Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Despite starting with significant political and geopolitical challenges, 2024 turned out to be a strong year for equity markets. Meanwhile, bond markets had a more mixed performance. We caught up with James Flintoft, Head of Investment Solutions at AJ Bell, to discuss the outlook, key events that affected markets and how the AJ Bell funds performed in the period.

How did markets perform in 2024?

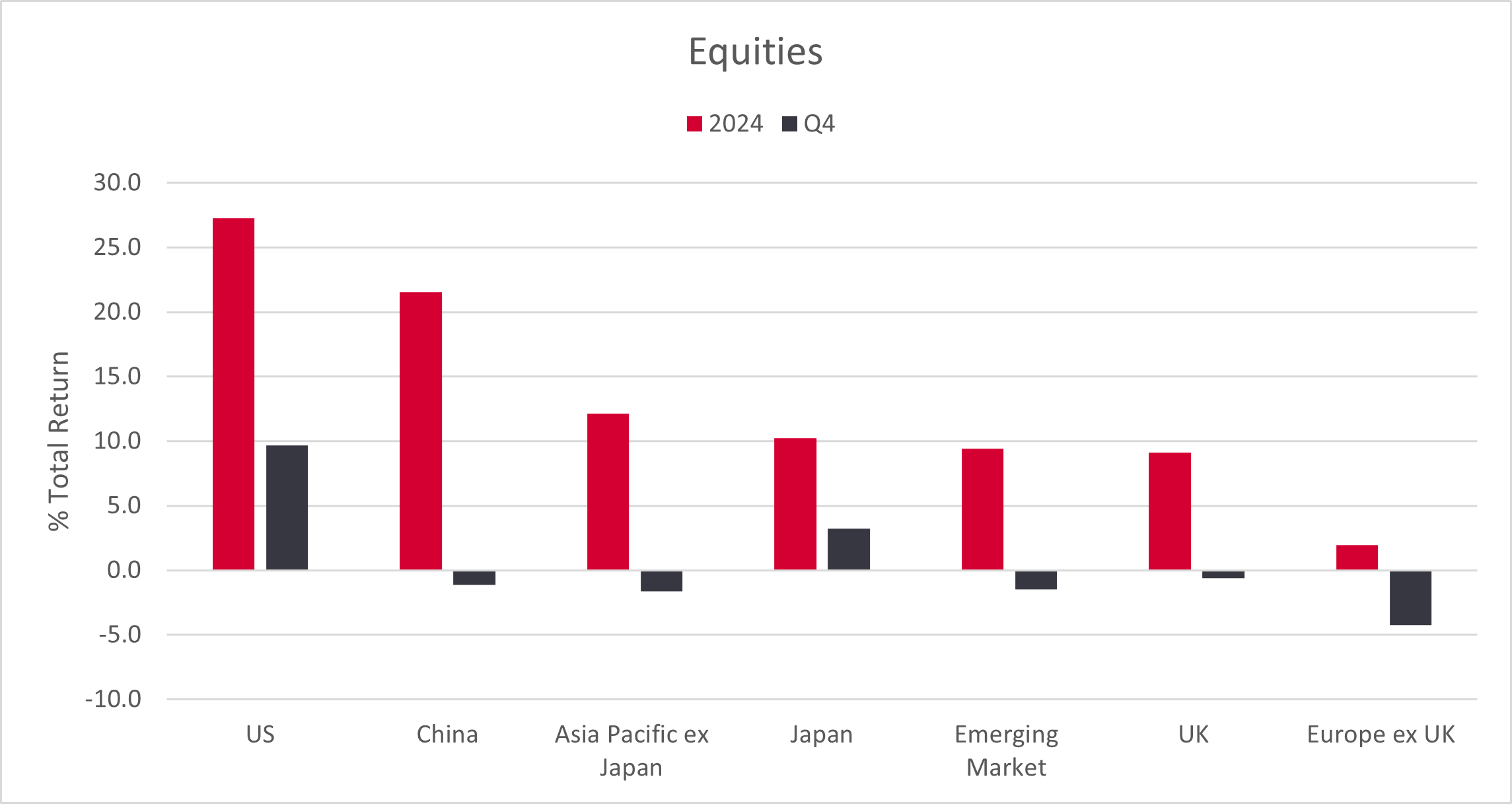

If you think about the whole year, it started with a lot of political and geopolitical challenges. Despite that situation, it has been a strong year for equity markets. The US, in particular, led the way for most of the year. Other developed markets, like the UK and Japan, also performed well, delivering historically solid returns.

China, on the other hand, faced some struggles at the start of the year but showed significant improvement toward the end. On the bond side, government bonds have been more affected by the political turbulence. However, corporate bonds have performed exceptionally well, proving to be the standout segment within bond markets in the year.

What happened in the final quarter of 2024?

There are three main elements to highlight. First, the US election, which had been long anticipated, finally took place. Heading into the year, the general expectation was that Donald Trump would win, and that outcome materialised. This fueled some dollar strength and significant optimism around the US equity market, resulting in strong returns.

In the UK, the situation was less favorable. While there was some initial post-election optimism, it was tempered by developments around the Budget. On the currency front, the pound had a mixed performance – weak against the dollar but relatively strong against the euro.

Finally, in China, the end of Q3 saw a series of government announcements that initially sparked optimism. However, as the fourth quarter progressed, investors began to adopt a wait-and-see approach, holding out for concrete action. This shift led to some volatility in Chinese markets during the quarter.

Source: AJ Bell and Morningstar, 01/01/24 to 31/12/24. Total returns represent those in GBP terms.

Looking at the bond markets, how have bonds behaved as interest rates have been cut?

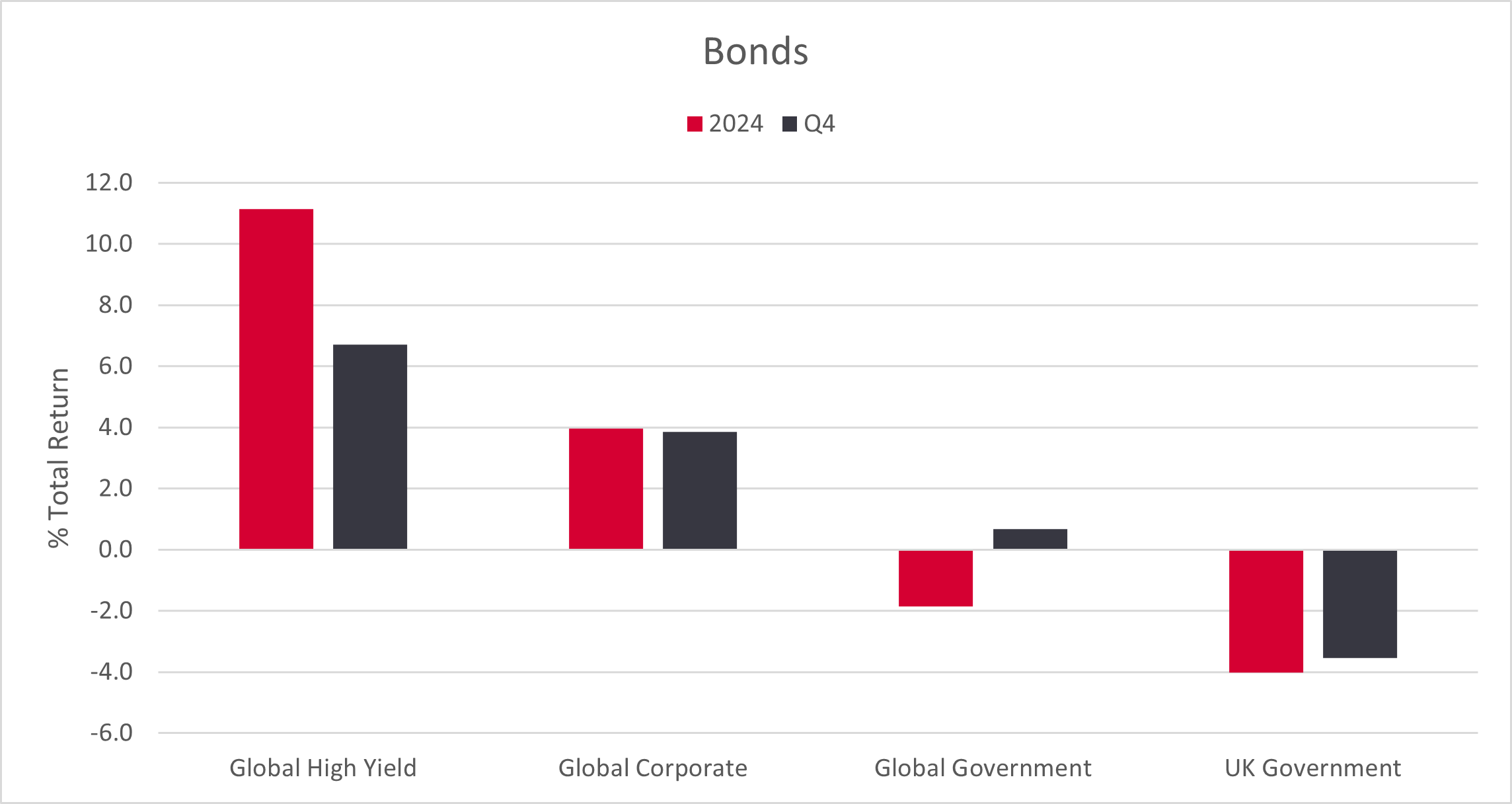

You would expect bonds to perform well in this kind of environment, but it all comes down to expectations. At the start of 2024 expectations for interest rate cuts were quite high. However, as the year progressed, some of those rate cuts were delayed, and now there’s an expectation that rates will remain higher for longer than initially anticipated.

As a result, government bonds have been volatile and haven’t performed particularly well. On the other hand, corporate bonds have been the standout performers, especially in the riskier segments of the bond market. Optimism about the economy has shifted over the year, with conditions generally turning out much better than anticipated at the start. Overall, riskier corporate bonds have been a strong place to invest, while government bonds have faced considerable volatility.

Source: AJ Bell and Morningstar, 01/01/24 to 31/12/24. Total returns represent those in GBP terms.

Looking specifically at the AJ Bell funds, how did they perform in 2024?

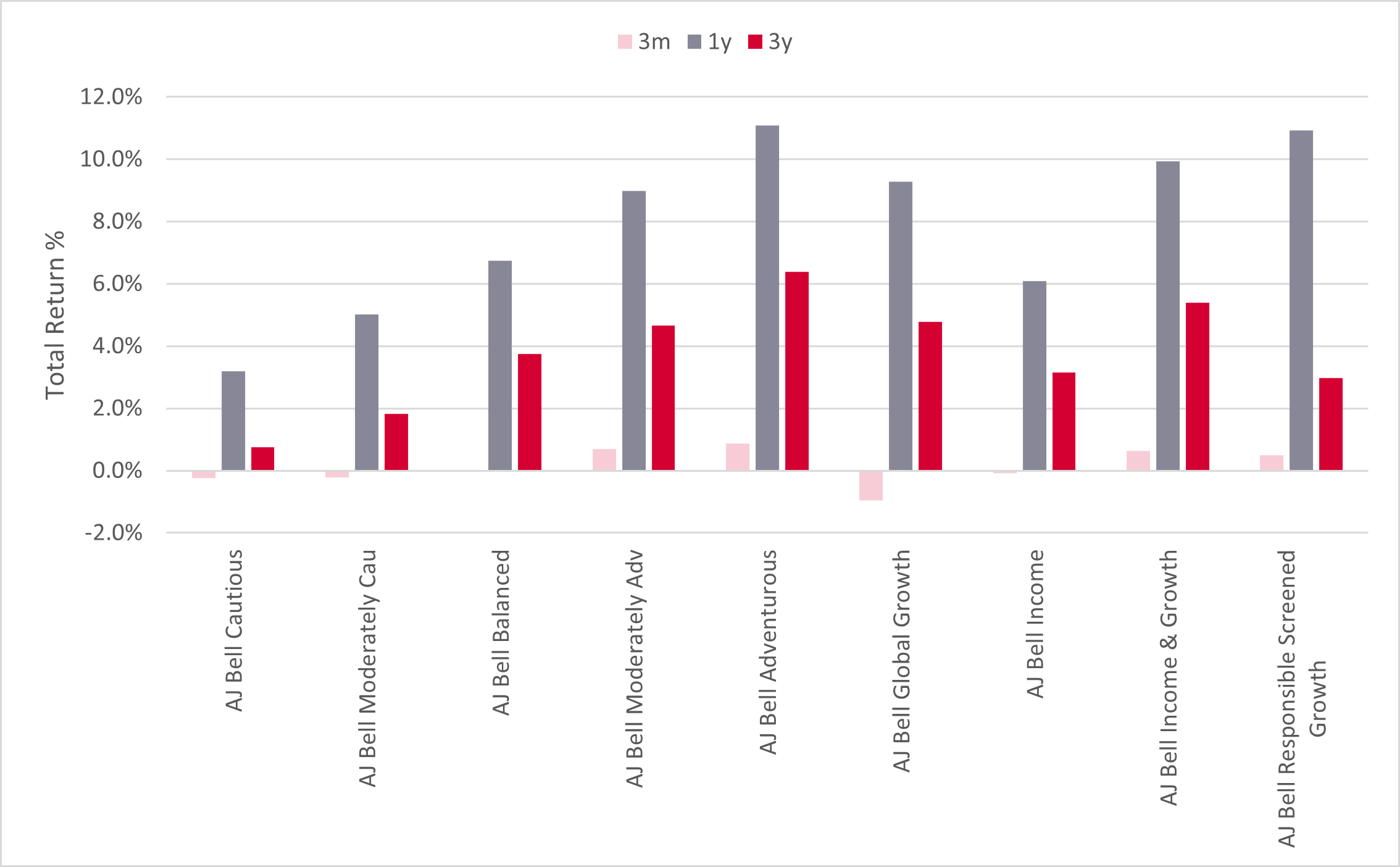

Performance in 2024 was about what you’d expect in a typical year, perhaps slightly above in some areas. Higher-risk investments delivered particularly strong returns, even reaching double digits in some cases.

Throughout the year, there was a mix of market conditions. Bond markets have been volatile, which may have led to some disappointment for lower-risk portfolios at times. However, as the year progressed and especially toward the end, overall returns turned out to be quite solid.

Source: AJ Bell and Morningstar, 01/01/22 to 31/12/24. Total returns represent those in GBP terms.

Thinking about 2025, how are you positioning the portfolios for the year ahead?

We like to focus on identifying risks, and at the moment, we’re particularly attentive to the bond exposure within our portfolios. One key risk we see is inflation. Amid all the political noise over the past year, the return of inflation to target had somewhat slipped under the radar, with less attention paid to inflation figures than at the start of the year.

This poses a potential risk for bond market positioning, and we’re considering de-risking some of that exposure. On the equity side, we aim to avoid getting overly influenced by sentiment in how we position ourselves. However, we’re paying close attention to market concentration, particularly in the US, where a significant portion of the index is dominated by just a few stocks.

Find the latest quarterly reports for each of the AJ Bell funds

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Wed, 11/06/2025 - 17:20

- Mon, 26/05/2025 - 15:33

- Tue, 22/04/2025 - 16:46

- Tue, 22/04/2025 - 09:54

- Wed, 09/04/2025 - 10:39