Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Staying on top of your investments is important if you want to make a success out of putting your money to work in the financial markets.

A useful tool created for this purpose is the Morningstar Portfolio X-Ray, which is available to AJ Bell customers.

To find your own X-Ray portfolio report simply log in to your account and look for four icons underneath the ‘account menu' section to the right of your screen. The second one from the left (marked 'X-Ray’ when you hover over it) will bring up your report on screen.

It’s helpful in determining if you have the appropriate mix of investments. Diversification is about spreading your investments into assets which have different risk and return profiles and, by doing so, should help to smooth your portfolio returns.

The proportion of your portfolio allocated to distinct asset classes will depend on your investment profile and risk appetite. To maintain these proportions, you will need to manage your portfolio actively through a process known as rebalancing.

For example, if you have a portfolio with 60% stocks and 40% bonds, and the stocks perform well while the bonds' returns decrease, the value of your holdings may change to 70% stocks and 30% bonds. Rebalancing involves selling some of the stocks which have appreciated in value and purchasing more bonds until the portfolio returns to its original allocation of 60% stocks and 40% bonds.

This practice can help maintain a consistent level of risk exposure and promotes the discipline of selling assets which have appreciated in value and buying those that may be relatively undervalued. This is not necessarily something you would want to do too regularly as there are costs to trading investments, but doing so on an annual basis is a sensible rule of thumb for most people.

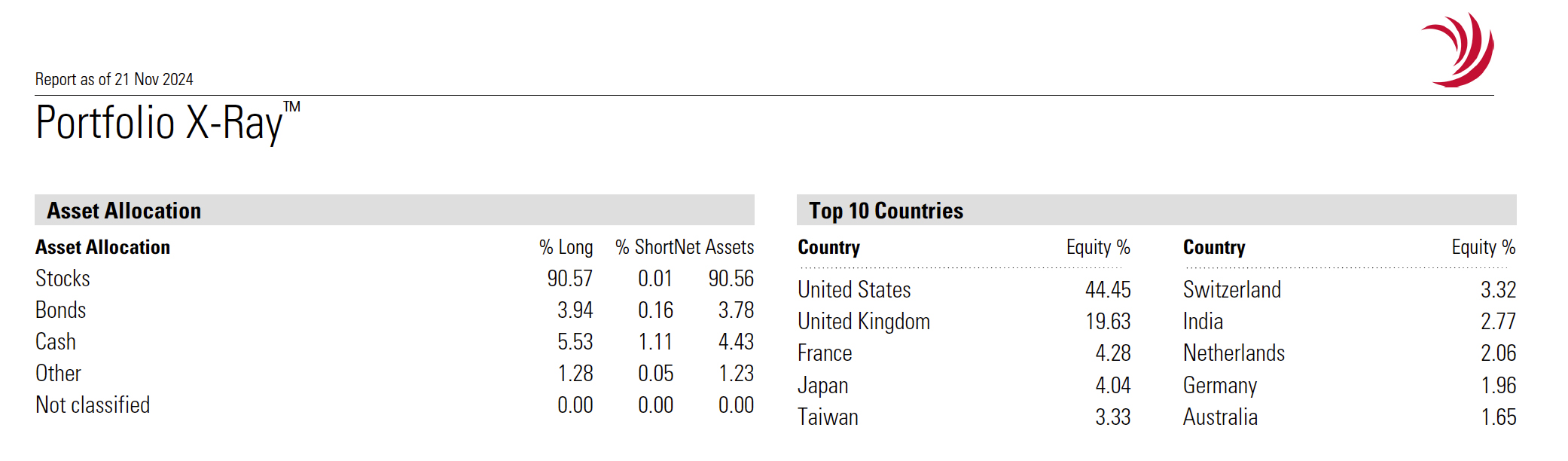

An example of an X-Ray report

The first section of the X-Ray is helpful in this regard as it shows the balance of your portfolio between stocks, bonds and cash as well as ‘other’ and ‘not classified’ categories. In the example shown, stocks make up the vast majority of the portfolio – suggesting a higher tolerance for risk.

You can also see a geographic breakdown; in this case, the US accounts for a large proportion of the portfolio, although lower than MSCI All-Country World Index where it has a rough two-thirds weighting. The X-Ray contents vary from investor to investor to reflect the different investments held – rather than one report applying to everyone.

Comparing different types of stocks

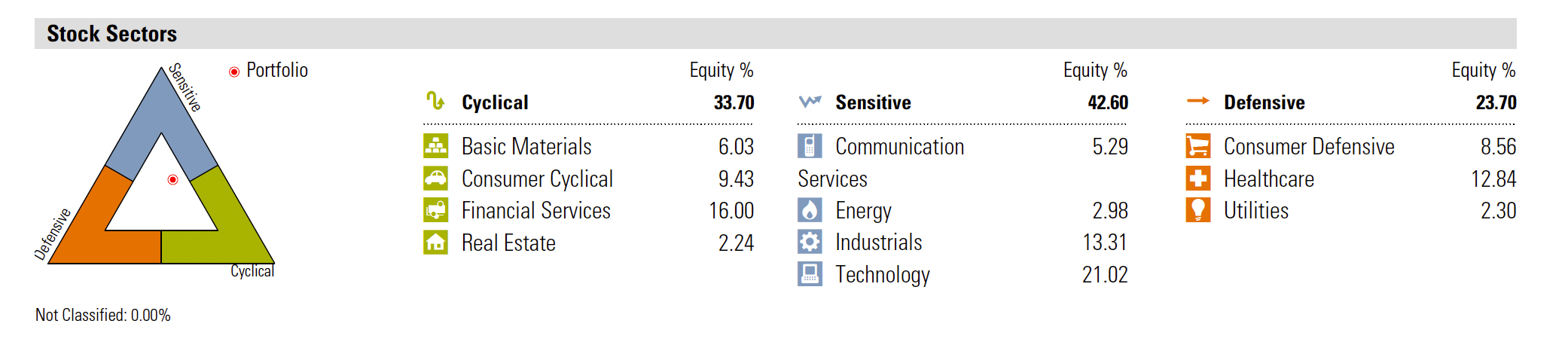

The X-Ray tool analyses the underlying stocks within the portfolio, categorising them as Cyclical, Sensitive or Defensive based on their correlation to the business cycle. Cyclical stocks, such as housebuilders, are highly sensitive to the economy, while Defensive stocks, such as utilities, are not. Sensitive stocks, such as industrial companies, fall in between.

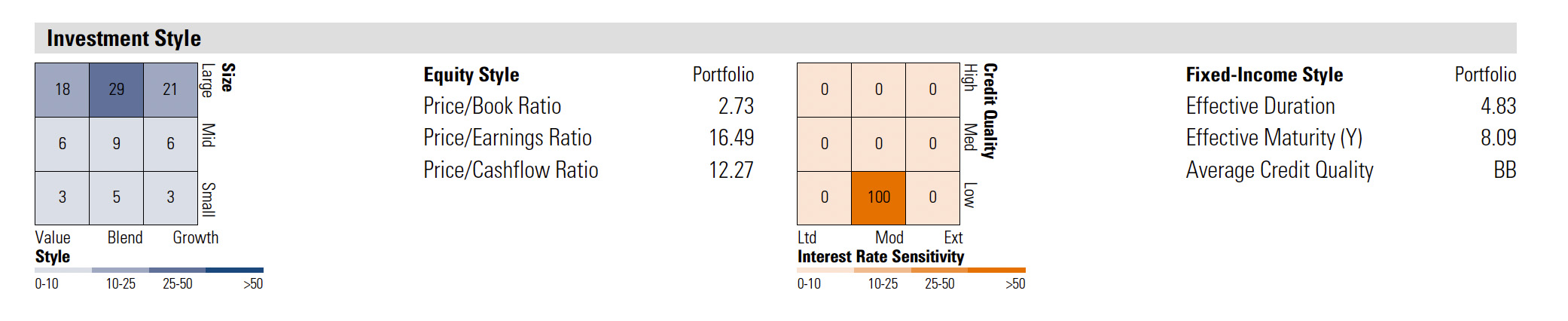

Additionally, you get insight into your exposure to different investment styles. Diversifying across styles such as value and growth can help manage risk and reduce volatility, as different styles perform better at different times in the economic cycle. The information in the X-Ray report includes valuation metrics for the stocks and shares component of the portfolio and, for the bonds, details of how long they have until they mature and the average level of creditworthiness.

Comparing your performance to a benchmark

The X-Ray report shows your performance in absolute terms and compared to a benchmark. The ‘+/- Benchmark’ indicates how much you have outperformed or underperformed, not the benchmark's actual performance.

If you are drastically underperforming the benchmark, particularly if the underperformance has been over an extended time period, it is worth taking a closer look at your investments and trying to work what might be going wrong.

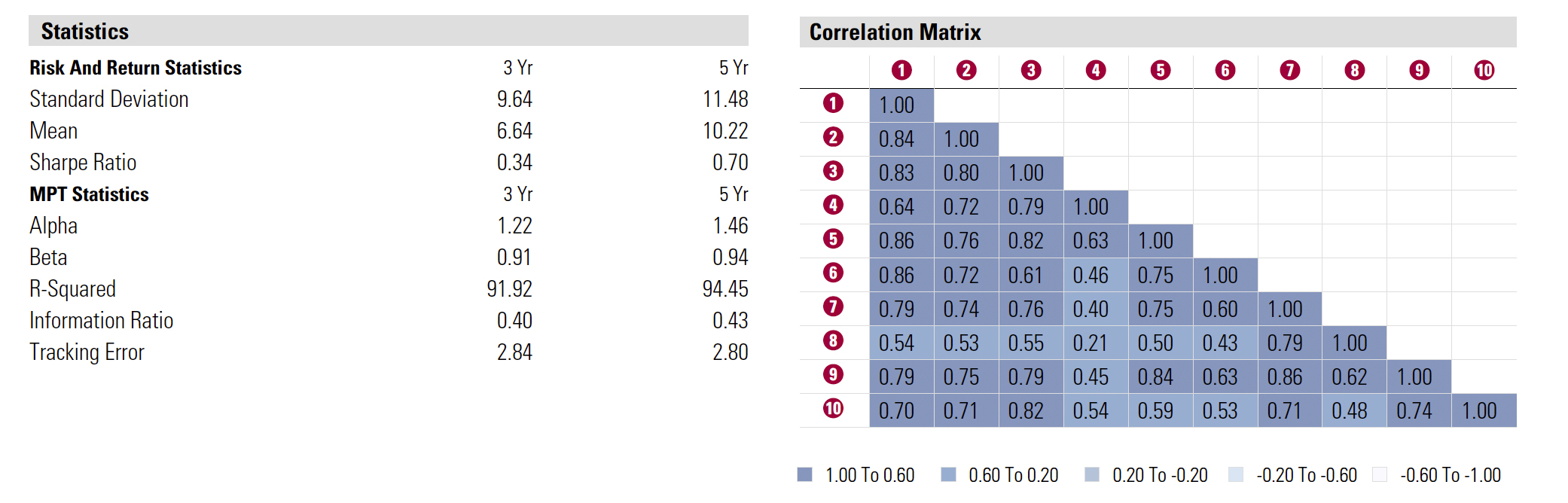

Some sections of the X-Ray tool are slightly more complicated, although they can still be useful. The finance industry uses standard deviation to measure risk, indicating how much your portfolio’s value fluctuates. If your portfolio consistently delivers 5% annually without variation, its standard deviation would be zero. In this case, lower deviation signifies less risk.

Other useful bits of information

The Sharpe ratio incorporates the standard deviation to compare the returns on offer from an investment with the level of risk. The higher the figure, the better.

If you think of the shares and funds in your portfolio as magnets, attracting or repelling others, the correlation matrix measures this attraction. Positively correlated shares move together, while negatively correlated ones move oppositely. The numbers in this section of the X-Ray report indicate the strength of correlation between asset pairs. A +1.0 means perfect synchronisation in the same direction, -1.0 means opposite directions, and zero means no relationship.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 10:47

- Fri, 13/06/2025 - 10:25

- Wed, 11/06/2025 - 09:38

- Fri, 06/06/2025 - 10:32