Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Revisiting the Triffin dilemma as Trump's election victory sees dollar soar

Fans of Gene Roddenberry’s long running Star Trek television and film franchise will know that any would-be captain of a Starfleet vessel had to complete the so-called Kobayashi Maru test, a simulation from which there was no way out, to see how they responded to extreme pressure. The first captain of the USS Enterprise, James T. Kirk, earned his place at Starfleet Academy by reprogramming the computer that ran the test, to ensure there was a way to rescue a marooned ship, avoid starting a war and escape unscathed. It will be interesting to see how America’s president-elect, Donald Trump, seeks to wriggle out of a potential no-win scenario that he may face in the coming four years.

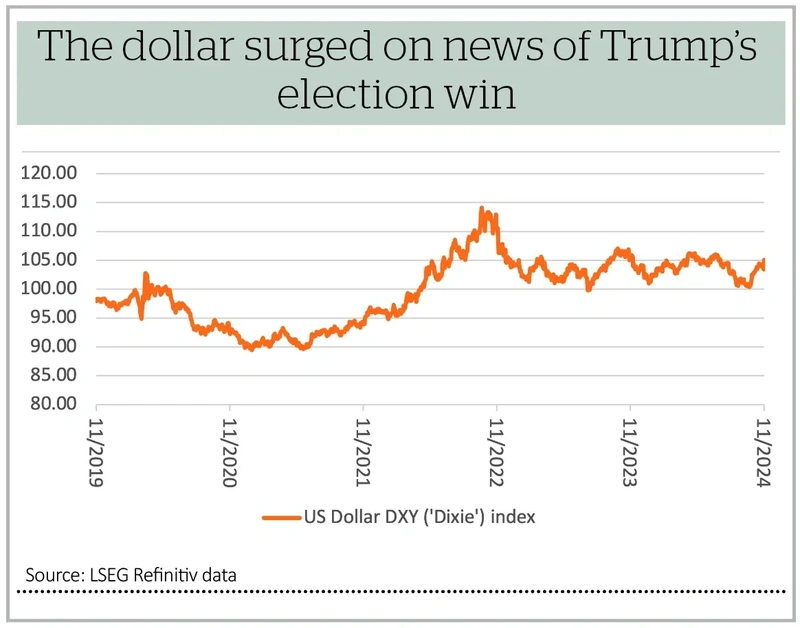

This is because Trump may just find himself on the horns of a dilemma when it comes to the US dollar. Upon news of the victory achieved by the Republican Party candidate in the 60th presidential election in US history, the greenback surged and all but wiped out the losses suffered over the summer.

But rhetoric during his previous presidency, and also comments from vice-president elect J.D. Vance in the 2024 campaign, suggest Trump prefers a weak dollar, as a means of boosting exports. Trump spent his first spell in the White House badgering the US Federal Reserve for interest rate cuts, and looser monetary policy could also weaken the dollar, at least if the Fed lowers headline borrowing costs either faster than expected, or faster than its global peers.

It will therefore be interesting to see what, if anything, Trump has to say about the bouncy buck. This issue has implications and also for the world, at least if the Triffin Dilemma has anything to say about it.

TRIFFIN TOPICAL AGAIN

The current world monetary system was set up in 1971, when then US president Richard M. Nixon and treasury secretary John Connally took America off the gold standard, effectively killing the Bretton Woods system set up toward the end of the Second World War. Bretton Woods had replaced the pound with the dollar as the globe’s reserve currency, pegged other currencies to the US currency and in turn to gold, for which they could exchange greenbacks.

The idea was that America, the world’s economic superpower, could not easily run a cheap dollar policy and export its way to total dominance or be fiscally imprudent at home. A soaring gold price (or tumbling dollar) would be the sign than the US was printing - and devaluing – dollars.

Professor Robert Triffin spotted the catch in a book he wrote in 1960, Gold and The Dollar Crisis: The Future of Convertibility. He argued that the greenback’s global reserve currency status would come at a cost – either to America or the world.

This is the potential scenario that faces the new Trump administration. The current system is all well and good while confidence in the dollar remains, lenders are happy to hold US treasuries and the US is happy to run a trade deficit. But it becomes a problem if lenders lose faith (as they did briefly in 2008) or America’s trade policy is changed.

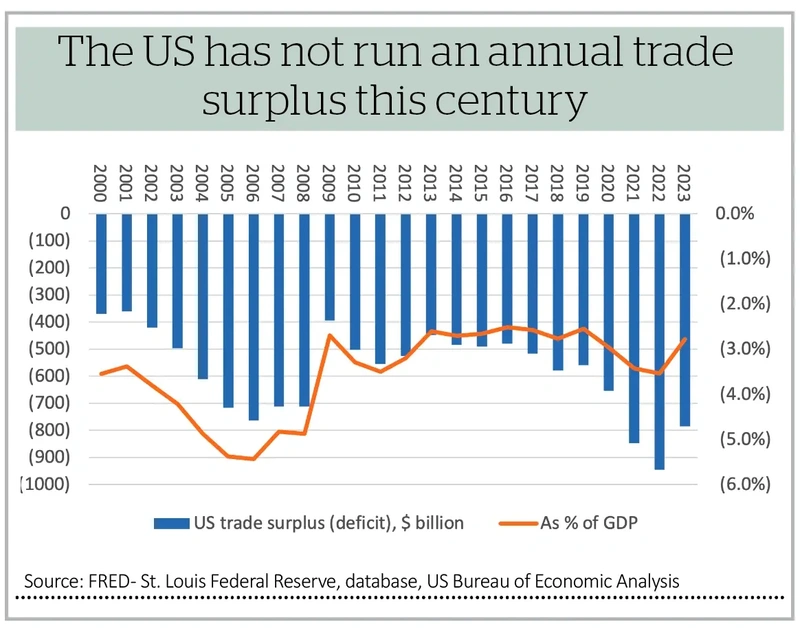

This is where president Trump enters the equation. America’s last trade surplus was 1975, according to the US Bureau of Economic Analysis, and Trump’s first administration made little or no dent in the annual trade deficit. If he succeeds this time around, and America sells more than it buys, dollars will flow back to the US and drain the global economy and the world’s financial markets of the greenbacks and liquidity upon which they are reliant.

EMERGING ISSUE

As noted in this column two weeks ago commodity prices generally struggle under a strong dollar, and so do emerging markets, the former because a higher greenback increases the cost of raw materials for non-dollar users, and the latter because their dollar-denominated debts become heavier and more expensive to service. In short, a strong dollar is inherently disinflationary, even deflationary for the world.

This is the potential no-win scenario that faces the new Trump administration. His policies are designed to boost US economic exports, output and growth. But if they prove so successful that the dollar advances strongly as a result, then the damage to the rest of the world could be considerable and perhaps enough to deprive America of the buyers of its exports for which it longs.

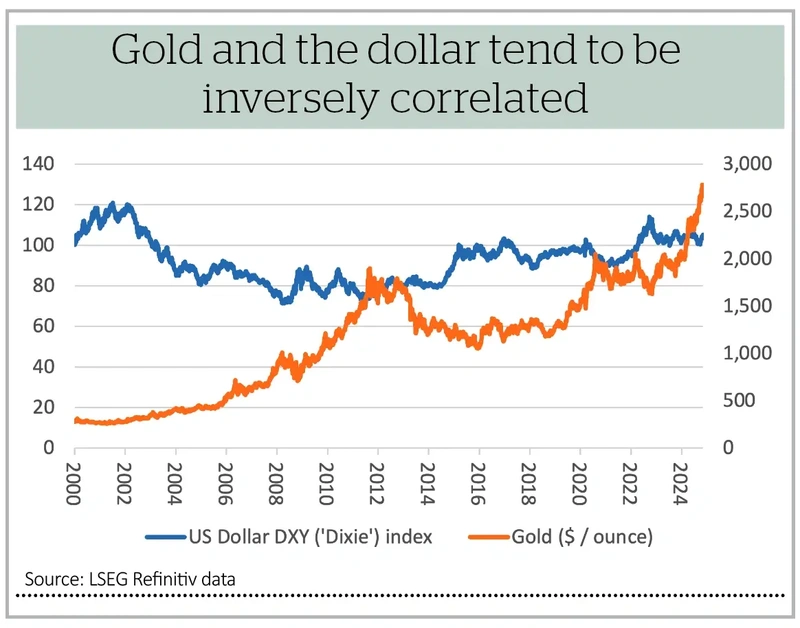

There is no computer for Trump to reprogramme. It may be that his threat of across-the-board tariffs on US imports is no more than a bargaining tool, but investors will need to watch the trade-weighted dollar (DXY) index, any comments from the president-elect on US Federal Reserve policy and the gold price for clues as to what may be coming next.

The precious metal may be the biggest ‘tell’ of all. If Trump fails – or backs off – and the US keeps piling up a fiscal deficit as well as a trade one then gold could thrive, not least as such an environment would smack of plentiful dollar supply and greenback weakness (especially if the Fed resorts to lower interest rates, or even a return to quantitative easing, to keep the national debt and associated interest bill manageable). If he succeeds, renewed faith in paper dollars would perhaps lessen even gold bugs’ ardour for the precious metal as a store of value.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine