Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The US Federal Reserve’s decision to cut interest rates by half a percentage point is generally winning praise for the signals it sends on the fight against inflation and the pre-emptive, pro-growth nature of the move but it just may be that the central bank has little option, owing to America’s ballooning budget deficit.

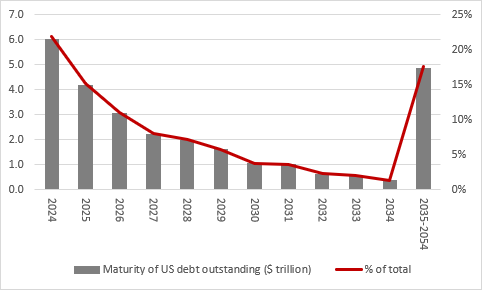

Another row over the debt ceiling is already brewing. Neither presidential candidate seems willing to address the issue and nearly half of the US government’s debt matures in the next two years.

Rolling over cheaper, older borrowing to prevailing bond yields would increase an annual bill that already stands at record highs and could potentially leave America with a choice between austerity or further debt accumulation, and thus potentially inflation and money printing further down the road.

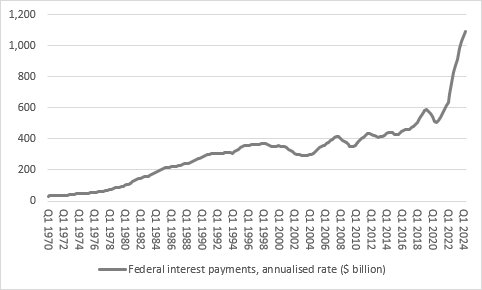

According to Federal statistics, America’s interest bill is now running at an annualised rate of more than $1 trillion a year.

Source: FRED - St. Louis Federal Reserve database

The combination of higher interest rates (and thus higher government bond yields) and ever higher government borrowing means the bill is going up and doing so very quickly.

This might not be much of a problem when interest rates – and therefore US government bond yields – are at record lows, as they were for a 10-years-plus stretch after the Great Financial Crisis of 2007-09. It is more of a challenge when interest rates – and US Treasury yields – are higher and debt must be refinanced, also at higher rates.

The annual $1 trillion interest bill implies an interest rate of 3.1% across the aggregate $34.8 trillion stock of debt – but the US yield curve currently shows yields above that, right across the board. As a result, any debt that matures now will be refinanced at a higher interest rate, adding to the interest bill. That’s before any further US government borrowing is considered.

This issue is becoming particularly acute, since nearly half of US government debt matures in what is left of 2024, 2025 and 2026. The chances of the aggregate Federal deficit coming down are zero, judging by forecasts from the Congressional Budget Office of annual overspends of nearly $2 trillion every year from 2025 to 2029. Lower interest rates and bond yields would help a lot when it comes to reining in those interest payments.

Source: Bureau of the Fiscal Service

Higher inflation would boost nominal GDP growth and help debt-to-GDP ratios, too, so it may just be that the US Federal Reserve has to play a little fast and loose with inflation, whether it likes it or not.

The US is already spending more on interest payments ($1 trillion) than it is on defence ($900 billion is the budget for 2025), according to the Congressional Budget Office, a situation that does not necessarily bode well given the current global geopolitical climate. Nor does an interest bill that gobbles up 20% of total tax revenues feel easy to manage over the long term, either.

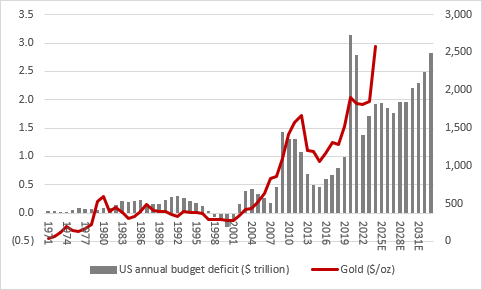

America is never, ever going to go broke – it can simply print more money to pay its bills, interest or otherwise, should it so choose.

But that choice could still have consequences. Basic economics suggests that if the supply of something goes up then its value goes down, and money is no different. The loss of value can come in the form of purchasing power, or in simpler terms, inflation.

That may be why the US 2-year and 10-year bond yields both rose when Fed chair Jay Powell announced a 50 basis-point interest rate cut on 18 September. It may also be why gold trades at record highs, as investors look for something that could be a store of value, one where supply grows very slowly relative to the supply of fiat money and paper obligations such as government bonds.

Source: FRED - St. Louis Federal Reserve database, Congressional Budget Office, LSEG Refinitiv data

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.