYSE), makers of Wegovy and Zepbound respectively, have seen their share prices soar as investors seemingly extrapolate their initial success years into the future.

Beneath that sunny narrative there are clouds building in the form of greater competition, increasing scrutiny of the high price of the drugs and new evidence suggesting increased health risks.

This article explores each of these risks to provide a wider context for readers and to answer the question of whether the potential rewards outweigh those risks.

According to healthcare consultancy group IQVIA (IQV:NYSE) there are currently around 120 obesity drugs in development, which speaks to the potential barrage of competition coming down the track.

That is why both Eli Lilly and Novo Nordisk are investing heavily in new capacity to satisfy the huge demand and stay one step ahead of future competition. Currently demand outstrips supply and is likely to remain that way for the next couple of years.

Lilly has more than doubled its spending on a Lebanon manufacturing site to $9 billion to boost capacity, making it the largest investment in the company’s history.

For its part Novo Nordisk announced plans to invest $6 billion in a Danish site which makes semaglutide, the active ingredient in both Wegovy and Ozempic, which treats Type 2 diabetes.

Production involves a complex fermentation process and according to experts Lilly’s active ingredient is even harder to manufacture. This means new production facilities can take several years to come fully on stream.

As well as producing active ingredients, another bottleneck is the fill-finish process. Both production challenges have seen Lilly and Novo increasingly leaning on outsourced contract manufacturers.

According to the Financial Times, US firms Thermo Fisher Scientific (TMO:NYSE), Catalent (CTLT:NYSE), Simtra and German-based Vetter control more than half of the fill-finish market.

National Reliance is a US contract manufacturer which sprang up during the pandemic and specialises in fill-finish for injectable cancer drugs. The company will fill Lilly’s Zepbound injector pens at its Cincinnati plant with a total capacity of 200 million doses a year by 2025.

Some experts believe contract manufacturers do not have enough capacity to fully meet the demand from Lilly and Novo which implies little in the way of spare capacity for the next three to five years.

One solution could be daily oral pills rather than weekly injectables, which both companies are developing. Analysts at Barclays believe an oral pill could create its own supply problems given a 50mg dose of Novo’s semaglutide requires 146 times more active ingredient than a weekly injection.

COMPETITION IS COMING

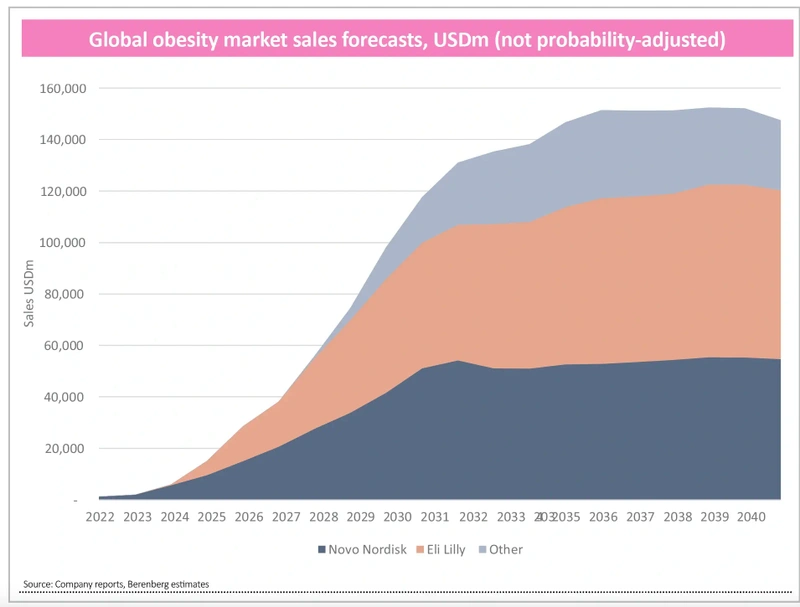

It seems inevitable that such a large potential market will attract competition. Analysts at Berenberg recently upgraded their forecast for the weight-loss market to around $150 billion by 2025, up from a prior forecast of $125 billion.

The most likely usurpers of the current duopoly (a market controlled by two competitors) according to Berenberg include biotechnology giant Amgen (AMGN:NASDAQ), Roche (ROG:SWX), AstraZeneca (AZN) and Danish biotech Zealand Pharma (ZEAL:CPH).

Amgen is expecting phase three data for its obesity drug candidate MariTide by the end of 2024, which, if approved, could enter the market by 2026.

Phase one data is expected for Roche’s weekly injectable obesity candidate CT-388 as well as its oral version CT-966, while we may also see phase one data from Astra’s oral obesity drug candidate AZD5004 by the end of 2024.

Zealand Pharma has created quite a stir as a potential disrupter in the weight-loss field, helping its shares jump three-fold in the last 12 months.

In June, the company announced positive headline results in an early-stage trial of its obesity drug candidate Petrelintide, an alternative treatment which showed meaningful reductions in body weight with a greater tolerability profile than existing weight loss drugs.

Zealand’s chief medical officer David Kendal says: ‘These results support our conviction that Petrelintide is very well tolerated and can potentially play an important role as an alternative to incretin-based therapies for the management of overweight and obesity’.

The company raised $1 billion in fresh equity on 20 June through a private placement to support the development of its novel weight-loss treatment.

Fund managers Ailsa Craig and Marek Poszepczynski at International Biotechnology Trust (IBT) believe the entrance of new players should be positive.

‘In the long term, the entry of these new players should stimulate healthy competition, lead to better treatment options, and potentially result in lower prices for patients,’ they said.

‘Various companies are developing new solutions to address the limitations of current injectable drugs, aiming for improved tolerability, better efficacy, and more convenient administration methods, such as oral options vs the current injectables,’ added the fund managers.

Meanwhile, the two incumbents are not standing still. Novo is expecting phase three data from its latest generation of obesity drug CagriSema by the end of the year. Analysts expect it to leapfrog Lilly’s Zepbound and to deliver greater weight-loss potential.

In the second half of 2025 Lilly’s oral obesity drug candidate Orforglipron is expected to release phase three data while an improved version of Zepbound is expected the following year, yet again raising the weight-loss bar.

Berenberg believes the current duopoly will remain in place longer term and expects Lilly to have a leading 45% share of the weight-loss market by 2035 followed by Novo at 35% and the rest having to make-do with 20% of the pie.

Fund manager Alex Hunter at Sarasin Partners also believes the duopoly has staying power. Part of his reasoning is that while future iterations of weight-loss drugs will be more effective with fewer side effects, the pace of improvement will be incremental, and less likely to displace incumbents.

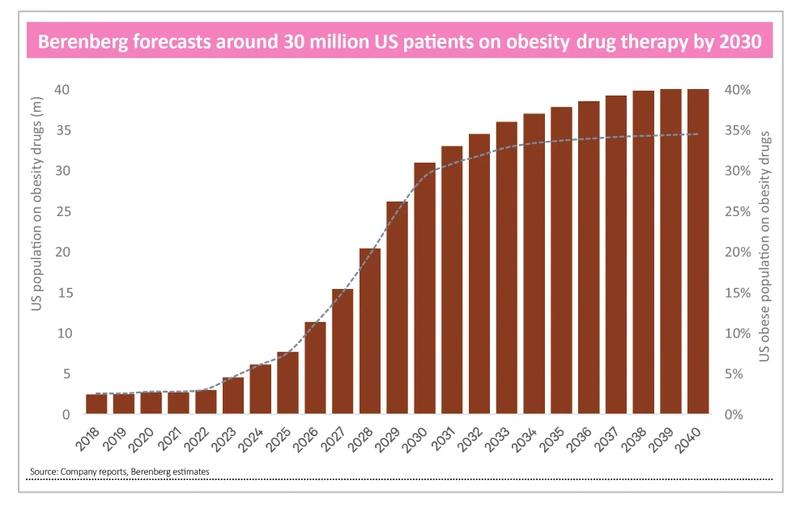

There are around 100 million obese people in the US of which only four million currently receive treatment. Berenberg is projecting a third will be taking obesity drugs by 2035 and 40% by 2040.

Novo estimates around a third of patients taking Wegovy suffer from three or more conditions including cardiovascular disease, sleep apnea (breathing stops and starts during sleep) and liver disease.

Positive late-stage clinical trials suggest weight-loss drugs could offer effective treatments for other diseases which Berenberg believes could expand the market further.

For context, in the US there are around 50 million people on statins to treat high cholesterol and 100 million on antihypertensive drugs according to Berenberg.

Outside the US, analysts forecast around 10 million people will be taking obesity drugs by the end of the decade, more than double the number in 2023.

POLTICAL PRESSURES

US president Joe Biden and senator Bernie Sanders have called on Novo Nordisk to cut prices of its obesity drug Wegovy and diabetes drug Ozempic.

In an opinion piece written for USA Today, Biden and Sanders said it could cost $411 billion per year assuming only half of obese Americans took Novo Nordisk’s and Eli Lilly’s weight-loss drugs which is $5 billion more than the US spent on all prescription drugs in 2022.

They argue that without political intervention the weight-loss drugs have the potential to bankrupt the US healthcare system.

‘If Novo Nordisk and other pharmaceutical companies refuse to substantially lower prescription drug prices in our country and end their greed, we will do everything within our power to end it for them. Novo Nordisk must substantially reduce the price of Ozempic and Wegovy,’ they said.

Both companies have pushed back. Novo Nordisk said it had reduced the cost of Ozempic and Wegovy by 40% since launch and over 80% of Americans eligible for insurance only pay $25 or less per month.

The drugs cost around $1,000 and $1,349 per month respectively according to the company’s website. Lilly’s diabetes drug Mounjaro costs around $1,100 per month but can be purchased for around $25 per month by customers eligible for the company’s savings card programme.

Berenberg estimates diabetes drugs will attract rebates of 70% by 2027 equating to a net price per month of around $350.

THE ROLE OF ULTRA-PROCESSED FOODS IN WEIGHT GAIN

Obesity has reached pandemic proportions with the number of sufferers more than doubling since 1990 to 890 million according to the WHO (Worldwide Health Organisation).

There is a growing movement which believes ultra-processed foods or UPFs have contributed to the pandemic. UPFs are not strictly foods, but synthetic industrially processed substances which look, feel and taste like food.

Fund manager Daniel Babington at TAM Asset Management explained to Shares some of the characteristics of UPFs and how they contribute to weight-gain and related diseases.

There is increasing evidence that UFPs interfere with proteins in the gut designed to signal to the brain when the stomach is full, resulting in over consumption.

That is primarily due to UPFs having very poor nutrition and characteristics which encourage overconsumption.

For food companies UPFs reduce the cost of production, increase shelf life and enhance flavour and textures. Large food companies have funded research denying any link of UPF to obesity and related diseases like diabetes and cancer.

LONG-TERM HEALTH EFFECTS

Another potential bump in the road for obesity drugs comes from a new study which suggests increased health risks.

Results of a study released on 25 June by the JAWA Network Open medical journal showed patients taking an earlier version of Novo Nordisk’s diabetes drug Saxenda experienced a decline in bone density in the hips, spine and forearm.

The findings are based on new analysis of a study first published in 2021 which tracked 195 obese participants being treated with Saxenda with some taking exercise and some not taking exercise.

In the group doing exercise and taking the drug, bone density was preserved while those just taking the drug experienced a decline in bone density which can lead to bone fractures.

Associate professor at the University of North Carolina’s school of medicine John Batsis said these types of fractures can lead to ‘increased morbidity and mortality, functional impairment and disability’.

Another potential hurdle for obesity drugs in the US is insurance coverage. IBT fund managers Craig and Poszepczynski observe: ‘Medicare generally does not provide coverage for obesity drugs, and Medicaid coverage varies by state.

‘Pharmaceutical companies do offer patient assistance programs, but inconsistent reimbursement policies and high costs limit access for a significant number of patients.’

ARE NOVO AND LILLY TOO RISKY TO BUY?

Just because the share prices of Novo and Lilly have shot up 468% and 814% respectively over the last five years and trade at premium valuations to the market average does not necessarily mean they are too expensive.

The important consideration is how the potential growth stacks up against valuation and how durable growth turns out to be. In general, higher than average valuations imply stronger and longer growth.

Fund manager Alex Hunter at Sarasin Partners told Shares he believes investors have got it roughly right, and the valuations are rational. Hunter owns Lilly over Novo based on his view it has a better risk to reward.

A common way to evaluate fast-growing companies is to compare the forward PE (price to earnings) ratio to expected EPS (earnings per share) growth. Growth investors like Mark Slater use the price to earnings growth or PEG ratio as an indicator of value.

Let’s look at consensus expectations and compare them to valuations, based on the one year forward PE ratio.

Novo trades on a 2024 PE of 41.6 times and is forecast to growth EPS at a compound annual growth rate of 17.5% a year between 2023 and 2028.

Lilly has a forward PE ratio of 65.5 and is forecast to deliver an annualised EPS growth rate of 45% a year over the same period.

Therefore, Novo has a PEG of 2.3 times (41.6/17.5) and Lilly has a PEG of 1.4 times (65.5/45). For reference, the MSCI World index has a PEG of 2.5 times according to Gerrit Smith, fund manager at Stonehage Fleming.

The durability of Novo’s and Lilly’s current dominant market positions will ultimately determine if the shares continue to outperform the market long term.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

News

- The biggest gainer on the S&P 500 this year is up 145%, and it isn’t Nvidia

- Entain shares plumb four-year low after latest profit downgrade

- No pain relief for shareholders in consumer goods group Reckitt Benckiser

- McDonald’s sales drop shows customers are no longer ‘lovin’ it’

- Bumper share buyback unveiled by IT reseller Computacenter

- MicroStrategy set for 10-for-one share split

magazine

magazine