It’s vital that Chancellor Rachel Reeves increases the maximum property value that people can buy using money held in a Lifetime ISA.

The limit has been kept at £450,000 since Lifetime ISAs were launched in April 2017 yet the average UK property price has increased by 27.9% since that date*. One solution is to increase the maximum property value in line with annual house price inflation.

The upper limit for properties bought using money from a Lifetime ISA without penalty would now be £575,550 had it been uprated by the 27.9% increase in average UK property prices since the tax-efficient account type was launched just under eight years ago.

Tweaking the maximum property value limit for penalty-free withdrawals from a Lifetime ISA by a small amount each year would make a massive difference to so many individuals.

Many aspiring homeowners who’ve worked hard to save for a deposit now face the prospect of properties in their desired location exceeding the upper limit in a Lifetime ISA. They must either buy somewhere else with lower property prices or pay the 25% penalty to withdraw their money from the Lifetime ISA.

Taking a hit via the penalty charge could see an aspiring homeowner left with a smaller deposit than they would have otherwise had, meaning they may have to take out a bigger mortgage which could also come with a higher rate of borrowing.

Flats and terraced houses in more parts of London will soon exceed the £450,000 limit, as will terraced houses in Hampshire, Hertfordshire and Surrey, according to analysis by AJ Bell. That’s particularly bad for anyone who commutes into the capital as they might have to lay down their roots with a home much further out.

The government has frozen allowances on all types of ISAs until 2030. If the Lifetime ISA’s terms and conditions also remain frozen for another five years, flats in places like Ealing and Merton in outer London and terraced houses further afield in locations such as Winchester and Guildford will be deemed too expensive for first-time buyers to deploy funds from a Lifetime ISA without penalty because they are forecast to exceed the £450,000 limit. Even typical first-time buyer properties in the Cotswolds, South Oxfordshire and parts of Kent are projected to be in the penalty zone over the next five years.

The analysis, conducted by AJ Bell and based on Land Registry data and OBR forecast house price increases, illustrates the dilemma faced by those saving for their first home in many parts of the country.

Lifetime ISAs may not be designed to help people buy homes in Kensington or Fulham, but Watford and Croydon surely shouldn’t be off limits. Watford is project to exceed £450,000 for the average price of a terraced house in 2027 while Croydon hits the tipping point in 2029.

*Source: Nationwide House Price Index.

Boosting support for first-time buyers using the Lifetime ISA

The government wants to help people achieve their dream of home ownership but the Lifetime ISA in its current form can be more hindrance than help for many individuals. Someone set on a particular location might have no choice but to pay the Lifetime ISA exit penalty if the property is worth more than £450,000. The 25% charge isn’t simply giving the government back its bonus – it’s also 6.25% of the savers’ own money.

For example, £8,000 worth of contributions into a Lifetime ISA would be topped up by a further £2,000 bonus money from the government. A 25% exit penalty on that £10,000 sum would equate to £2,500 – effectively giving back the £2,000 government bonus and losing a further £500 (6.25% of £8,000 personal contribution). In this situation, the saver would be penalised for saving which could affect their attitude towards putting money away in the future.

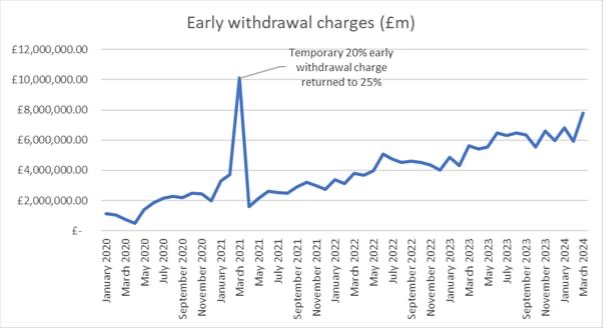

Rachel Reeves should seriously consider reducing the exit penalty to 20% so that savers only give up the government bonus if their withdrawal circumstances trigger the charge**. The government implemented a temporary reduction in the charge during the pandemic to avoid penalising anyone forced to take their money early when the economy ground to a halt. It should now make that measure permanent to avoid putting people off using a Lifetime ISA.

Source: AJ Bell/HMRC

**Lifetime ISA rules state that money can only be withdrawn without the 25% penalty charge if someone is buying their first home worth £450,000 or less, or they are aged 60 or over, or they are terminally ill.

Regions where first-time buyers may not be able to use a Lifetime ISA

AJ Bell calculates an additional 23 regions of the UK would be out of reach for first-time buyers hoping to buy a typical terraced home by the end of this parliament in five years’ time, if no action is taken. That’s in addition to the 39 areas where the average terrace already costs more than £450,000.

AJ Bell calculates flats in another six areas of the UK, including Brent and Southwark, could exceed the £450,000 maximum property value in five years’ time. That’s on top of the 13 regions where the average flat already costs more than that threshold.

This analysis is based on the average price of a terraced house or flat in January 2025 calculated by HM Land Registry and uprating the value each year using annual house price growth forecasts from the OBR.

Two areas – Sutton and Newham – go over the £450,000 threshold in 2025 for terraced homes, joined by Mole Valley in 2026 and the other affected regions either exceed the limit in 2027, 2028 or 2029. Flats in four areas – Brent, Barnet, Southwark and Ealing – exceed the £450,000 threshold in 2027 and two more areas are due to follow in 2028.

Terraced houses:

Region |

Average terraced house in 2029 |

Kensington and Chelsea |

£2,282,331.20 |

City of Westminster |

£1,649,655.30 |

Camden |

£1,479,456.32 |

Islington |

£1,171,092.44 |

City of London |

£1,164,355.15 |

Hammersmith and Fulham |

£1,140,290.67 |

Hackney |

£984,508.43 |

Richmond upon Thames |

£962,200.53 |

Wandsworth |

£954,345.21 |

Lambeth |

£863,624.77 |

Southwark |

£833,667.69 |

Inner London |

£832,218.06 |

Tower Hamlets |

£762,643.81 |

Haringey |

£762,489.21 |

Brent |

£755,481.93 |

Barnet |

£708,844.05 |

Ealing |

£701,457.00 |

Merton |

£696,192.86 |

Waltham Forest |

£641,314.29 |

Lewisham |

£640,713.82 |

London |

£629,743.04 |

Kingston upon Thames |

£617,424.57 |

Hounslow |

£607,389.21 |

Harrow |

£604,968.31 |

Elmbridge |

£604,204.29 |

Redbridge |

£603,529.89 |

Greenwich |

£593,143.88 |

St Albans |

£592,850.37 |

Cambridge |

£577,380.59 |

Outer London |

£573,857.34 |

Windsor and Maidenhead |

£567,016.99 |

Enfield |

£543,046.61 |

Brighton and Hove |

£540,253.78 |

Epsom and Ewell |

£533,088.55 |

Oxford |

£532,876.82 |

Bromley |

£528,600.75 |

Three Rivers |

£507,121.85 |

Hillingdon |

£506,858.59 |

Hertsmere |

£506,105.77 |

Sutton |

£503,899.96 |

Newham |

£502,491.78 |

Mole Valley |

£491,728.25 |

Tandridge |

£489,253.58 |

Epping Forest |

£486,925.66 |

Surrey |

£484,817.31 |

Tunbridge Wells |

£479,424.34 |

Reigate and Banstead |

£478,784.67 |

Guildford |

£478,772.35 |

Watford |

£478,068.82 |

Waverley |

£471,493.96 |

Runnymede |

£465,636.08 |

Bexley |

£463,438.12 |

Dacorum |

£462,210.30 |

Winchester |

£459,694.18 |

Croydon |

£456,885.67 |

East Hertfordshire |

£455,263.52 |

Havering |

£455,261.28 |

Hertfordshire |

£453,893.43 |

South Oxfordshire |

£453,409.48 |

Spelthorne |

£453,308.65 |

Cotswolds |

£452,942.32 |

Brentwood |

£452,161.50 |

Source: AJ Bell. Based on current Nationwide UK house price index. Prices increased each year until 2029 in line with OBR forecast average house price growth. Areas shaded blue currently below £450,000 but projected to move above this threshold between now and 2029. Areas in bold already above £450,000 threshold

Flats:

Region |

Average flat in 2029 |

Kensington and Chelsea |

£1,032,218.41 |

City of Westminster |

£908,226.01 |

Camden |

£815,608.96 |

City of London |

£748,565.40 |

Hammersmith and Fulham |

£683,927.05 |

Islington |

£633,362.63 |

Hackney |

£599,331.12 |

Inner London |

£580,831.01 |

Wandsworth |

£561,700.19 |

Richmond upon Thames |

£556,290.42 |

Haringey |

£531,925.71 |

Tower Hamlets |

£513,439.04 |

Lambeth |

£508,637.57 |

Brent |

£484,790.43 |

Barnet |

£479,829.88 |

Southwark |

£479,392.98 |

Ealing |

£479,074.82 |

London |

£473,764.75 |

Merton |

£463,533.34 |

Source: AJ Bell. Based on current Nationwide UK house price index. Prices increased each year until 2029 in line with OBR forecast average house price growth. Areas shaded blue currently below £450,000 but projected to move above this threshold between now and 2029. Areas in bold already above £450,000 threshold.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Wed, 23/04/2025 - 15:04

- Tue, 22/04/2025 - 13:58

- Thu, 17/04/2025 - 09:28

- Thu, 17/04/2025 - 08:03

- Tue, 15/04/2025 - 10:38