Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

How the obesity drug market is evolving in unexpected ways as we enter 2025

Out of nowhere the market for weight loss drugs has become one of the most exciting investment themes in the last two years, rivalling investor enthusiasm for AI.

There is good reason for the excitement. Rod Wong, managing partner at RTW Biotech Opportunities (RTW) fund describes the development of obesity drugs as the biggest ever financial opportunity in healthcare.

That is because obesity is the biggest disease challenging western society and linked to many of the top 10 causes of death including cardiovascular disease, stroke, cancer, and kidney disease.

Wong believes the creation of effective weight loss drugs is the first innovation in healthcare to create more than a trillion dollars in value.

To put that claim into context, the increase in market value of obesity leaders Novo Nordisk (NOVO-B:CPH) and Eli Lilly (LLY:NYSE) since 2020 is roughly £700 billion or $900 billion, most of which is attributable to the perceived value of their respective weight loss drugs.

Analysts forecast the obesity market could be generating an estimated $150 billion a year in sales by 2030.

The obesity landscape is likely to evolve rapidly in coming years and take some unexpected twists and turns. Later we discuss how global food companies are trying to piggyback off the success of weight loss treatments, but before that we describe the current state play in the healthcare space.

ARMS RACE HEATS UP

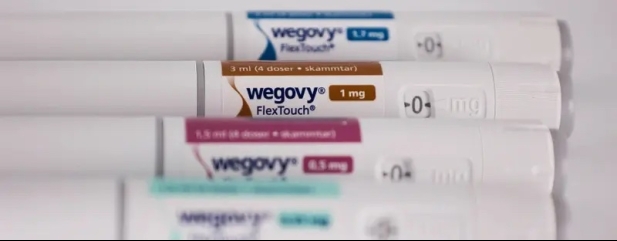

There are currently only two approved weight loss drugs on the market in the shape of Novo’s Wegovy and Lilly’s Zepbound, which launched in December 2023.

To the end of September 2024, Wegovy generated revenue of $5.4 billion while Zepbound raked in around $3 billion for Lilly. Despite the two-and-a-half-year head enjoyed by Novo, Lilly’s obesity drug is expected to narrow the gap quickly.

Analysts are forecasting Zepbound’s annual sales to reach $27.2 billion by 2030, overtaking Wegovy’s estimated $18.7 billion in annual sales.

In an interview with Bloomberg Lilly’s CEO David Ricks said he expects Zepbound to become the biggest selling drug ever for Lilly and the one of the best-selling drugs of all time. One of the key drivers behind this forecast is the extra weight loss that Lilly’s solution induces in patients compared with Novo’s Wegovy.

A head-to-head study released in December 2024 by Lilly showed that patients shed an average 20% of their bodyweight, far superior to the average 14% bodyweight loss for Novo’s Wegovy.

This is just the beginning of the arms race to improve effectiveness and reduce associated side effects. Both firms are working hard to maintain their effective duopoly and lead against competitors.

There are around 20 quoted global pharmaceutical and biotech companies which have entered the race to develop obesity drugs. The larger ones include AstraZeneca (AZN), Amgen (AMGN:NASDAQ), Pfizer (PFE:NYSE), Roche (RO:SWX) and Regeneron Pharmaceuticals (REGN:NASDAQ).

Novo and Lilly are also fighting against time because of the loss of patent protection, which for Wegovy is expected in the 2031/32 timeframe. Both companies are working on improved versions of their GLP-1 (glucagon-like-peptide-1 agonists) treatments which work by mimicking a protein in the gut which tells the brain it is full, reducing appetite and balancing blood sugars.

On 20 December Novo shares plummeted more than 25% after the company released results from a late-stage clinical trial of its next generation treatment, CagriSema which failed to live up to expectations. Although the drug induced a 22.7% average weight loss, an improvement on Wegovy, it was barely superior to Zepbound’s 20% weight loss.

Only 40% of patients lost the targeted 25% reduction in weight and many stopped early due to side effects including nausea and vomiting. Meanwhile Lilly is conducting late-stage trials with its own next generation treatment, Retatrutide with results expected by the end of 2025.

Current treatments are given via weekly injections and both companies as well as several others are working on a daily oral version which will likely open the market up to a wider population. Lilly is expected to release results from a late-stage trial of its oral GLP-1 formulation Orforglipron in the first half of 2025.

The obesity market appears to be a straight fight between the two incumbents given the extensive lead they have over competitors, but if there is one thing investors have learned within technology and science, it is to expect the unexpected.

Rod Wong told investors at an event in December 2024 that he expects the number of biotech competitors in the obesity space to triple over the next few years.

FOOD COMPANIES PIGGY-BACK WEIGHT LOSS BOOM

There was concern among investors that food companies would be negatively impacted by people eating less while on weight loss drugs. In 2024 retail giant Walmart (WMT:NYSE) said it saw evidence of a slight pullback in food consumption when people took the medication, which led to a sell-off in the share prices of food companies.

One of the world’s largest food groups, Swiss-based Nestle (NESN:SWX) has seen its shares underperform the FTSE World index by more than 80% since late 2022, when interest in obesity drugs started to take-off.

Perhaps unsurprisingly, Nestle has responded to the booming demand for weight loss drugs and is looking to participate in what management see as a new market opportunity. Nestle’s Health Science division has launched a platform called glp-1nutrition.com to respond to consumer needs for solutions while on weight-loss programmes.

GENERIC MAKERS MAKE HAY

So far, the US insurance industry has tried to regulate the pace of reimbursement for obesity drugs to reduce the financial burden.

This means none of the elderly over 65 years of age on the US government health plan Medicaid are eligible for subsidised obesity drugs and only around half of people on Medicare, the general health plan, get cheaper access to the drugs.

This makes a big difference because the list price for Wegovy in the US is around $1,350 per month while Zepbound is only a slightly more digestible $1,100 per month.

On average for those people with sone kind of insurance coverage the net cost is around $375 per month. As obesity drugs continue to demonstrate additional health benefits such as reducing the risks of stroke, sleep apnoea, kidney disease and cognitive decline, the more likely the insurance industry will increase access to them.

In any case, despite these restrictions and Novo and Lilly spending billions of dollars to build new manufacturing capacity, both companies have struggled to keep up with surging demand. This has led to shortages and in order mitigate the impact, the US FDA (Food and Drug Administration) has allowed certain licenced pharmacies to step in to ensure a consistent supply. These products are commonly referred to as compounders.

Although the pharmacies do not undergo the same FDA approval process as commercially available drugs, the compounds are procured from FDA registered and GMP (Good Manufacturing Processes) approved facilities.

Telehealth companies such as Hims & Hers Health (HIMS:NYSE) have benefited from advertising compounders at a fraction of the price of the branded drugs, generating as much a $1 billion for compounding pharmacies, according to Bloomberg. Hims & Hers shares have risen by 188% over the last year.

In December 2024 the FDA declared Lilly’s Zepbound was no longer in shortage which means the compounders have up to 90 days to stop making copycat drugs. In response to accusations of ‘flip-flopping’ by the FDA, the compounders have started litigation proceedings against the regulator.

The KitKat chocolate bars and Nesquik shakes maker has launched protein shots in the US which it claims suppress appetite by inducing a natural reaction in the body like current GLP-1 treatments, but with less potency.

The shake, called Boost Pre-Meal Hunger Support is designed to be consumed half an hour before a meal. The shots are sold at $10.99 for a pack of four on Amazon (AMZN:NASDAQ) and advertised as promoting a ‘natural GLP-1 response to a meal’.

Stephan Palzer, chief technology officer at Nestle told Reuters: ‘You get an increase in natural GLP-1 which helps in controlling the feeling of hunger. So, this dose has a significant effect on satiety’.

The formula used by Nestle has been patented but is not intended to replace weight loss drugs. Nestle conducted a study in 2021 on patients with type-2 diabetes which showed participants taking their whey protein shake saw a 22% reduction in glucose levels during the two hours after a meal, compared with participants on a placebo.

The approach of Nestle and other food groups is to focus on some of the shortcomings of current treatments, such as lean muscle loss to provide palatable solutions. Anna Mohl, CEO of Nestlé Health Science says ‘We have brands and expertise across our portfolio to support needs that can include preserving lean muscle mass, managing digestive upset, supporting an adequate daily consumption of micronutrients, and more.

‘Along with women’s health and healthy aging, GLP-1 companion products are a key solution that we’re focusing on,’ added Mohl.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Exchange-Traded Funds

Feature

Great Ideas

News

- Anpario’s fifth full-year upgrade in a row feeds further gains

- US wildfires could rank among the most costly natural disasters in country’s history

- Greggs shares hit a 52-week low despite sales hitting £2 billion milestone

- Is another upgrade cooking at Cranswick?

- Oil price hits six-month high amid sanctions and cold weather

- Why rising bond yields are testing equity investors’ risk appetite

magazine

magazine