Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Oil continues to make all the headlines, as the price of a barrel of Brent crude hovers around the $70 mark. That is some 40% below the peak for the year, reached in $115.1, and the big question now is why crude is crashing now.

A meeting of the Organisation of the Petroleum Exporting Countries (OPEC) in Vienna late last month did nothing to arrest the slide, as Saudi Arabia reportedly resisted calls for production cuts. Conspiracy theorists are therefore arguing the Saudis are happy to suffer in the short-term in an attempt to weaken America's booming shale industry. Riyadh's production costs are low but the International Monetary Fund (IMF) asserts it can only fully fund welfare programmes and its budget if oil stays nearer $90 a barrel.

Oil trades at four-year lows on both the European Brent and American WTI benchmarks

Source: Thomson Reuters Datastream

This is one possible explanation, and a good one – research from Capital Economics points out that Saudi Arabia has form here, as it tried a similar tactic in the late 1980s when confronted the threat posed by OPEC's position by a surge in North Sea production.

This fingers supply as the problem, rather than demand but it seems baffling that either factor could have changed quite so much in just the last X months. Oil last collapsed in such a rapid manner in 2007-08, albeit from much higher levels, and that was when the global economy was about to drop into a hole.

As such, oil's decline might not be all good news, even if there is the chance it puts welcome cash into consumers' pockets just ahead of Christmas. As such advisers and clients must guard against complacency, even if they must also consider a scenario whereby bad news is good news, in that central banks keep monetary policy looser for longer amid fears of disappointing growth. Cheap liquidity is a potential source of support for financial asset valuations, at least if events since 2009 are any guide. The crack team at US investment bank Morgan Stanley even warned at a briefing this week of the possibility of a 2015 market “melt-up” in the event upside growth surprises combined with loose policy, prompting equity prices to overshoot on the upside.

The range of possible endgames and risk of policy error both continue to grow and clients may need to prepare for an increase in volatility next year at the very least. The chart below logs every day where the FTSE 100 moved by more than 2%. There has been just one such instance since July 2013 against an average over the last 20 years of one such rise or fall every 13.5 trading days. The last similar fallow period was 2004-05 and although volatility then picked up from there, the FTSE 100 only peaked in June 2007.

Volatility in the UK equity market stands near 20-year lows

Source: Thomson Reuters Datastream, AJ Bell Research

Russian roulette

Vladimir Putin is unlikely to be smiling too much as the oil price falls and takes the Russia's rouble and RTS stock market index with it. The President's advisers reportedly asked Saudi Arabia to push for production cuts and shore up the oil price at that OPEC meeting in Vienna but to no avail. Moscow needs oil above $110 to balance its budget and avoid tapping into its foreign exchange reserves to meet the coupon payments on its foreign-currency denominated bonds.

Russia's currency and stock market remain under pressure as oil slides

Source: Thomson Reuters Datastream, AJ Bell Research

Putin may be particularly irritated as America may be the source of his woes. If the oil price slide is due to increased supply rather than soggy demand then the boom in Uncle Sam's output will have a lot to do with it, even if the markets may also be pricing in an increase in exports from Libya, as peace hopefully descends, and Iran, if sanctions are lifted. The table below shows these countries' respective production profiles in a global context.

Oil traders may be pricing in increases in US, Libyan and Iranian production...

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|

| USA | 7,244 | 6,903 | 6,828 | 6,862 | 6,783 | 7,263 | 7,552 | 7,868 | 8,892 | 10,003 |

| Year-on-year change | (1.6%) | (4.7%) | (1.1%) | 0.5% | (1.2%) | 7.1% | 4.0% | 4.2% | 13.0% | 12.5% |

| Iran | 4,201 | 4,184 | 4,260 | 4,303 | 4,396 | 4,249 | 4,356 | 4,358 | 3,751 | 3,558 |

| Year-on-year change | 5.0% | (0.4%) | 1.8% | 1.0% | 2.2% | (3.3%) | 2.5% | 0.0% | (13.9%) | (5.1%) |

| Libya | 1,623 | 1,745 | 1,816 | 1,820 | 1,820 | 1,652 | 1,658 | 479 | 1,509 | 988 |

| Year-on-year change | 9.3% | 7.5% | 4.1% | 0.2% | 0.0% | (9.2%) | 0.4% | (71.1%) | 215.0% | (34.5%) |

| Global production | 81,054 | 82,107 | 82,593 | 82,383 | 82,955 | 81,262 | 83,296 | 84,049 | 86,204 | 86,754 |

| Year-on-year change | 4.4% | 1.3% | 0.6% | (0.3%) | 0.7% | (2.0%) | 2.5% | 0.9% | 2.6% | 0.6% |

Source: BP Statistical Review of World Energy, June 2014. Production in thousands of barrels, daily.

Between them they could easily add nearly two million barrels to supply, a sum probably sufficient to offset any increase in demand, which rose by around 1.2 million barrels in 2013 when global GDP growth rates was 3.3%, compared to the 3.3% and 3.8% expected by the International Monetary Fund for 2014 and 2015 respectively.

...which could be enough to outpace increases in global demand

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Global production | 81,054 | 82,107 | 82,593 | 82,383 | 82,955 | 81,262 | 83,296 | 84,049 | 86,204 | 86,754 |

| Year-on-year change | 4.4% | 1.3% | 0.6% | (0.3%) | 0.7% | (2.0%) | 2.5% | 0.9% | 2.6% | 0.6% |

| Global consumption | 83,055 | 84,389 | 85,325 | 86,754 | 86,147 | 85,111 | 87,801 | 88,934 | 89,931 | 91,331 |

| Year-on-year change | 3.5% | 1.6% | 1.1% | 1.7% | (0.7%) | (1.2%) | 3.2% | 1.3% | 1.1% | 1.6% |

Source: BP Statistical Review of World Energy, June 2014. Production in thousands of barrels, daily.

Born in the USA

This still does not explain oil's slide in an entirely satisfactory manner, especially as the Iranian sanctions talks in Vienna are ongoing and could run for another several months. Still, the supply-side explanation appears to be the one that fits for the Saudis, if talk of their desire to try and dampen US enthusiasm for shale oil and gas is near the mark.

Research from Canada's Scotiabank asserts that the North Dakota Bakken and Texas Permian Basin shale fields come with 'mid-cycle break-even costs' of around $68 to $69 a barrel. Even if South Texas' Eagle Ford comes in nearer $50 a period of oil in the $70-a-barrel range could make life uncomfortable for some fledgling shale resource explorers and producers, especially ones that have funded their operations with plenty of debt.

This may explain the fresh slide in high yield, or junk, debt in the USA, especially for paper rated CCC or below. The ever-intriguing blog Wolf Street reports energy companies have issued 15% of all US junk debt in 2014, up from 10.3% in 2013 and 4.3% a decade ago. Sliding oil prices are the last thing indebted, start-up producers want to see and anyone caught reaching for yield here may come to regret it. Whether there are wider implications of the CCC slump for the markets remains to be seen, but the charts for 2007-08 suggest there could be.

The S&P 500 looks to correlate closely to the US junk debt market...

Source: Thomson Reuters Datastream

...but stocks are now powering ahead as paper rated CCC and below swoons

Source: Thomson Reuters Datastream

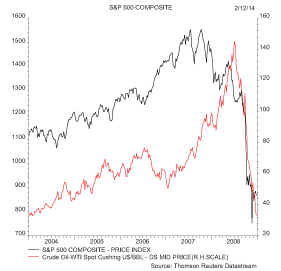

Oil itself blazed higher during 2005-07 as the global economy powered on but high prices hardly helped matters and crude collapsed in 2007-09. At the moment, buyers of US stocks seem unconcerned by the latest oil price retreat. The charts below compare the S&P 500 index with the American oil benchmark, West Texas Intermediate (WTI).

Oil fizzled as the markets plunged in 2007-08

Source: Thomson Reuters Datastream

...but stocks are rising even as oil goes lower in 2014

Source: Thomson Reuters Datastream

Don't mess with Texas

This may be because it is tempting to view the drop in oil prices as a positive, given the extra dollars, pounds and euros it puts in consumers' pockets. Yet lower hydrocarbon prices also crimps government tax receipts at a time when sovereigns are hardly flush with cash, as Russia will attest, and it seems unlikely to me that a weak oil price is a harbinger of economic strength, at least if history is any guide.

As a final point it may be worth noting the importance of oil and gas to America's economy overall. In the past year, Texas has added 421,000 non-farm jobs, the largest amount in any individual state by far – the only other areas to top the 100,000 mark are California, Florida and New York.

Leading states by jobs added year-on-year in October 2014

Source: Thomson Reuters Datastream

In these circumstances, a prolonged drop in oil and gas prices could, in theory, have far wider implications than at first seems likely, given the potential direct effect upon jobs in the hydrocarbon industry.

Russ Mould, AJ Bell Investment Director.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.