Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

While he will probably be disappointed with BP’s share price performance during his nine-year tenure as the oil major’s CEO, Bob Dudley will be able to look back and argue that he got three important things right.

He increased the company’s focus on safety and worked to improve BP’s reputation in the wake of the Gulf of Mexico disaster. He forecast that oil prices would be ‘lower for longer’ and targeted BP’s cost base. And he began to slowly increase the company’s reserves of oil and gas, which are now higher than they were when he took over.

That combination helped BP to rebuild its dividend and help investors in their quest for income in a low-yield world.

His successor, Bernard Looney, still has work to do. Total annual production of hydrocarbons in 2018 was lower than it was a decade earlier, net debt has crept up to nearly $47 billion from $27 billion and BP – as an oil firm – needs to show how it can fit in with Paris Agreement and the target of a carbon-neutral world by 2050. The company is already working on biofuels and wind and solar energy.

| BP | |||||||

|---|---|---|---|---|---|---|---|

| 30-Sep-10 | 03-Oct-19 | Change | |||||

| Share price | 427.8p | 484.9p | 13.50% | ||||

| Total return* | 40,207.35 | 74,735.81 | 85.90% | ||||

| FTSE 100 | |||||||

| 30-Sep-10 | 03-Oct-19 | Change | |||||

| Index | 5,548.62 | 7,077.64 | 27.60% | ||||

| Total return* | 365.52 | 6,502.22 | 80.30% | ||||

Source: Refinitiv data. Bob Dudley took over at BP on 1 October 2010. **Includes dividend reinvestment

In terms of safety and reputation, the BP board prior to the Macondo disaster was notable for the absence of any real experts in the field of safety, barring the presence of two non-execs from the drugs and food industries respectively. Dudley oversaw a rapid shake-up and one of his very first appointments was Frank Bowman as a non-executive director and chairman of the safety, ethics and environmental committees. He has previously been a US admiral with responsibility for running the USS City of Corpus Christi - a nuclear submarine, a vessel where safety is absolutely paramount.

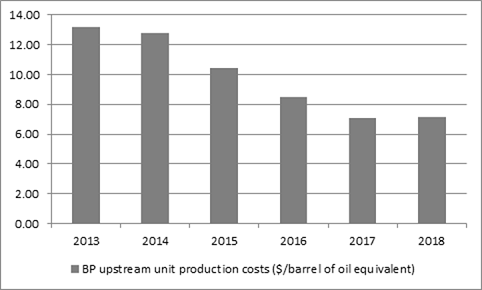

In terms of BP’s cost base, Dudley’s 2015 forecast of lower oil prices for longer is proving pretty prescient. His goal of ensuring that all BP projects are profitable on the basis of $40 oil should leave the company on a solid footing.

Source: Company accounts

In terms of exploration work, BP has begun to replenish its reserves. The major’s estimated net proved reserves of both liquids and gas have increased under Bob Dudley and the pace has picked up markedly in the last two to three years. On an oil equivalent basis, in barrels, net proved reserves ended 2018 at just under 20 billion, compared to 18 billion in 2010 and a low of 17 billion in 2012.

Source: Company accounts

This is a result of an improved reserve replacement ratio as BP has discovered and then begun to develop new fields.

Source: Company accounts

That in turn should start to filter through to production, where growth has been distinctly lacking during the Dudley era. Combine that with cost control and BP is primed to benefit from any increases in the oil price, if and when they come.

Source: Company accounts

One benefit for investors of this turnaround is that BP has slowly rebuilt its dividend. The firm is forecast to be the third-highest payer in the FTSE 100 in cash terms in 2019 and ranks in the top 25 by dividend yield at around the 6% mark.

Ten biggest dividend payers in FTSE 100

| Dividend (£ million) 2019E | Dividend yield (%) 2019E | Dividend cover (x) 2019E | |

|---|---|---|---|

| Royal Dutch Shell | 11,714 | 6.00% | 1.43x |

| HSBC | 7,975 | 6.40% | 1.38x |

| BP | 6,461 | 6.20% | 1.31x |

| British American Tobacco | 4,758 | 7.10% | 1.51x |

| GlaxoSmithKline | 3,990 | 5.50% | 1.37x |

| Rio Tinto | 3,343 | 5.80% | 1.64x |

| AstraZeneca | 2,821 | 3.60% | 1.25x |

| Lloyds | 2,436 | 6.40% | 2.17x |

| Glencore | 2,208 | 6.30% | 1.76x |

| Vodafone | 2,141 | 6.40% | 1.23x |

Source: Sharecast, consensus analysts’ forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55