Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Another year, another loss and another trading deficit is on the cards for 2023 from Ocado Retail food delivery joint-venture between Ocado and Marks & Spencer, even if the business’ new boss, Hannah Gibson, continues to put a positive spin on it by targeting positive earnings before interest, taxes, depreciation and amortisation (EBITDA, or, ultimately, earnings before bad stuff, EBBS) for the coming year,” says AJ Bell investment director Russ Mould.

“The market does not seem impressed, judging by the share price reaction and just as Netflix is moving on from publishing net subscriber additions – not least because it’s no longer helpful for the share price to do so – Ocado is going to need to focus on turning customers into profits and cashflow.

“Investors have long since become bored of profitless prosperity, whereby firms claim to be winning the war for customers but then consistently fail to turn those new users into profit, including or often even excluding bad stuff.

“The pandemic did see many customers change their shopping and grocery-buying habits, but the change in behaviour does not seem to have been a permanent one. The cost-of-living crisis has brought fresh challenges to shoppers, and they have responded by trading down through brands and cutting out some purchases altogether.

Source: Company accounts

“With food price inflation running in the double-digits, in percentage terms, Ocado Retail’s 0.3% increase in fourth-quarter revenues looks pretty meagre, even allowing for a further slight increase in average customer orders per week.

Source: Company accounts

“This reflects how Ocado has swallowed some of the price increases to help it win and keep customers. The FTSE 100 firm quantifies its own average price rise at 7.6%.

“It also acknowledges an 8% drop in volumes and cites the two factors combined as the reason behind a near-1% drop in average order size to £117 a basket. The growing prevalence of M&S goods and products on the platform may not be helping here.

Source: Company accounts

“The good news is the base for comparison is now easing as shopper behaviour sets the next ‘new normal’ and this, combined with ongoing cost efficiencies, means Ocado is hopeful of achieving a positive figure on an EBBS basis in the second half of its fiscal year to November 2023, and one large enough to offset any deficit it expects in the first six months.

“Ocado Retail does continue to add costs as its expands customer delivery capacity toward its goal of 600,000 average orders per week and the ongoing fight for share continues. Ocado is also investing in Zoom, its one-hour delivery service, an arena where Sainsbury is now upping the ante after its partnership with Just Eat. As customer behaviour patterns settle post the pandemic and lockdowns, investors will be left looking at a mature, highly competitive business where prime weapons for market share remain price, quality, service and convenience (and that includes, for some customers, delivery).

“On top of that, Ocado offers its Ocado Smart Platform and its licensing business, which continues to add customers overseas, the latest coming in South Korea.

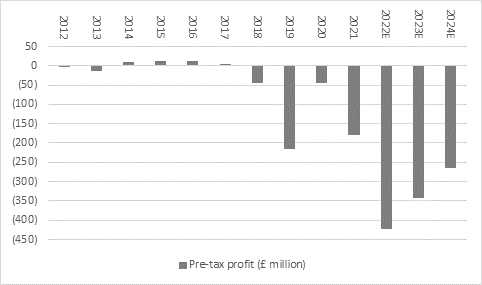

“Although new wins have slowed to a trickle of late. Overseas partners continue to ramp up their customer fulfilment centres (CFCs) and volumes and bulls of Ocado’s shares will still view developments here as the real key to the share price, which still languishes nearly 80% below 2020’s peak. But even those bulls will have to patient, as analysts do not expect a pre-tax profit from Ocado overall until the year to November 2025 at the earliest. Jam tomorrow, indeed.”

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

These articles are for information purposes only and are not a personal recommendation or advice.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55