Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

There is £430 billion of ‘excess cash’ sitting in savings accounts that people could be taking more risk with, according to a new report from Barclays.

The study found that as a nation of cash lovers, Brits are often holding on to too much cash, meaning they are not maximising the amount they could be earning from their savings. The report found that around 13 million people hold more cash than they really need.

While interest rates are currently higher than they have been for years, keeping money in cash long-term can mean your money struggles to keep up with rising prices (often referred to as inflation). Instead, people could be earning higher returns through investing.

How much cash do you need?

Most people will need some money in cash, but it depends on the person and their financial situation as to how much they really need. First up, you’ll want to keep some money in cash for emergencies – if you had an unexpected bill or lost your job, for example. You don’t want that money exposed to investment markets, as it might drop in value at just the time you need to take it out.

Likewise, any money you know you’ll need in the short term should be saved in cash, rather than invested. That’s because generally you only want to invest money you know you won’t need in the next five years or more. It’ll give you time to hopefully ride out the ups and downs of investment markets.

The final factor to consider is that any money you don’t want to take any risk with should be kept in cash. That’s because investing involves taking some risk with your money. But if you want to achieve a potentially higher return from some of your money and know you won’t need it for at least five years, then investing could be the right way to go.

Why should I invest rather than stick to cash?

Cash usually generates a lower return over the long term. If we look back at cash returns compared to investing returns, investments have always outperformed cash over longer periods. By investing, you’ll probably generate more money for your future self.

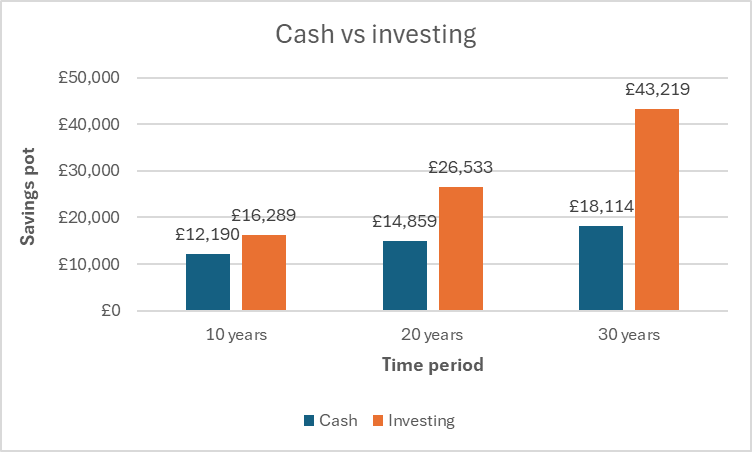

For example, if you saved £10,000 in a cash account earning 2% a year after 10 years, you’d have a pot worth £12,190. However, if you’d invested that money and earned returns of 5% a year after charges your pot would be worth £16,289 – meaning you’d have just over £4,000 extra in your savings. Over 20 years the gap is even bigger, with nearly £11,700 more if you had invested than if you had saved the money in cash*. These figures highlight how defaulting or sticking to cash is potentially hurting people’s future wealth.

Source: AJ Bell. Based on £10,000 initial investment that earns 2% return a year in cash and 5% return a year after charges for investing.

However, there is more risk with investing, as with cash savings you will always get your original savings back. But with investing there is the chance your investments could drop in value, meaning you lose out. Historically, investment markets have rebounded after they fell, but it’s still a risk that has to be considered. This is also why it’s important to have enough cash to meet your short-term spending needs and emergencies.

The other factor to consider when deciding whether to save or invest is inflation. Cash savings will rarely beat inflation, which means the spending power of your money gets eroded year after year. For example, if a chocolate bar costs £1 today and you have £100, you can buy 100 chocolate bars. But if inflation is 10%, in a year’s time that chocolate bar will cost £1.10. If you still have £100, you’ll only be able to buy 90 chocolate bars. Because investing offers higher returns, it gives your savings a better chance of beating inflation, even in times when inflation is higher.

Want to learn more about investing? Check out our 'New to Investing' guide.

*AJ Bell calculations

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 10:47

- Fri, 13/06/2025 - 10:25

- Wed, 11/06/2025 - 09:38

- Fri, 06/06/2025 - 10:32