Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

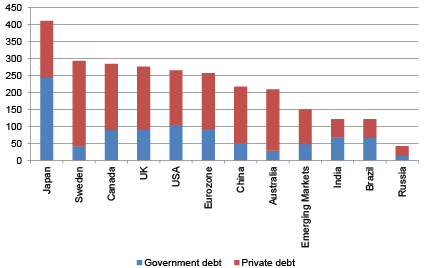

Regular readers will have to indulge this column a little this week, as it returns to two themes which appear here frequently, namely debt and the dollar. The implications of the sixteenth Geneva Report on the World Economy continue to gnaw away at me, especially as the writers' conclude that debt as a percentage of global GDP is now 212%, some thirty-six points higher than the 176% reached when the Great Financial Crisis broke in 2008. For the record, those figures exclude financial companies, such as banks.

Global debt as % of GDP excluding financials is higher now than in 2008

Source: Geneva World Economic Report October 2014

In this context, fixed income markets remain a conundrum. As Tim Price of PFP Group asks, how can sovereign debt possibly trade at all-time low yields (and thus all-time high prices) when there has never been more of it around?

Buyers of the dollar face a similar dilemma. The US Federal Reserve has been printing greenbacks hand over fist since 2008 and yet the buck has begun to march higher as soon as America's monthly QE scheme has moved toward zero, let alone been sterilised and withdrawn.

Sovereign debt is outperforming equities hands down in 2014 and the dollar's surge also runs contrary to the consensus that a healthy economic recovery is firmly underway, given its historic status as a haven during times of stress. In the very short term, bonds could be a touch overbought, looking at benchmarks as the UK 10-year and US 10- and 30-year and equities a touch oversold.

Fixed income has broadly outperformed in 2014

| Return | |

|---|---|

| S&P 500 | 5.0% |

| Global high yield and emerging sovereign debt * | 4.4% |

| Gold | 3.7% |

| Global government debt * | 3.1% |

| Global developed sovereign debt * | 3.1% |

| Global aggregate corporate debt ** | 3.0% |

| FTSE All World | -0.7% |

| Global high yield corporate debt ** | -1.0% |

| Euro Stoxx 600 | -1.4% |

| FTSE 100 | -5.6% |

| Bloomberg Commodity index | -6.6% |

| Nikkei 225 | -9.1% |

Source: Thomson Reuters Datastream. * Bank of America Merrill Lynch index ($). ** Barclays index ($). Equity indices in local currencies. Commodities in $.

But trying to time these markets could prove more difficult than it looks. This month may have felt choppy but 15 October's 181-point fall in the FTSE 100 was the first 2%-plus daily move in the benchmark since June 2013. There have been 383 such gains or advances since 1 January 1994, or one every 14 trading days, so there has to be a chance markets become a lot livelier especially if central banks cease to apply their QE anaesthetic.

Debt mountain

Figures quoted by Mark Tinker of AXA Investment Management in his ever-informative weekly Market Thinking show that 60% of the $37 trillion global government bond markets offers a yield of 1% or less. This does seem completely counter-intuitive, given the apparent surfeit of supply. Three possible explanations suggest themselves:

- First, Quantitative Easing (QE) and central bank bond buying programmes, or hopes for them, continue to distort the market's pricing mechanism.

- Second, clients remain concerned about the prospects for global growth and are actively pricing in a short-term deflationary shock.

- Third, increased human longevity creates a huge need for dependable income in retirement and bonds are a logical place to look, especially when many clients will still remember the equity bear markets of 2001 to 2003 and 2007 to 2009 only too well.

Bond markets remain concerned about growth in 2015 and beyond

Source: Thomson Reuters Datastream

Last week's violent bond market action points to the second of this trio in particular and it is worth bearing in mind the consensus was for interest rate increases and a sovereign sell-off in 2014. The opposite has occurred and rate hike expectations are already slipping back for 2015.

Greenback riddle

The dollar presents clients with a similar dilemma. Again there is no apparent shortage, given the Fed's balance sheet expansion and QE scheme, yet the buck is on a roll.

Dollar is still riding high on a trade-weighted basis

Source: Thomson Reuters Datastream

One reason behind this could owe more to technicals and market flow than economic fundamentals (although American is hardly on its own when it comes to trying to talk down its currency to boost exports). This is the 'carry' trade, where clients borrow in a low-yielding one (say the dollar) and invest in a higher-yielding one in a bid to boost returns. As AXA's Tinker put its this is all well and good “until a currency move wipes out your spread or even worse if you are trading on margin.”

The chance of clients trading on margin is small but the foreign exchange market uses leverage extensively and a rise in the dollar could become self-perpetuating if the borrowers, or 'shorts' of the greenback are forced to close out their positions. Equally, any further turmoil in Europe is likely to give the buck a bid, given the Swiss and Japanese are still printing and other potential bolt-holes such as the Singapore dollar or Norwegian krone are just too small to accommodate everyone.

Despite the European Central Bank's best efforts, or at least its most honeyed words, Greek and Portuguese 10-year government bond yield are rising again. Athens is gripped by concerns February's parliamentary vote for a new President could force Prime Minister Antonio Samaras to resign and call an election at a time when left-wing Syriza party is becoming more and more popular, helped by its promise to seek debt relief and spurn austerity. ECB President Mario Draghi may have more work to do, even if economic data from Spain and Ireland offer some grounds for optimism.

Fresh signs of concern emerge in some Eurozone debt markets

Source: Thomson Reuters Datastream

Looking for the exit

Syriza's threat is a reminder of the findings of a report from the McKinsey Global Institute entitled Debt and Deleveraging: The global credit bubble and its economic consequences. The document analyses over 40 periods of debt reduction and argues they nearly all follow one of the same four paths when it comes to reducing debt as a percentage of GDP and ultimately freeing an economy from the straitjacket of its liabilities.

- Default

- Austerity measures, in the form of tax increases and spending cuts

- High inflation which erodes the real value of the debt

- Economic growth, either as a result of a commodities boom (for those lucky enough to be producing), a peace dividend following a war or, least appetisingly, a war effort.

Adam Smith offered a shorter menu of options in his seminal tome, An Inquiry into the Nature and Causes of the Wealth of Nations. The eighteenth-century political economist simply stated: 'History shows that once an enormous debt has been incurred by a nation, there are only two ways to solve it: one is to simply declare bankruptcy and repudiate the debt. The other is to inflate the currency and thus to destroy the wealth of the ordinary citizen.'

That is not a cheery way to end any weekly comment but advisers and clients do face difficult conditions. Bond and currency market action speaks of markets looking for safety even at a time when sentiment on equities remains very bullish and the last 10% correction in stocks dates back over three years.

A balancing act may be required, whereby portfolios are built to weather deflation now but to the risk of inflation on a longer-term view. Given the immediate response from Federal Reserve governors Bullard and Williams to less than a week's equity weakness, it seems more than possible the Fed could react to any deflationary scare, or even just a regular stock market slide, with more loose policy down the road, to confound the broad interest rate consensus yet again.

Russ Mould, AJ Bell Investment Director.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55