Becoming an ISA millionaire is the lofty goal of many investors, but new data shows that once you’ve hit that point it’s a far more rapid path to hitting your second million. Figures from AJ Bell show that it takes 25 years of saving £1,433 a month to build up a £1 million ISA, but only takes a further 10 years to make it to the £2 million mark.

The beauty of compounding helps to accelerate your growth. For example, after 12 years of saving £1,433 a month, your annual fund growth already matches the £17,196 you’re saving each year. And that magic of compound growth applies whether you’re targeting an ISA pot of £1 million, £100,000 or £10,000.

Compound growth is a formidable force, though you do have to be diligent and patient to harness its power. Clearly the higher the return you achieve on your investments, the more powerful the effect of compound growth on your wealth. Over the long term, a cash saver is therefore likely to see a weaker compounding effect than an investor putting their money into the stock market, though the latter will of course see greater fluctuations in the value of their holdings along the way. Those who are holding too much cash for the long term may well be doing themselves a disservice and making it more difficult to meet their financial goals.

The effect of compound growth can also be compromised by any tax you pay on your investments. But the £20,000 annual ISA allowance means you can stash up to £1,666 a month into a tax shelter, where your investments can grow free from both income tax and capital gains tax. So, any tax paid on savings up to this amount is effectively voluntary.

The making of a million pound ISA

It takes 25 years of saving £1,433 a month to build up a million pound ISA, assuming you get 6% growth on your investments. That’s clearly a pretty punchy amount to be able to put away from your monthly income, but once you get to the million pound mark, getting to your second million is much easier. Based on continuing to save the same £1,433 a month in an ISA, it would take less than 10 further years to get to your second million. That’s because as well as the money you’re saving each month, you’re also getting growth on the first million pounds you’ve stashed away. For most of us the million pound ISA is a distant dream, but the same dynamic works whether you’re building towards a savings pot of £1 million, £100,000 or £10,000.

Compound growth is a wonderful thing when you break it down. Even to reach your first million pounds in 25 years, you would only need to save less than half of this sum, or £429,900, because the remainder would be made up by growth on the savings you make (assuming 6% a year investment growth).

Indeed after 12 years of saving £1,433 a month, your annual fund growth is already exceeding the £17,196 you’re putting away each year. This effect gets turbocharged the more you save, because of the growth on the pot of money you’ve already built up. This explains why it only takes 10 years, rather than 25 years, to save your second million. In other words, it’s 2.5 times easier to save your second ISA million than your first.

This is reflected in the amount you need to save as well. To get from £0 to £1 million in 25 years you need to stump up a total of £429,900. But to get from £1 million to £2 million by saving £1,433 a month, you would only need to stash away £171,960 yourself. Over a decade of saving, you would receive £859,189 in growth, because not only are your new savings growing, but so is the million pounds you’ve already built up in your ISA.

| Monthly savings | Years | Savings required | Fund growth | |

|---|---|---|---|---|

| £0 to £1 million | £1,433 | 25 | £429,900 | £570,157 |

| £1m to £2 million | £1,433 | 10 | £171,960 | £859,189 |

| £2m to £3 million | £1,433 | 6 | £103,176 | £874,067 |

Source: AJ Bell, based on 6% net fund growth per annum. Numbers do not add to round millions as they have been calculated based on whole years of saving

Feeling a bit greedy all of a sudden? Well, to get to your third million would only take a further six years of saving £1,433 a month. During this time you would only need to stump up £103,176 in savings, with £874,067 accruing in fund growth. In total that means 41 years of saving £1,433 a month to get to £3 million. If you are in the fortunate position to be able to do that, over the course of those 41 years, you would have stashed away £705,036, with the remaining £2,303,414 coming from fund growth (the combined total slightly exceeds £3 million as we are working in whole years of saving).

You don’t have to be a millionaire to enjoy the benefits of compound growth

£1,433 is an extremely large amount of monthly savings to be able to set aside, no doubt. But the magic of compound growth applies whatever your target nest egg is.

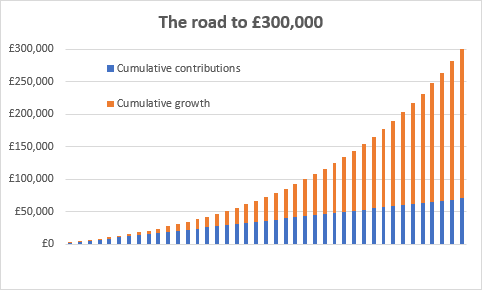

For instance, to build up your first £100,000 over 25 years would require monthly savings of £143.30, and if you carried on at this pace of contributions, you’d hit the £200,000 mark within a further 10 years, and £300,000 within an additional six years. In total over 41 years, you would have saved £70,504 yourself, with a further £230,341 coming from fund growth (again the combined total adds to just over £300,000 as we have calculated them using whole years of saving).

Source: AJ Bell, based on 6% net fund growth per annum

Growth makes a big difference

The level of growth you get does impact the time it takes to build up your nest egg. Our examples above assume 6% growth, but if you only get 4% growth – a level more in line with long run cash rates – then it would take you 30 years to build up £1 million from a monthly saving of £1,433, not 25 years. It would then take another 14 years to hit the £2 million mark. That’s 44 years in total to hit £2 million with 4% growth compared to 35 years at 6% growth. Conversely, if you received 8% growth on your investments, then you would hit the £1 million mark after 22 years and the £2 million mark after a further eight years (30 years in total).

| Annual fund return | Monthly saving | Years to hit £100,000 | Monthly saving | Years to hit £1 million |

|---|---|---|---|---|

| 4% | £143.30 | 30 | £1,433 | 30 |

| 6% | £143.30 | 25 | £1,433 | 25 |

| 8% | £143.30 | 22 | £1,433 | 22 |

Source: AJ Bell

Some investors may wish to take a more cautious approach with their long-term savings, though if they do so they should recognise there is a trade-off here. A more conservative approach will mean less volatility, but will likely mean hitting your financial goals requires more time or a larger amount of monthly savings.

The same goes if you pay tax on your investments. We’ve assumed in the examples above there is no tax to pay on investment returns, which is the case within an ISA wrapper. A £1,433 monthly saving equates to £17,196 a year, which falls neatly within the annual ISA allowance of £20,000, so it’s possible for savings at this level to be free from income tax and capital gains tax. Only if your savings exceed £20,000 a year do you need to pay tax on them, provided you’ve made the most of your ISA allowance.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 09/05/2025 - 08:06

- Thu, 08/05/2025 - 17:13

- Tue, 06/05/2025 - 16:16

- Thu, 01/05/2025 - 10:57

- Tue, 29/04/2025 - 09:23