Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Many people are unsure whether they have enough money to start investing. Fortunately, there are only a few simple steps to follow to establish whether you are in a good position to begin putting money into the markets.

First you need to think about all of your finances and prioritise paying off expensive debt and building up an ‘emergency’ cash pot. Once you’ve got those things sorted you can start investing with as little as £25 a month.

You need to think about the impact of fees if you’re investing small sums, so it’s sometimes better to wait until you have a slightly larger amount.

For example, if you invest £25 and pay £1.50 to buy a fund with it, you’ve spent 6% of your initial investment just on trading fees.

That means you need to see a 6.4% return on your investment in order to get back to your original £25, let alone make a profit. However, you needn’t think that you must have £1,000 to start investing – you can start much smaller.

Should I invest regularly or in a lump sum?

Different people choose to invest in different ways, and there’s no right answer.

Some people prefer to save up and then invest a lump sum once they’ve reached a certain amount – whether that’s £500 or £1,000, or more. Other people prefer to invest small amounts each month.

Investing on a regular basis, such as every month, can help to smooth out your returns, is a great way to get into the savings habit and can give you good discipline. But you need to be mindful of charges.

For example, if you’re investing £50 every month across two or three stocks, you’ll pay £5 per stock in trading costs with AJ Bell and you’ll rapidly use up your savings on charges.

In this situation, you might find AJ Bell’s regular investing service to be useful. Charging only £1.50 per deal, it involves you investing a pre-agreed amount of money into the same investment on a set date every month.

An alternative is to use AJ Bell Dodl, an investment app where you can buy and sell stocks and funds without incurring any dealing fees. This may not suit everyone as you cannot access the full range of investments on Dodl that you can find on AJ Bell’s main investment platform.

Keep investing without any effort

A big advantage to regular investing is that you don’t have to remember to invest your cash each month, as often it can be easy to plan to invest money but forget to do so.

On top of becoming more organised, regular investing also means you have a rigid investment process that you stick to. This is important as often emotions can get in the way of investing, meaning if markets fall you could panic and decide not to buy.

Regular investors also benefit from smoother returns, thanks to something called ‘pound cost averaging’. Because you’re putting a regular amount in the market, regardless of market movements, you’ll help to smooth out your volatility. When markets rise you are buying fewer shares or units in a fund and when they fall, you’re buying more shares or units when they are cheaper.

What if I've got a lump sum?

If you have the money ready to invest on day one then you might be better investing it straight away, as it will benefit from having more time invested – assuming markets rise.

For example, if you have £1,200 to invest and do so in a lump sum on 1 January, it will be invested for 365 days of the year. But if you break it into £100 a month and invest it on the first day of each month, then the final £100 will only be invested for one month, and only £100 will be invested for 365 days.

However, this depends greatly on how markets perform when you put that lump sum in. If you invested £1,200 and then the market fell, you’d likely have been better off with monthly investing. So you’ll need to balance the two approaches and make a decision based on your risk appetite and what your view of investment markets is.

How does this work in practice?

To illustrate these points, we’ll run through two examples comparing lump sum versus regular investing in different market conditions.

Example 1

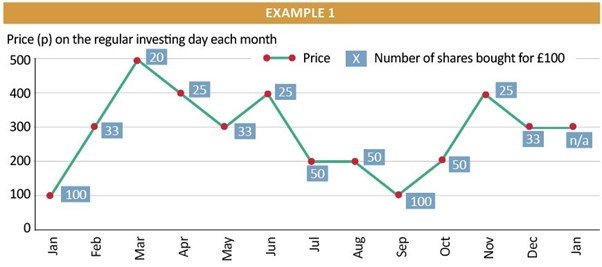

The first example looks at shares in Company X which started the year at 100p and ended the year at 300p.

Source: Shares magazine

Investing a £1,200 lump sum means you could buy 1,200 shares (£1,200 / 100p). After 12 months your investment would be worth £3,600 (300p x 1,200).

If you could only afford to invest £100 a month, you would have invested the same amount after a year as the lump sum investor (£1,200) yet bought a different number of shares.

Accounting for the ups and downs of the market and the fact your £100 a month would buy different a number of shares almost every month, after one year, you end up with 544 shares worth £1,632 (300p x 544). That is less than half if you’d invested the lump sum.

The shares saw lots of ups and downs but ended the year higher than the starting point.

Example 2

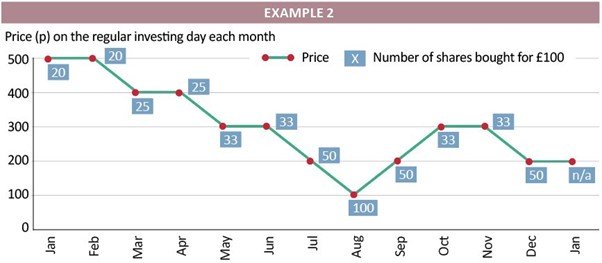

The second example looks at Company Y whose shares started at 500p and ended the year at 200p. Investing the same £1,200 lump sum would get you 240 shares (£1,200 / 500p) if bought at the start of the year. At the end of the year, they would be worth £480 (200p x 240).

Source: Shares magazine

Going down the regular investing route at £100 a month would mean you buy more shares for your money as the year progresses, thanks to the share price falling. You would end the year with 472 shares worth £944 (200p x 472). That’s nearly twice as much as the lump sum route.

Unfortunately, no-one knows how share prices will behave in the future so it is impossible to say with accuracy which method is better. However, understanding how these dynamics work and the pros and cons of the different investing routes can help you to decide which option is best for you. You could also decide to do a bit of both: invest some money as a lump sum and the rest monthly. Or invest the money monthly but over a shorter time period of a few months, rather than a full year.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 10:47

- Fri, 13/06/2025 - 10:25

- Wed, 11/06/2025 - 09:38

- Fri, 06/06/2025 - 10:32