Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Palantir priced for perfection in an imperfect landscape

Some years ago, a UK technology supplier listed in London was quietly acquired by defence contractor BAE Systems (BA.). The £538 million buyout price was small, yet Detica, as it was called, had developed a reputation for providing its services to international militaries and intelligence communities, including GCHQ, the UK’s national intelligence centre.

The nature of its hush-hush work often put it at odds with international investors who value openness and transparency. Which provides a useful jumping-off point to talk about Palantir (PLTR:NYSE).

International investors have seldom encountered an equity story quite like Palantir, the company co-started by Peter Thiel, a prominent Silicon Valley figure, co-founder of PayPal (PYPL:NASDAQ), Founders Fund and an early investor in Facebook, now Meta Platforms (META:NASDAQ).

Part software company, part consultancy, Palantir’s work with US government agencies and intelligence communities lends it a mystique that not all investors embrace.

Yet the shroud of secrecy that envelopes much of its work has not prevented the company luring backers. This year the shares have roughly doubled to $32.50 giving the company a market cap of nearly $73 billion. When the business listed on Wall Street in 2020 at $10 per share, its market value was just over $20 billion.

COMMERCIAL SEGMENT GROWTH

What is also interesting about the past couple of years is how Palantir has moved the dial of its non-government commercial revenues, a direction of travel forecast by analysts since before its IPO (initial public offering). ‘The commercial sector is the growth story for the company as it expands beyond government clientele,’ wrote Beth Kindig, lead tech analyst at the IO Fund, in 2020.

Heading into 2024, Palantir had been demonstrating multiple signs of acceleration from strong growth in its US commercial segment, driven by AIP, its Artificial Intelligence Platform which lets customers lever its AI (artificial intelligence) and ML (machine learning) tools and harness the power of the latest large language models of data.

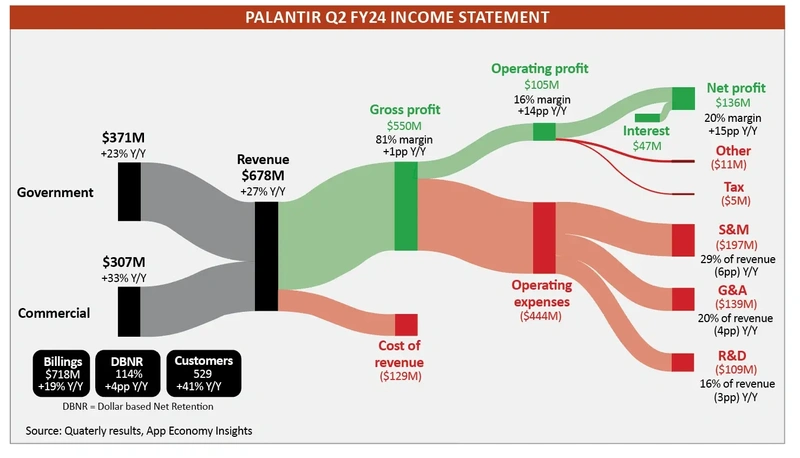

Palantir’s first-quarter government/commercial revenue growth split was 16%/27%, rising to 23%/33% in the second quarter. Commercial is still the junior partner, but only just, at $307 million in Q2 versus $371 million for government revenue.

In the first quarter of this year, the firm added 41 net new customers in the commercial segment, an increase of 69% year-on-year and 19% quarter-on-quarter, accelerating from 55% year-on-year in the previous quarter. Interestingly, Palantir is also successfully expanding beyond its US backyard.

As has been the case since the launch of AIP just over a year ago, Palantir is continuing to witness elevated interest and high demand with management saying ‘continued interest is loud and clear’.

Seeding the demand are Palantir’s AIP bootcamps, which bring potential customers and developers together for intense teach-ins to demonstrate what AIP can do for them.

Palantir had completed 560 bootcamps across 465 organisations by February 2024, tacking on an additional 450 organizations in the months since.

As one example, a leading utility company signed a seven-figure deal just days after completing a bootcamp, Palantir said. Another customer immediately signed a paid engagement after just one day of their multi-day bootcamp and then converted to a seven-figure deal three weeks later. ‘We have seen Palantir’s quarterly deals accelerate following AIP’s launch, but we have also seen a larger proportion of deals on the smaller end, between $1 million and $5 million,’ said IO Fund’s Kindig.

SIGNIFICANT CHALLENGES

There are challenges to deal with, not least the admission from Palantir itself that its AIP sales execution is far from optimal. ‘We are good at educating customers on what is the art of the possible, and then some portion of those customers buy it. So, I expect as we get better and better at that, our numbers will increase,’ said Alex Karp.

‘But it is really early days. We’re not flawlessly executing on our sales motion.’

Europe presents another possible headache. About 16% of Palantir’s business is in Europe but the region is ‘gliding towards zero percent GDP growth over the next couple of years. That is a problem for us. There is no easy remedy for that.’

Then there’s the battle to change the narrative around the company, seen by some as the face of Big Brother, gobbling up individuals’ private data. This became evident following a public backlash from some quarters after Palantir was awarded a £330 million NHS England contract to develop a new patient data platform.

Palantir only turned an annual net profit for the first time in 2023 so it is early days and there seems no fundamental reason why it cannot overcome the challenges it faces, in time. But with the stock priced for perfection, don’t expect smooth sailing.

Full year 2024 (to Dec) revenue estimates range from $2.68 billion at the low end to $2.80 billion on the high end. ‘That’s about 4.4% higher than Palantir’s guidance, suggesting analysts are expecting business momentum to accelerate each quarter with a beat and raise,’ says Kindig.

Looking further out, Stockopedia has the stock trading on a 12-month rolling PE (price to earnings) multiple of 79, a hefty premium to other leading software stocks: Salesforce (CRM:NYSE) and Microsoft (MSFT:NSASDAQ) trade on rolling PEs of 25 and 31 respectively. Palantir’s earnings growth is seen around 22% in 2025. If that pace were to dip below 20%, the stock’s substantial premium could quickly be whittled away.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Ask Rachel

Feature

Great Ideas

News

- Watkin Jones shares pummeled on cut to guidance

- Beeks Financial Cloud scales new all-time high after record results and contract extension

- Powell signals start of interest rates cuts at Jackson Hole

- Will UK shop price deflation open the door to a September rate cut from the Bank of England?

- Temu parent PDD sends warning on Chinese consumers

magazine

magazine