Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The UK tax system is full of traps and distortions, but every so often, it also throws up quirks and loopholes that can help people shelter more money than usual.

This loophole is only available for children with Child Trust Funds (CTFs), which were available for children born between 1 September 2002 and 2 January 2011. They have since been replaced with Junior ISAs, with CTF holders able to transfer their balance across.

Both come with a generous yearly allowance of £9,000 but the CTF allowance renews on the child’s birthday each year, whilst the Junior ISA runs in line with the tax year.

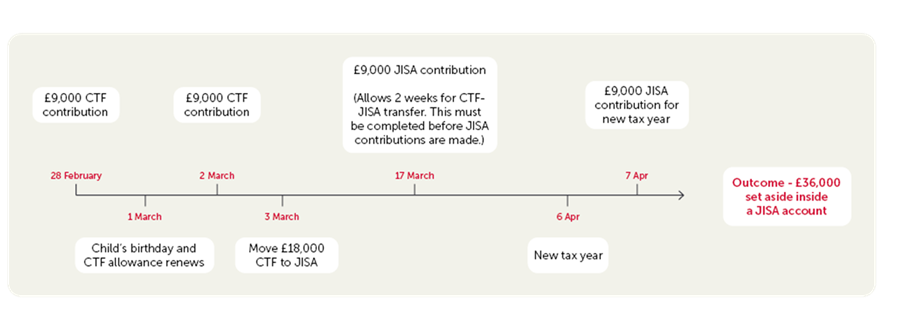

How you can put away £36,000

Parents of a child with a CTF could get four bites of the £9,000 allowance cherry.

Let’s assume a child with a CTF was born on 1 March 2009. Their parents could pay in £9,000 on 28 February and another £9,000 on 2 March before immediately applying for a transfer to a Junior ISA. That has its own fresh £9,000 allowance that could be used after the transfer completes, but before the end of the tax year. This is because a CTF and JISA cannot both be held at the same time. Come the new tax year, the allowance renews and another £9,000 can be paid into the Junior ISA.

Whether or not the whole exercise can be completed clearly depends on the date of the child’s birthday, and a family needs to be able to afford the £36,000 too.

Even if a family cannot make full use of the £36,000 loophole, many young people who have Child Trust Funds but are still under 18 would benefit from a transfer to a Junior ISA anyway, where the charges will likely be lower, and they’ll have a much wider investment choice.

Junior ISA benefits

For parents of children without a CTF, there is still the chance to put away up to £18,000 over the next six weeks for each of their children using the full JISA allowances for this tax year and the next.

Money paid into a JISA by a parent also escapes the sneaky ‘parental settlement rule’. If the income generated by capital gifted from a parent to a child is over £100 for a tax year, it is taxed as if it is the parent’s own.

If a parent paid £9,000 cash into the top children’s savings account earning 5%, the interest of £450 over the year would be taxable on the parent. But in a Junior ISA the income would accumulate in the account tax-free for the child. The money is locked up until the child’s 18th birthday, but for wealthy families looking to start to pass money to the next generation, sticking money into a JISA can prove a valuable loophole to avoid unnecessary tax.

Although Junior ISA rules state that accounts must be set up and managed by a parent or legal guardian, anyone can pay money into it as a gift. This makes them especially useful for grandparents looking to make use of gifting allowances with frozen inheritance tax thresholds until 2030, and the prospect of unused pensions being brought into the value of their estates, too.

When the child turns 18, the account converts to an adult ISA of their own, allowing them to continue building wealth for the future.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 10:47

- Fri, 13/06/2025 - 10:25

- Wed, 11/06/2025 - 09:38

- Fri, 06/06/2025 - 10:32