Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why markets need more conversation and less action

A second wobble in US equities in seven months, following the summer squall of last August, is creating a fair degree of noise, if not panic.

Dyed-in-the-wool bulls will assert that the S&P 500 is down by just 9% from its high (at the time of writing), while even the Nasdaq’s 13% slide is no great drama in the context of the bull run seen since the Covid-inspired lows of early 2020. The S&P 500 is back to where it was in late August, the Nasdaq in mid-September, but such pullbacks, in recent times, have simply been chances to ‘buy on the dip,’ goes the bullish thesis.

Bears will have a different take. They will point to the almost parabolic gains of the past two years and the accompanying rise of meme stocks, one-day options trading, a new all-time high in margin debt in the US and what they would assert are many other classic features of markets that are becoming overheated – complexity, opacity and leverage (debt), right up to a leading figure in the cryptocurrency world buying and then eating a piece of art for which he paid $6.2 million.

For anyone worrying about the gentleman’s digestive system, the ‘art’ was a banana taped to a wall, but such devil-may-care behaviour does not usually characterise market bottoms, or end well. As John Maynard Keynes once tartly observed: ‘When the capital development of a country becomes a by-product of a casino, the job is likely to be ill-done.’

However, no-one, but no-one can time market tops (or bottoms) to perfection – even Warren Buffett was one to two years early when he went heavily to cash in the late 1990s and then again in the middle of the first decade of the new millennium ahead of the smashes of 1998-2000 and 2007-09.

One measure that could help investors test the market mood is volatility. The more we get of it, as crudely measured by the number of daily moves of more than 1%, 2% and 5% to the downside or upside, the less healthy the market probably is, at least if history is any guide. In this respect, a little more conversation and a little less action may be no bad thing, both on the stock exchange and in the White House.

SUSPICIOUS MINDS

The timing of the latest US equity market stumble, be it no more than that or a warning of something more malign, is notable for how it coincides with the 25th anniversary of top in the technology, media and telecoms bubble. The Nasdaq Composite peaked at 5,048 on 10 March 2000. It troughed at 1,114 on 9 October 2002 and then took thirteen years to recoup that crushing loss.

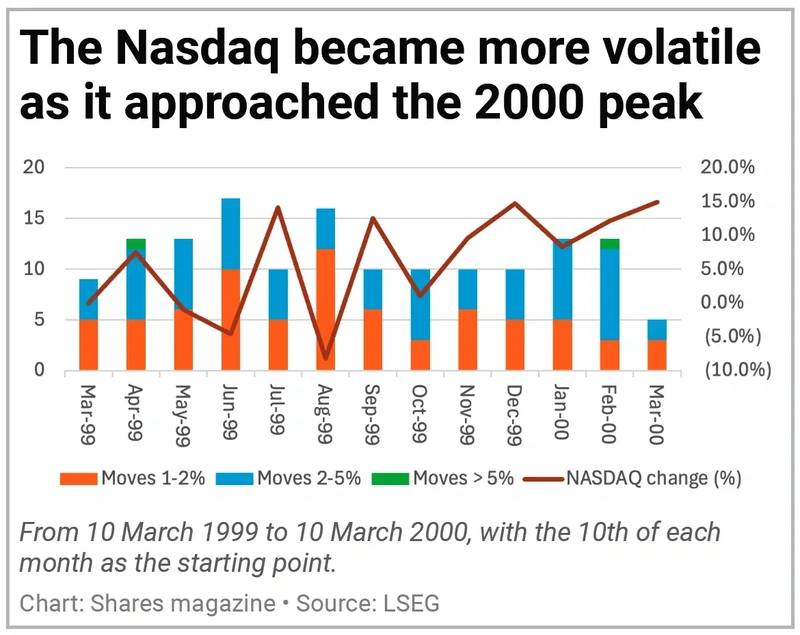

One warning that trouble may have been coming was how volatility started to increase. As valuations became extended, even when based on very bullish earnings growth forecasts, any minor departure from the bullish script caused share prices to slide, only for the bullish narrative to reassert itself. Again, this can be seen in how the number of one-day, open-to-close movements in excess of 1%, 2% and 5% became increasingly prevalent, even as the Nasdaq doubled in a year.

DON’T BE CRUEL

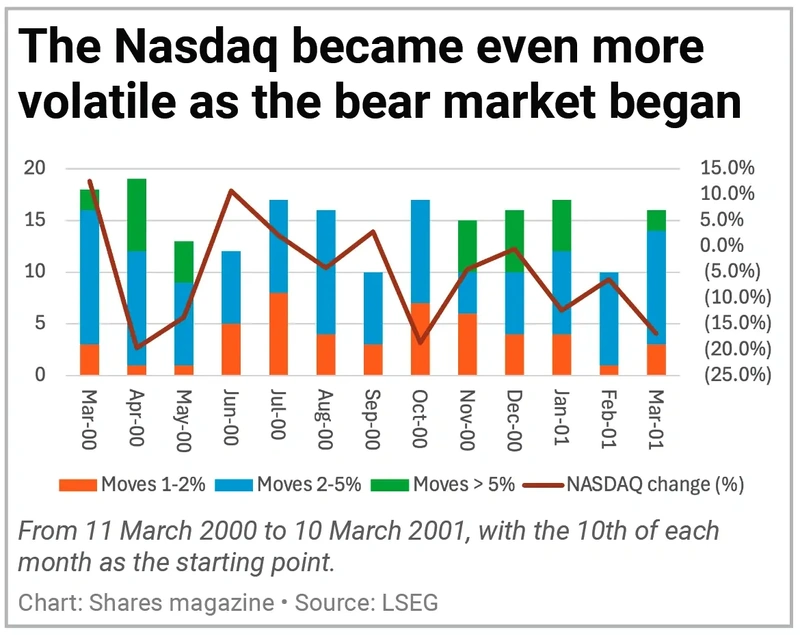

Worse was to follow. Volatility soared – the Nasdaq by more than 1% on an open-to-close basis on 196 occasions in the next 260 trading days, with 115 gains or drops between 2% and 5% and 31 swings of more than 5%.

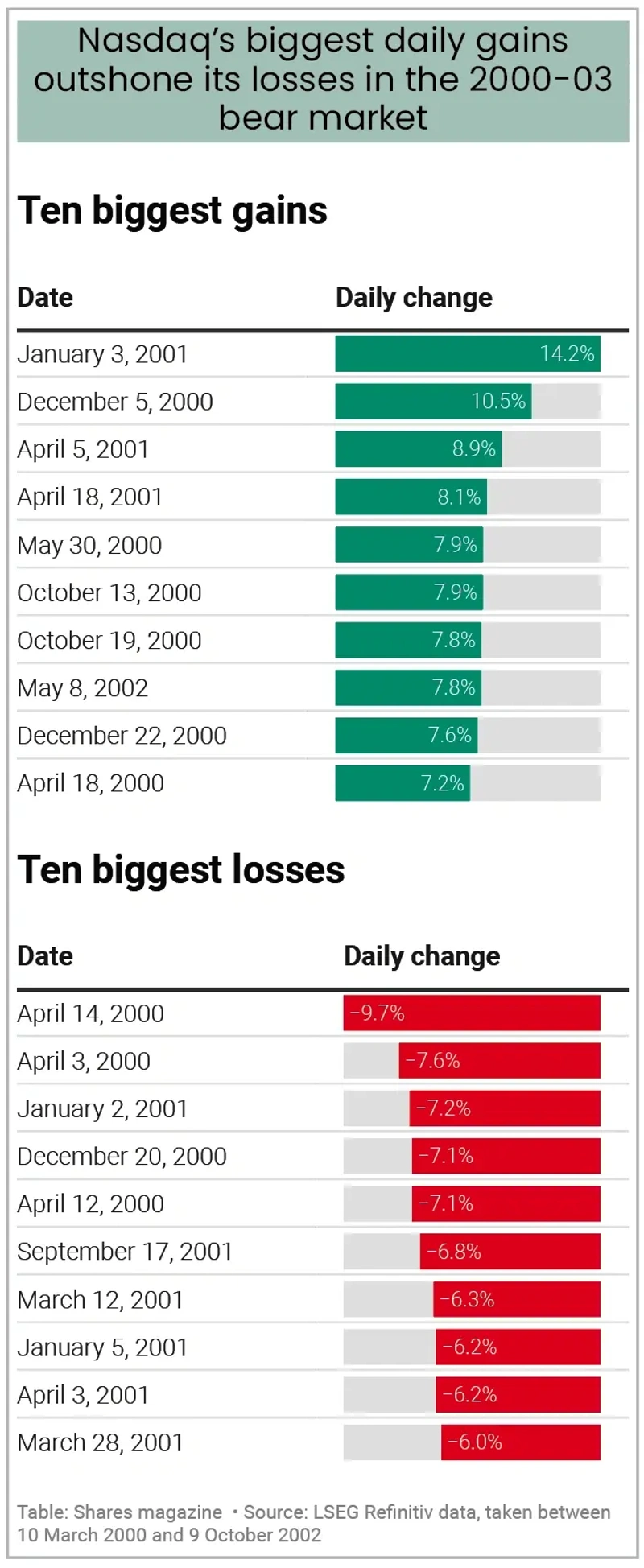

Rallies were bear traps in disguise, as the index ground lower and that punishment forced more and more bulls to throw in the towel over the next 31 months. From peak to trough, the Nasdaq had 446 days where it rose and 440 where it fell. The best daily gains were bigger than the worst daily falls, but the bears won out over the bulls as they grappled for control.

RETURN TO SENDER

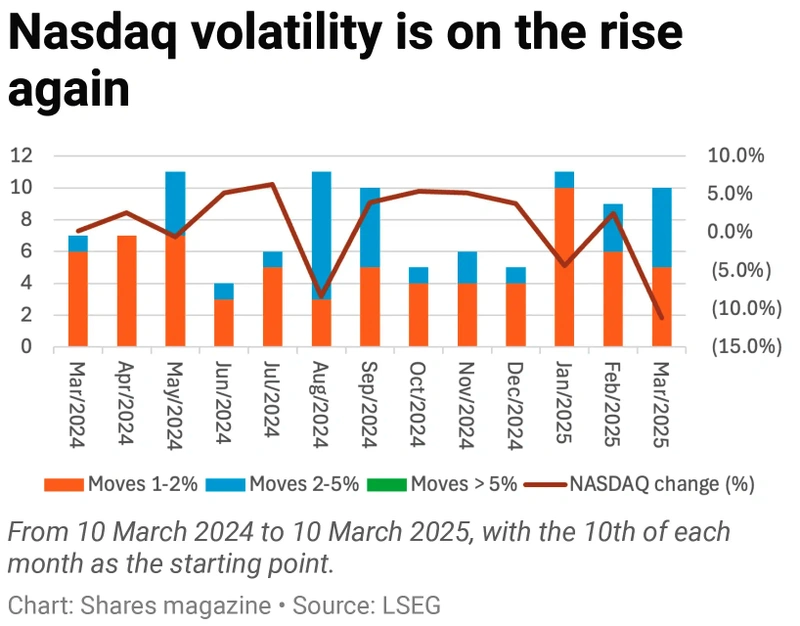

The worrying sign now is that volatility is picking up again (and it can even be traced back to a tricky August, like that of 1999).

There is one massive difference, though, namely that the Nasdaq is up by just 9% over the past year. It can be argued the environment is not as frenzied now as it was in 2000, even allowing for hot spots like AI and memes.

Bears may grab that one, too, mind you. One shrewdie is pointing out on social media that shares in Microsoft (MSFT:NASDAQ), the poster child for investment in AI, are unchanged since January 2024 (after a near-20% slide from last July’s peak). Gold is up 50% in the same time frame. Maybe the market mood is changing after all.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Feature

Great Ideas

Investment Trusts

News

- ASOS shares hit new all-time low despite US restructuring news

- Greatland Gold shares gain 53% year-to-date as bullion price hits new high

- Stagflation fears stoked by stalling consumer confidence and rising inflation

- Vistry expected to draw a line under cost issues and provide new medium-term targets

- Threat of Asda-led price war puts supermarket shares under pressure

magazine

magazine