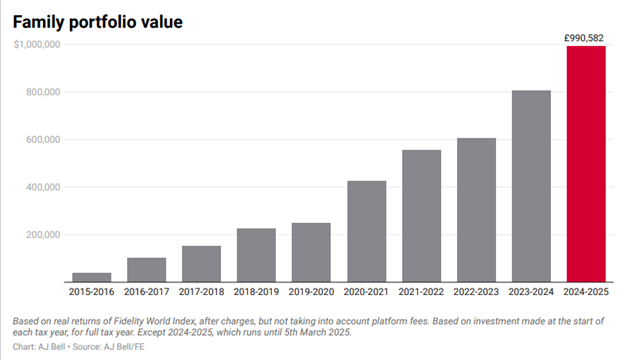

A family of four who had maxed out their Individual Savings Accounts (ISAs) every year for the past 10 years ago would be on the cusp of being a tax-free million pound family. Thanks to generous ISA allowances and investment growth compounding over time, a family who packed their ISAs full could have reached millionaire status with a decade of investing.

To reach the target you need to use two adult ISA allowances and two Junior ISA allowances each year, which would currently rely on you putting away £58,000 a year. But ISA allowances haven’t always been this generous, with a family of four only needing £38,640 to max out their limits 10 years ago, when Junior ISA limits were £4,080 and the adult ISA limit was £15,240.

If the family had invested that money every year in a global tracker fund (we used the Fidelity World Index), they’d be on the cusp of their target today, with a collective pot worth £990,582*. Next year’s ISA allowance or some additional investment growth before the end of this tax year would tip them over the edge to the crucial family millionaire status.

How to become a million pound family

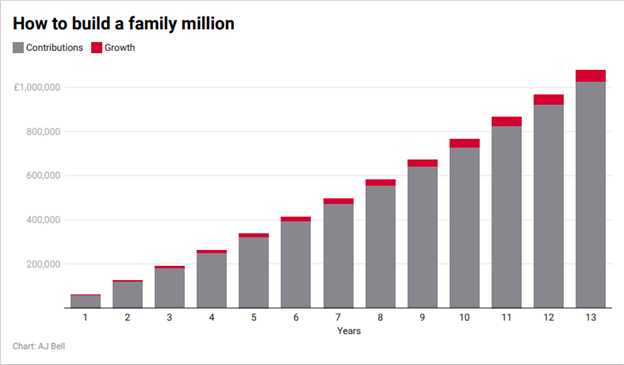

Not everyone will have had the foresight (or spare cash) to have started packing their family’s ISAs 10 years ago. So what does it take if you want to start the journey today? A family of two adults and two children who used all their ISA allowances each year, would have more than £1m in their collective pot after 13 years. The big caveat is that it requires them to have £58,000 available to invest each year — no mean feat.

The plan works by the parents each putting away £20,000 a year into their ISAs, which would grow to £372,000 a piece after 13 years, assuming investment growth of 5% a year after charges. At the same time, they’d need to pay £9,000 into each of their children’s ISAs every year, with those growing to £266,000 each after 13 years. In total, it means the family has £1,079,000 after 13 years — clinching family millionaire status.

As the tax year end looms, people may be wondering how to maximise their ISA allowances. Lots of people will overlook their children’s allowances when planning out their investments. The Junior ISA allowance is very generous, and by investing the money you can really grow the pot to boost your family’s wealth.

Clearly higher investment returns would help to reach the goal sooner. If all the ISA pots saw growth of 7% a year after charges, they’d get to family millionaire status after just over 11 years — with their collective pot reaching £980,000 after 11 years and then a small further contribution taking them to the millionaire marker.

If the family can’t spare the whopping £58,000 each year, they can still reach the million-pound target, it will just take longer. For example, if they wanted to hit the goal within 18 years, to coincide with their kids becoming adults, they’d need to pay £12,000 into each adult’s ISA (so £1,000 a month) and then £5,000 a year into each child’s ISA. Assuming that generated investment returns of 5% a year after charges, that would net them a tidy £1,004,000 after 18 years – just tipping them into millionaire status.

*Data accurate to 5th March 2025. Performance figures include fund charges but doesn’t include platform or transaction charges.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 16/05/2025 - 16:29

- Thu, 15/05/2025 - 15:50

- Fri, 09/05/2025 - 08:06

- Thu, 08/05/2025 - 17:13

- Tue, 06/05/2025 - 16:16