For decades it was taken as a given that life expectancy would continue increasing for each generation. However, even prior to the pandemic, life expectancy improvements had ground to a halt. Despite a very marginal improvement in 2021-2023, average lifespans have still not recovered to pre-pandemic levels.

Life expectancy trends are important to follow as it is vital to make sure you have adequate savings in a pension or elsewhere to see you through retirement.

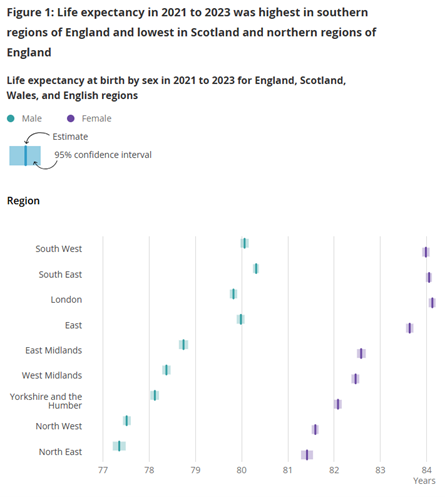

Life expectancy by region

Average life expectancy across the UK is only part of the story — when you dig into the numbers you see the staggering life expectancy disparities that persist between different regions of the UK.

For example, the 10 highest local area male life expectancies at birth were all in the south of England, while the 10 lowest were in Scotland, the north of England and Wales.

Average male life expectancy in Blackpool, the area with the lowest male life expectancy in England, was over a decade below life expectancy in Hart, Hampshire — which had the highest life expectancy for men. The near eight-year gap in average life expectancy for women in the region with the lowest life expectancy, also Blackpool, and the highest, Kensington and Chelsea, is slightly smaller but still significant.

Source: ONS

What life expectancy means for pensions

The differences in average life expectancy between regions presents a colossal challenge to a government which, at some point, will need to address the rapidly mounting cost of state pensions to the Exchequer. Despite life expectancy improvements stalling in recent years, the number of people celebrating their 100th birthday has more than doubled over the last two decades.

The average cost of paying state pensions in the UK is now around £125 billion. Assuming that bill continues to grow as expected as a result of longer-term life expectancy improvements, there’s a risk of a greater burden on taxpayers.

There are already plans in place to increase the state pension age to 67 by 2028 and 68 by 2046, but there is every chance the timetable to 68 will need to be brought forward at some stage — particularly if public finances remain in the doldrums. However, the universal nature of the state pension means doing this will inevitably hit the poorest, hardest.

Then there is the state pension triple-lock, which provides gold-plated annual increases in the value of the state pension in line with the highest of average earnings growth, inflation or 2.5%. This policy has been useful to successive governments politically but remains potentially very expensive and without a clear end goal.

Revisiting either the state pension age or triple-lock will not be something the current administration will want to do, particularly after the fallout from the decision to means-test the Winter Fuel Payment, but at some stage a government will need to face up to this challenge and come to a decision on what the state pension should be worth and for how long people should receive it.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Wed, 11/06/2025 - 09:38

- Wed, 21/05/2025 - 10:29

- Tue, 20/05/2025 - 15:54

- Tue, 20/05/2025 - 11:52

- Tue, 20/05/2025 - 11:42