ISAs are a popular savings and investment product, with millions of people across the UK taking advantage of the tax perks of an ISA to set aside money for the future.

There is now well in excess of £700 billion held by Brits in ISAs, with most of this invested for the long-term in stocks and shares ISAs. Despite complexity creeping into the ISA system in recent years, savers and investors clearly remain attracted to the choice, tax efficiency and flexibility they can get from the product.

The total value of ISAs held by UK adults is up 64% in a decade, from £443 billion to £726 billion between 2013 and 2023. Around £431 billion is invested in stocks and shares ISAs, and £294 billion in cash ISAs.

A further £9.9 billion is held in Junior ISAs for children, with £5.4 billion in investment accounts and £4.5 billion held in cash.

ISA trends among different age groups

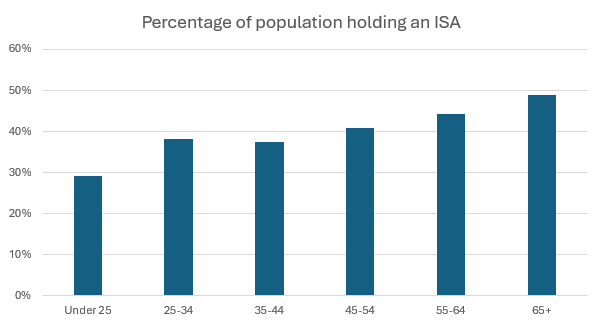

Of the UK’s 22.3 million ISA holders, more than 6 million are over 65, meaning roughly half (49%) of all adults in this age group hold an ISA.

However, there are plenty of young people using ISAs, too. Some 29% of 18 to 24 year olds have an ISA account, rising to 38% among those in their late 20s and early 30s.

Source: AJ Bell. HMRC and ONS figures used to estimate % of ISA holders by age group

Although it illustrates that ISAs are a popular way for young people to start building up their savings and investments, a sizeable proportion are paying into a cash ISA rather than investing. Despite young people often having long time horizons over which they’ll accumulate wealth, investors are still in the minority.

Many younger people will also be using a Lifetime ISA alongside, or instead of, a cash or stocks and shares ISA. Since launch in 2017, around £8 billion has been paid into Lifetime ISAs, with AJ Bell campaigning for reforms to improve uptake and future-proof the accounts to ensure they work for aspiring homeowners.

| Age | Contributed to an ISA | Holds an ISA but made no subscription | Doesn't have an ISA | ||

|---|---|---|---|---|---|

| Cash | Stocks and shares | Both | |||

| 18-25 | 14% | 5% | 1% | 9% | 71% |

| 25-34 | 16% | 7% | 2% | 14% | 62% |

| 35-44 | 12% | 6% | 1% | 19% | 63% |

| 45-54 | 11% | 7% | 1% | 22% | 59% |

| 55-64 | 11% | 7% | 1% | 25% | 56% |

| 65+ | 10% | 5% | 1% | 33% | 51% |

Source: AJ Bell. Analysis of HMRC and ONS data. Total percentage of UK adult population in each age group contributing to ISAs in 2021/22

Are ISA holders putting too much in cash?

A significant number of UK adults hold a large cash ISA balance but don’t invest. Over 4.4 million adults hold in excess of £10,000 in a cash ISA but don’t invest and 3 million have over £20,000 without having any stocks and shares ISA investments.

At a conservative estimate, those 3 million savers hold almost £100 billion in cash ISA accounts but no ISA investments*. Encouraging just a small proportion of them to invest could have a significant impact on markets, providing a huge injection of capital from retail investors who tend naturally to focus on investing in UK companies and funds.

How much do people hold in their ISA?

The average ISA account is worth over £33,000, although this varies significantly by age.

Among ISA holders aged 65 and over, the average account is worth more than £63,000, while under 25s have around £7,700.

Around 1.8 million ISA holders used the full £20,000 annual ISA allowance, according to HMRC’s most recent figures, equating to roughly 8% of all ISA holders.

Unsurprisingly, most people pay in far smaller amounts – almost 60% of those subscribing to ISAs paid in less than £5,000.

| Average ISA balance by age group | |

|---|---|

| Under 25 | £7,698 |

| 25-34 | £9,477 |

| 35-44 | £13,527 |

| 45-54 | £25,362 |

| 55-64 | £40,945 |

| 65+ | £63,365 |

Source: AJ Bell/ HMRC

Gender investing gap

There are more female ISA holders than men, with 11.5 million women having an ISA account and 10.7 million men.

However, men are much more likely to be investing their ISA, whereas women favour cash ISAs more heavily.

While a similar proportion of male and female ISA holders made contributions to their accounts in the last year for which HMRC publishes data, men were far more likely to be investing.

Almost half (44%) of men paying into an ISA opted to put their money into a stocks and shares account. In contrast, less than a third of females (31%) contributing to an ISA put their money into investments.

Read more about why women tend toward cash ISAs in the latest AJ Bell Money Matters report.

Junior ISA holders

Close to £10 billion is held in Junior ISAs for children across the UK, with 1.25 million accounts paid into annually.

While the maximum amount that can be paid in each year stands at £9,000, the average is much lower, at £1,220.

As with adult ISAs, those paying in larger sums tend to be investing, with a higher average contribution to a stocks and shares Junior ISA (£1,797) compared to a cash Junior ISA (£848).

Figures based on AJ Bell analysis of HMRC data published September 2024. Total values and subscriptions run up until 2022/23. Age and gender breakdown runs up until 2021/22.

Proportion of adult population holding an ISA estimated based on HMRC figures for total number of ISA holders, as well as ONS data on population size.

*Source: AJ Bell. HMRC estimates that among those ISA holders with cash ISAs only and no stocks and shares ISA there are 647,000 adults with £20,000-£24,999, 1,213,000 with £25,000-£49,999, and 1,111,000 with £50,000 or more. Assuming each holds only the minimum balance within the range (£20,000, £25,000 and £50,000 respectively) the total held by these individuals amounts to £98,802,779,503.82.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.