Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Stock markets remain rocky and very few asset classes are providing any shelter from the storm – Government bond yields are compressing as prices rise, the yen is trying to go higher and gold has rallied strongly after five years in the doldrums as some investors start to follow the yellow brick road, as it were.

Yet the only commodity really grabbing the headlines (despite gold’s intriguing rally) is oil. The price of crude continues to buck and sway and global share prices are slavishly following it lower, higher and then lower again.

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to

be held for the long term.

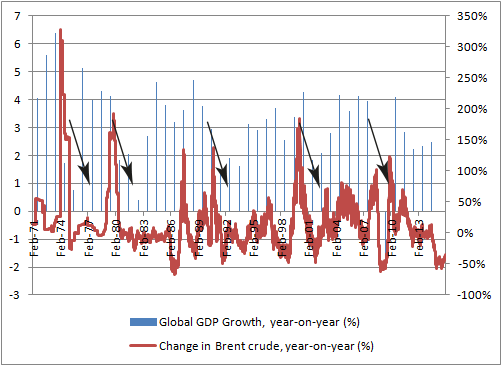

At first, this seems entirely counter-intuitive. Our research going back to 1970 shows that cheap oil has never sparked a recession, but has instead helped global GDP growth to accelerate over the next one to two years. Expensive oil is a different matter, as the recessions (and stock market falls) of 1973-74, 1980, 1991-92, 2000-03 and 2007-09 attest, but cheap oil should be good news.

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to

be held for the long term.

The question investors therefore need to be addressing is why are low oil prices seen as bad news. Perversely, the answer may lie with a different sector – banks. Banking indices stand at 12-month lows in the UK, USA, Western Europe and Japan.

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to

be held for the long term.

The prospects of sagging economic growth and interest rates remaining lower for longer are not helping the sector, but this column suspects someone, somewhere is starting to worry about who has lent how much money to which oil producing countries and companies – and how much they could lose if crude prices stay lower for too much longer.

This may be an irrational fear, but the events of 2007-09 showed it was better to protect yourself and ask questions later. US banks such as JP Morgan, Citibank, Wells Fargo and Bank of America have all taken provisions against the loans made to energy firms and all have tried to make soothing noises that no more will be required – but then they would say that, wouldn’t they? This link between banks and oils may be one of the unfolding stories of 2016 and investors would do well to remain on their guard.

Good news

The good news for oil producers and exporters is demand still seems to be going up, albeit slowly. January’s monthly OPEC report shows that global consumption reached an average of 94 million barrels a day in Q4 2015, up 1.3% year-on-year.

Global oil demand continues to grow (just)

Source: OPEC December report

OPEC data suggests the supply-demand imbalance is also relatively minor, at barely one million barrels a day, since global output averaged 95.2 million barrels a day in December. Assuming their supply-side numbers are accurate (and admittedly that is a big “if”) such an imbalance may not take long to correct itself.

Further good news comes from the supply side.

First, the Baker Hughes rig count continues to collapse. In the USA, the number of active oil and gas drillers has plunged to 571, down some 62% year-on-year. The worldwide count of 1,891 is the lowest number since 2002.

Global oil drilling activity continues to decline

Source: Baker Hughes

NOTE: Past performance is not a guide to future performance and some investments need to

be held for the long term.

This decline in exploration work results directly from savage cuts in capital expenditure at all of the major oil firms, including ExxonMobil, Shell, BP, ConocoPhillips and others, including national champions such as Brazil’s Petrobras.

All of these firms are fighting to preserve dividend payments, stay in profit and keep balance sheets healthy. Cutting capex saves cash but can come at a long-term cost. Oil firms were already finding it harder – and more expensive – to extract oil from deeper water and more inhospitable areas in a safe manner. Investment cutbacks will only further check output growth on a long-term basis and bulls of oil will be intrigued to see the low reserve replacement ratios offered by Shell and BP for 2015. This measures how much of oil pumped was replaced by new finds. At BP it was just 61%, whereas Shell’s total reserves shrank owing to an RRR of minus 20%, the first negative figure since 1999 according to research from Bloomberg.

British majors are struggling to replace oil already drilled

Source: Company accounts

Bad news

The bad news is these supply-side effects could take a long time to work through, as the market does look glutted. The removal of sanctions is bringing Iranian supply back into play, Iraq also wants to sell more and Libya is also desperate for cash.

More immediately, US oil inventories have just topped 500 million barrels after a mild winter, so there is no shortage of crude in storage even if demand does suddenly accelerate.

US oil inventories continue to rise

Source: Company accounts

The geopolitical angle to oil also makes its future price movements impossible to predict. Saudi Arabia’s motives for pumping at a furious rate remain unclear. It is possible Riyadh wishes to damage the US shale industry, while Riyadh’s Sunni Muslim regime has no love for Shi’a Iran, whose return to the international market will therefore be seen as an unwelcome development.

Yet Iran seems happy to sell at almost any price, such is its thirst for petrodollars and this may be the root of oil’s woes – forced, price insensitive sellers. BP, Shell and ExxonMobil are honourable exceptions but a lot of oil producers (companies and national) have a lot of debt.

Ratings agencies Standard & Poor’s and Moody’s have been cutting – or put on negative watch – the debt ratings of legions of oil firms, with the former even threatening AAA-rated ExxonMobil with a downgrade.

Lots of firms less well financed than these three are scrambling for cash and they have to sell oil at current prices whether they like or not, to make the interest payments to bond holders and banks.

Just look at the yield on energy company bonds. According to indices prepared by Bank of America Merrill Lynch for US firms, the investment-grade index yields 5.4% and the ‘junk’ one more than 20%.

For investment grade this is the highest yield since summer 2009. For junk, it is higher than at the peak of the 2007-09 credit crises. Firms who have to roll over debts this year might find the markets closed to them, or it simply too expensive to do so, if they are “junk” rated – and that could be curtains for them, helping take out some supply.

Oil explorers with lowly-rated debt are seeing funding costs surge in the US

Source: Company accounts

NOTE: Past performance is not a guide to future performance and some investments need to

be held for the long term.

National news

Yet it is not just companies who borrow or sell bonds. Countries do too and the Financial Times has been carefully chronicling the debt woes of countries such as Venezuela, Azerbaijan and Nigeria, who are now looking toward the World Bank or International Monetary Fund for financial help. Anyone who has loaned money to Caracas, Baku or Abuja could find themselves taking a loss, and this takes us back to the banks. The imminent reporting season could be instructive and hopefully the FTSE 100’s Big Five will be able to ease the market’s nerves about any exposure they may have.

That just leaves the oil stocks themselves. BP and Shell held their dividends unchanged at $0.40 and $1.88 respectively. Both firms’ bosses have committed to try and hold those payments, which are enough for 2016 dividend yields of 8.2% at BP and 8.7% at Shell.

Many investors are unlikely to want to take on stock-specific risk, but broad UK equity funds and especially income funds have a big decision to take here. An over or underweighting will have a strong influence on short and long-term performance and investors will need to divine a portfolio manager’s views on oil before committing their capital.

After all, BP and Shell now trade within touching distance of 30-year lows, on a relative basis against the UK market (this figure is obtained by dividing their share price by the value of the FTSE All-Share).

That is no defence against them going lower but it does at least mean oil staying lower for longer is at least partly reflected in current valuations, which could begin to look interesting if the dividend payments are held and oil begins to rise again, for whatever reason.

UK oil majors trade at multi-decade lows relative to the broader market

Source: Company accounts

NOTE: Past performance is not a guide to future performance and some investments need to

be held for the long term.

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55