Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Global stock and commodity markets have had a torrid start to the year, while currency markets remain volatile and only Government bonds, the yen and gold have offered any comfort at all.

The task facing every investor now is to step back from the day-to-day noise and work out whether stocks have further to fall or whether this is a chance to buy.

Timing the market is a dangerous game and if anyone is in doubt the best plan is probably to do nothing, so as to avoid racking up unnecessary dealing expenses, but these five indicators could prove useful in spotting whether there are bargains to be had or whether it is best to hunker down and try to weather the storm.

1. The transportation indices. The old theory goes that if the transports are not performing, the industrials can’t either, as if nothing is being shipped, nothing is being sold. The bad news is the Dow Jones Transportation index is now 27% below its December 2014 high – bear market territory – and still falling but any stabilisation here would be a good sign, as it could signal a turn in the Dow Jones Industrials and the US market.

Transportation stocks are still going off the rails

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

2. Doctor Copper. The industrial metal is a great barometer for global economic health and it currently trades at six-year low. A sustained increase in copper prices would help ease fears that we are sliding toward a deflationary downturn.

Dr Copper still looks peaky so any recovery could be a good sign for markets

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

3. Small caps. Market minnows are an excellent indicator risk appetite- they tend to outperform when investors are bullish and fall faster than the broader market when they are bearish. In the UK the FTSE Small Cap is only some 10% off its highs but America’s Russell 2000 has plunged by more than 20% and is now in bear market territory, too. Bulls will want to see these benchmarks start to consistently tick higher as a sign that confidence is returning.

Small caps are still sliding lower, especially in the USA

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

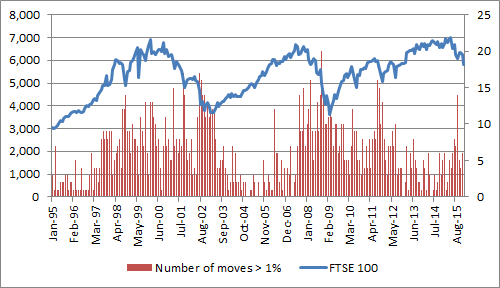

4. Market volatility. A little more conversation and little less action would be welcome. In just ten trading days the FTSE 100 had risen or fallen by more than 1% from open to close on five occasions, as of the time of writing. Volatility can be the friend of the investor – it can provide chances to sell stock expensively or buy it cheaply – but history shows that stock indices progress best when they make serene progress and a series of modest gains tend to fare less well when trading is choppy and there are big swings up and down. One potential good sign would therefore be a period of calm where the market does relatively little or only moves in small steps.

A period of calm and less market volatility would be a good thing, if history is any guide

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

5. Valuation – and especially the dividend yield. In the end, the valuation paid for an asset is the ultimate arbiter of the investment returns made on it. Valuation metrics using forecast earnings can be unreliable, as those forecasts are often wrong, so dividend yield can offer more comfort. Management teams are reluctant to cut the shareholder payouts as this tends to hit a share price hard and potentially their own wallets. At the time of writing, the FTSE All-Share is yielding around 4%, compared to a 10-year Gilt yield of 1.7% - that’s a 230 basis point (2.3%) premium. Granted, the risks are much higher with stocks than bonds – and dividend cuts remain a danger - but the All-Share has only twice offered such a premium yield of 2% or more since 2008 and on both occasions the stock market bottomed shortly afterwards.

New narrative needed

The past is no guarantee for the future but the premium offered by the equity yield relative to the ten-year Gilt year is perhaps the most bullish of the five charts listed here this week.

For the moment, Government bonds are rallying hard (and yields shrinking) and share prices are falling (with yields rising) so there is nothing to say that gap could not widen, especially if a true deflationary, recessionary shock grips the markets – and that is the current fear, if the transport stocks, copper price and small-cap action are to be used as a guide.

More confidence in company dividend payouts would also be welcome. That FTSE All-Share dividend yield premium looks tempting but there are few worse investments than an income stock that cuts its dividend, as share price falls will almost certainly accompany the lost yield.

The fattest-yielding stocks in the FTSE 100 all offer earnings cover of less than two times, with just one exception, which is hardly ideal.

Dividend cover is regrettably thin at the FTSE 100’s highest-yielding stocks

Source: Digital Look, analysts’ consensus estimates, London Stock Exchange data

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

When we get round to the April reporting season, these ten names will therefore go a long way to shaping sentiment toward the UK market at least for the rest of the year and potentially beyond.

| Dividend yield, 2016 E | Dividend cover, 2016 E | |

| BHP Billiton | 12.0% | 0.4 x |

| Royal Dutch Shell | 9.4% | 1.0 x |

| Rio Tinto | 8.9% | 1.0 x |

| Aberdeen Asset Mgt. | 8.8% | 1.2 x |

| Pearson | 7.1% | 1.2 x |

| BP | 7.6% | 0.9 x |

| HSBC | 7.2% | 1.5 x |

| Old Mutual | 6.5% | 2.1 x |

| SSE | 6.9% | 1.3 x |

| GlaxoSmithKline | 6.0% | 1.0 x |

Source: Digital Look, analyst consensus forecasts, London Stock Exchange data

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55