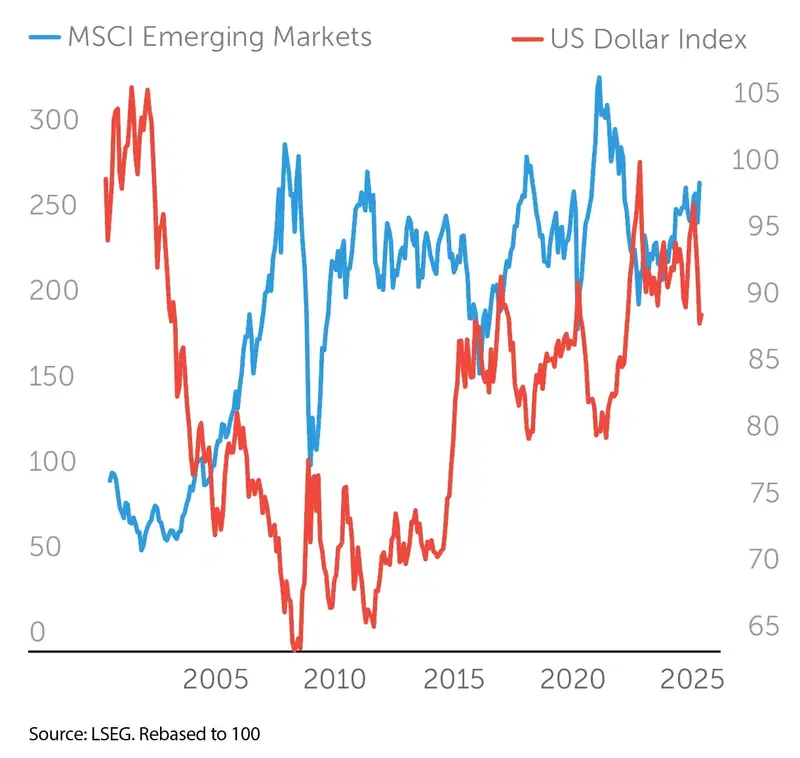

A strong dollar is typically a problem for emerging markets and, conversely, when the US currency is relatively weak it is a positive.

As the chart shows the inverse correlation (one goes up when the other falls and vice versa) between the Dixie – the US dollar index which measures its value relative to a basket of other currencies – and the MSCI Emerging Markets index is pretty clear.

Why is this the case though? First, when the dollar is strong, developing economies feel under pressure to hike interest rates to defend the value of their own currencies and higher rates are usually bad news for equity performance.

A lot of emerging market debt is denominated in dollars too, and that means when the dollar strengthens is becomes more expensive for countries to service these debts. When the reverse happens, these costs come down.

Flows of foreign capital into emerging markets may also wax and wane with a rising dollar – as this would usually be accompanied by higher US rates which, in turn, will draw capital which might have been invested elsewhere, including in the developing world.

Finally, for those emerging markets which are reliant on commodity exports, most of these commodities are priced in dollars which affects demand as it makes them more expensive to buy but also sees exporters lose out if their domestic currency depreciates against the dollar.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit www.temit.co.uk

‹ Previous2025-05-29Next ›

magazine

magazine