Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Stock pick for 2025: Niche defence and security firm Cohort is a hidden gem

Ongoing conflicts in Ukraine and the Middle East and calls from incoming US president Donald Trump for NATO members to increase defence spending as a percentage of national income will continue to provide a tailwind for the defence sector.

AIM-quoted Cohort (CHRT:AIM) is well positioned to benefit from an increase in defence spending and at the first-half results on 11 December, the group disclosed a record order book of £541 million, representing around 99% of consensus revenue expectations for the year to the end of April 2025.

Analysts continue to underestimate momentum in the business as reflected in persistent upward revisions to consensus earnings per share estimates for 2025 and 2026 which means today’s estimates are 20% and 40% higher than a year ago. This trend should continue to support the shares.

The company is differentiated from other defence contractors in that Cohort acts as the parent company overseeing six innovative and agile businesses which provide a range of products and services for UK, German, Portuguese and international customers in defence and related markets.

This decentralised approach allows the individual businesses to prosper and respond more flexibly to customers’ needs and grow and deepen customer relationships.

The proof of the operating model can be demonstrated by the financial success delivered by the group. The dividend has increased by more than 10% a year over the last three years and has increased every year since IPO (initial public offering) in 2006.

Revenue has increased at a compound annual growth rate of 11% a year over the last five years, while operating profit has grown at a CAGR of almost 30% a year reflecting rising margins. Free cash flow has grown at a CAGR (compound annual growth rate) of 20% a year.

WHAT IS THE STRATEGY?

Cohort’s strategy is to grow organically by exploiting its competitive advantages and make selective bolt-on acquisitions where the company sees an opportunity to increase profitability and gain access to new markets.

The company is also on the lookout for standalone businesses which offer growth potential and sustainable competitive advantages that are ready to join a larger group.

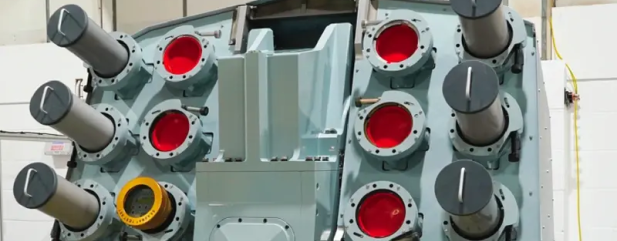

A good example of the type of deal Cohort targets is the recent purchase (21 November) of leading Australian-based developer and producer of high-end SATCOM terminals for global naval and defence customers, EM Solutions, for around £75 million.

The acquisition enhances the company’s existing defence and communications offering while gaining exposure to the naval surface vessel SATCOM (Satellite Communications) market which has strong structural growth drivers.

EM Solutions will also beef up the group order book to more than £650 million and is expected to be ‘materially’ earnings accretive in the first full year of ownership, in line with the company’s acquisition criteria.

Cohort financed the deal partly through an institutional and retail share placing, raising £40 million at a 4% discount to the prevailing share price. The balance sheet post purchase remains robust with net debt to earnings before interest, tax, depreciation, and amortisation of less than one.

TECHNOLOGY DRIVEN DEMAND

A key strength underpinning future success is the amount of money the group spends on research and development which increased 26% in the last financial year to more than £14.5 million, equating to around 7% of revenue.

The company’s six businesses are grouped under two divisions, the largest of which is sensors and effectors representing nearly 60% of group revenue and communications and intelligence representing the rest.

The UK remains the groups most important domestic market while internationally, rising tensions around the South China Sea are creating demand for naval systems demand in Australasia and Asia.

In summary, Cohort is a strong business with a proven track record of growth and of delivering shareholder value.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

- Emerging markets: tariffs, inflation and South Korean politics

- Profiling the South Korean stars beyond Samsung

- Find out which stocks surprised leading fund managers the most in 2024

- Surprise star turns and shock disappointments litter our best 2024 picks performance

- Discover how Tim Martin turned Wetherspoon into a high street champion

Great Ideas

- Stock pick for 2025: FRP Advisory is an exceptional company trading at an unexceptional price

- Stock pick for 2025: Fevertree Drinks is available at a knockdown price

- Stock pick for 2025: Niche defence and security firm Cohort is a hidden gem

- Stock pick for 2025: Auction Technology set to be bid up by the market

- Stock pick for 2025: Jet2's growth potential is not yet appreciated by investors

- Stock pick for 2025: Treatt has strong momentum under fresh leadership

- Stock pick for 2025: Kier has rebuilt its foundations and looks too cheap

- Stock pick for 2025: market set to toast a Diageo recovery

- Stock pick for 2025: GlobalData is worth backing as it goes for growth

- Stock pick for 2025: Alphabet is an AI winner for next year in the making

Investment Trusts

News

- UK stocks see October’s record outflow turn into net inflows in November

- SThree shares slump 28% after shock cut to earnings guidance

- Raspberry Pi shares boot up after fresh tie-up and new product launch

- Vivendi spin-off Canal+ marks biggest UK IPO of 2024

- Nasdaq hits new record as tech drives returns and investors lap up Bitcoin exposure

magazine

magazine