Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Silicon chips are a good guide to global economic health owing to their ubiquity – they are everywhere, from smart phones to laptops, car to industrial robots and servers to smart meters and global sales are expected to top $600 billion in 2023, to set a second consecutive all-time high.

However, the Philadelphia Semiconductor Index, or SOX, formed of 30 global chip producers and chip-equipment making companies, is trading one-third below last December’s all-time high, even after a substantial rally from autumn’s lows.

Disappointing earnings, cuts to capital investment budgets, ballooning inventories and fears of a recession have all weighed heavily. An upturn in trading and the SOX would potentially be a good sign for both the global economy and also global equities as the benchmark has an uncanny record of being a decent guide to investors’ risk appetite – it topped out six to nine months before the S&P 500 and FTSE All-World did so in 2000 and 2007, to herald two thumping bear markets, and then bottomed out before those headline indices did in 2002 and 2009, to signal the start of a new bull market.

This takes us to one of the SOX’s constituents, Idaho-headquartered Micron Technology. The firm is a specialist in memory chips, DRAM, NOR and NAND, that are used in computing and smart mobile devices to store data and its shares are way down from their highs too. The stock peaked late in 2021 but revenues and profits only began to take a tumble in this year’s June-August quarter, or the fourth and final quarter of Micron’s financial year.

Source: Refinitiv data

For that fourth quarter, chief executive Sanjay Mehotra, unveiled a 23% quarter-on-quarter drop in sales and a halving of operating profit. Computing markets had begun to slow as consumers stopped receiving stimulus cheques, had perhaps returned to the office and felt the squeeze on their pockets from inflation, while corporations looked to cut costs where they could.

Source: Company accounts. Fiscal year to August

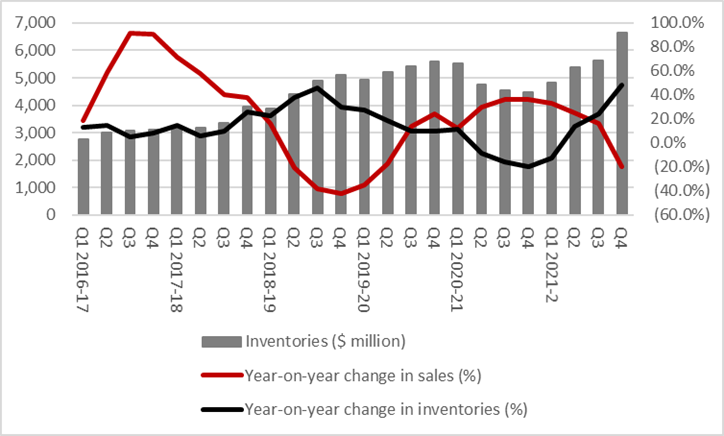

Worse still, Micron began to find itself with an inventory problem. Supplies of unsold product rose by a fifth quarter-on-quarter and 50% year-on-year to $6.6 billion, even as sales momentum sagged (or because sales momentum sagged). That took inventory days from 151 from 94 a year ago, a situation that meant Micron would be at risk of earnings disappointment, unless demand picked up fast to soak up that excess stock. Otherwise, the firm would have to slow production and cut prices.

Source: Company accounts. Fiscal year to August

Sure enough, Mr Mehotra dished out a profit warning alongside those fourth-quarter results and it is by this guidance that these first-quarter results for the three months to the end of November will be judged. The CEO forecast:

- Sales of $4.25 billion, down from $6.6 billion in Q4 and $7.7 billion a year ago

- Gross margin of 25%, down from 39.5% in Q4 and 46.4% a year ago

- An earnings per share (EPS) loss of $0.09, against a profit of $1.35 in Q4 and $0.71 a year ago

- A 30% cut to the full-year capital investment budget to $8 billion from $12.1 billion.

These huge swings in profit show how highly operationally-geared the business is, as even minor changes in sales make a big difference when you have $38 billion of property, plant and equipment on the balance sheet – chip fabrication facilities are big and expensive and need to run flat-out if they are to make money.

The bad news is that Micron hinted at further disappointment in November, when the $60 billion cap company hinted at further slowdowns in wafer starts and production and possibly deeper cuts to the capital investment budget.

Source: Company accounts. Fiscal year to August

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55