A Lifetime ISA account gives you a double whammy of returns, as you can claim the Government bonus and get investment returns on that bonus – which can supercharge your deposit savings.

The big perk of the Lifetime ISA is the ability to claim up to £1,000 a year from the Government for free, which you can put towards your deposit savings for your first home (or retirement savings if you’re planning for later life). If you contribute £4,000 a year, you can claim the full £1,000 bonus a year to add to your account.

However, you can boost this free money further if you invest your savings too, rather than sticking to cash. Because the Government bonus is paid into your account immediately, you can benefit from investment returns on that bonus – giving you more money on top of your free money.

Let’s look at how that would work in practice.

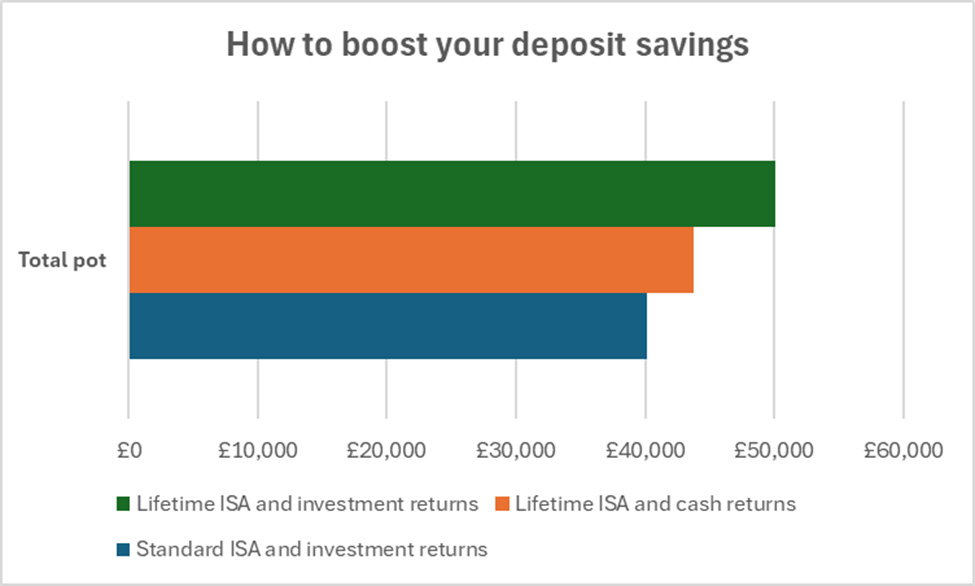

First, let’s look at your deposit savings if you didn’t use a Lifetime ISA and instead put £4,000 a year into a standard ISA and invested it. We’ll assume you did that every year for the past eight years. Over that time, you’d have contributed £32,000 of your own money towards your savings pot, and if it was invested and generating a 5% return a year after charges, you’d have a pot worth just over £40,000. Not too bad for a house deposit. But you could do better.

If instead you paid that same £4,000 a year into your Lifetime ISA each year for the past eight years, since the account launched in April 2017, you would have contributed the same £32,000 but also benefited from £8,000 in free money from the government.

This means your pot is worth £40,000 before any growth is factored in. If you opted for a cash Lifetime ISA and earned a 2% return a year on your money, you’d have seen just £3,773 of growth on your total pot (both your contributions and the Government bonus). This takes your deposit savings to around £43,700. This is better than the standard ISA option, but you could still increase your pot further.

If you opted for the Lifetime ISA route, contributing the same £32,000 and getting the £8,00 of Government bonus but instead invested the money and generated 5% return a year after charges, you’d have seen more than £10,000 of investment growth during that eight-years. That means your pot would be around £50,100 – more than £10,000 more than investing with the standard ISA and almost £6,500 more than the Lifetime ISA option in cash.

Want to crunch your own numbers? You can put your information into our Lifetime ISA calculator to see how much you could save or how long it will take to reach your deposit-saving goal.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Wed, 23/04/2025 - 15:04

- Tue, 22/04/2025 - 13:58

- Thu, 17/04/2025 - 09:28

- Thu, 17/04/2025 - 08:03

- Tue, 15/04/2025 - 10:38