Next month we will be lighting the candles on the cake celebrating 10 years of pension freedoms. George Osborne’s 2014 Budget bombshell was a dramatic initiative which ripped up the rulebook on annuities and gave people more control over how they access their pension savings.

In the biggest pensions shake-up in a generation, government relaxed some rules around drawdown from 2014, going on to open up choice on how to access pensions in April 2015 and launching a retirement revolution in the UK that has transformed the market.

A decade later, we can see the choices people made with their new-found freedom. Drawdown, which allows you to take as much or as little income from your pension as you’d like, has become by far the most popular retirement choice among those with pots of £30,000 or more.

Opting for drawdown

Last year, 60% of all those pension pots in excess of £30,000 used drawdown, while a further 8% used uncrystallised funds pension lump sum (UFPLS) payments, another form of flexible income payment.

Among those with £100,000 or more in their pension pot, the vast majority opted for flexible income through either drawdown (73%) or UFPLS (9%), while just 15% purchased an annuity.

Annuity sales nose-dived following the reforms. Some 75% of defined contribution pensions were used to buy an annuity before 2015**, falling to just 17% of pots worth over £30,000 last year and just 10% of all pots accessed since 2015. And while sales of annuities in the last 12 months have rallied, they are unlikely to match the number of people choosing drawdown.

Among those with smaller pension pots worth less than £30,000, withdrawing a pension in full is a common choice. Around 55% of pension pots have been fully encashed since 2015, although the vast majority (90%) were small pots worth less than £30,000.

Withdrawal rates

Contrary to worries at the time, there is little evidence people rushed out to ‘blow’ their entire pension pot on luxury items like Lamborghinis. Instead, Financial Conduct Authority (FCA) evidence shows those with larger pension pots are making sensible decisions using drawdown and annuities to make sure they have a decent income in retirement.

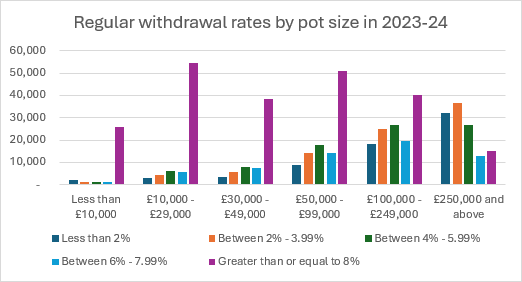

The most popular option in 2023-24 was to take income at a withdrawal rate of 8% or over. While there may be valid reasons for taking income at above 8% – people taking their income solely from one pot while leaving others untouched, for example – others might need more support to understand the consequences of their actions.

Those drawing down pensions at over 8% largely reflects the number of small pots drawn down relatively quickly, with the average withdrawal rate falling to more moderate levels from larger pension pots.

Among those with £100,000 or more in their pension pot, 65% withdrew less than 6% income last year, with 44% taking under 4%.

Source: FCA retirement income market data – September 2024

Managing small pension pots

The data shows that withdrawing a pension in full has become a common option for those with pots of under £30,000. Before the pension freedom reforms there was very little opportunity to fully encash pension pots.

Pension freedoms allowed those with modest pension pots – many people will build up multiple small pension accounts during their lifetime – to fully encash the account rather than leave them to set up multiple small annuity income payments in retirement.

There might be a better approach than cashing in small pension pots. Some people may find combining pensions more beneficial. Combining several smaller pots to form a larger one could give them more options and reduce charges, potentially producing a bigger income in retirement.

The Pensions Dashboard, once launched, will be massively helpful, showing people all their pension pots in one place and kickstarting conversations on consolidation.

The number of people relying mostly on defined contribution pensions for their later life income is soaring, as defined benefit pensions, a workplace pension based on earnings and length of service, become the preserve of a lucky few.

As we enter the next decade of pension freedoms, making sure these people are supported in their retirement decisions is paramount. People face tough decisions on how to secure a retirement income, and how much to take and when.

The introduction of targeted support will be a gamechanger, shaping the narrative for the next 10 years. Deciding on a robust income strategy is challenging, and more personalised guidance can help people understand their options, nudge them to act, and encourage more to seek regulated advice.

*Source: AJ Bell/FCA retirement income market data – September 2024

**Source: HMT, Freedom and Choice in Pensions

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Wed, 11/06/2025 - 09:38

- Wed, 21/05/2025 - 10:29

- Tue, 20/05/2025 - 15:54

- Tue, 20/05/2025 - 11:52

- Tue, 20/05/2025 - 11:42