Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Regular readers will be (perhaps painfully) aware for this column’s penchant for quoting the old market maxim: “You can have good news and cheap stocks, just not both at the same time.” It may be pertinent to look at a possible current example of this, in the form of emerging market equities, which are showing signs of life after three poor years.

So far in 2016, the MSCI Emerging Markets equity index is up by 3.3% in sterling terms, well ahead of Frontier and Developed (as defined by the G7) arenas:

Emerging market stocks are outperforming in 2016

Source: Thomson Reuters Datastream NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

There are five possible reasons why this might be:

- First, neither China’s economy nor currency have imploded

- Second, the dollar has stopped going up and emerging market currencies have rallied

- Third, commodity prices have stabilised, giving a lift to some emerging economies, such as those of Russia and Brazil, for example

- Fourth, the January and February global growth scare appears to be receding, even if macro data remain patchy, helped by fresh monetary stimulus from the European Central Bank

- Finally, the combination of crushed currencies and downbeaten stock valuations suggests at lot of the bad news surrounding Emerging Markets was already in the price

This is not to say EM are fully out of the woods. Three years of underperformance is not a great record, but EM lagged their developed counterparts for eight years after the 1997-98 debt and currency crisis, so nothing can be taken for granted.

But this column is intrigued to hear comments made quite independently by Rob Secker of M&G’s Global Emerging Markets and Asian teams and Colin Graham of BNP Paribas’ multi-asset funds that their models keep suggesting this is where the value may lie, either in the equity or debt arenas.

Should patient investors with a long-term time horizon and appetite for risk decide EM equities or bonds fit with their overall investment goals and target returns, then there is a good selection of active and passive funds which are dedicated to this area, while multi-asset funds such as the BNP Multi-Asset Income and range of Diversified World collectives run by Graham and his team can also provide exposure in a risk-managed way.

Best performing Global Emerging Market OEICs over the past five years

| OEIC | ISIN | Fund size £ million | Annualised 5-year performance | 12-month yield | Ongoing charge | Morningstar rating |

| Stewart Investors Global Emerging Markets Sustainability B (Acc) EUR | GB00B64TSC26 | £256.4 | 6.5% | 1.81% | 1.03% | ***** |

| Stewart Investors Global Emerging Markets Leaders B (Acc) GBP | GB0033874545 | £2,249.0 | 5.9% | 1.39% | 0.92% | ***** |

| Stewart Investors Global Emerging Markets B (Acc) GBP | GB0030187438 | £663.9 | 4.6% | 1.28% | 1.08% | ***** |

| Templeton Emerging Markets Smaller Companies W (Acc) GBP | LU0768361320 | £296.4 | 4.6% | n/a | 1.65% | ***** |

| St James's Global Emerging Markets (Acc) | GB00B64L8R37 | £635.3 | 4.1% | 0.27% | 1.99% | ***** |

Source: Morningstar, for Global Emerging Market Equity category. Where more than one class of fund features only the best performer is listed. NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Best performing Global Emerging Market Equity investment companies over the past five years

| Investment company | EPIC | Market cap (£ million) | Annualised 5-year performance * | Dividend yield | Ongoing charges** | Discount to NAV | Gearing | Morningstar rating |

| BlackRock Frontiers | BRFI | 162.2 | 6.9% | 4.0% | 1.60% | 0.6% | 2% | **** |

| Utilico Emerging Markets | UEM | 374.5 | 6.0% | 3.6% | 1.85% | -10.4% | 4% | ***** |

| Advance Frontier Markets | AFMF | 87.9 | 3.7% | n/a | 1.65% | -6.5% | 0% | *** |

| JP Morgan Global Emerging Markets Income | JEMI | 265.6 | 0.7% | 5.4% | 1.24% | -5.3% | 7% | **** |

| JP Morgan Emerging Markets | JMG | 719.2 | 0.6% | 1.1% | 1.16% | -12.3% | 0% | ***** |

Source: Morningstar, The Association of Investment Companies, for the Global Emerging Markets category *Share price **Includes performance fees NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term. * Share price. ** Includes performance fee

Best performing Global Emerging Market Equity ETFs over the past five years

| ETF | EPIC | Net assets £ million | Annualised 5-year performance | Dividend yield | Fund Ongoing Charge | Morningstar rating | Replication method |

| iShares MSCI Emerging Markets UCITS ETF (Acc) | IEMA | 230.8 | 4.5% | n/a | 0.68% | *** | Physical |

| iShares MSCI Emerging Markets Small Cap UCITS ETF (USD) | IEMS | 181.4 | -0.4% | 2.33% | 0.74% | **** | Physical |

| db x-trackers MSCI Emerging Markets UCITS ETF 1C (GBP) | XMEM | 992.0 | -2.3% | n/a | 0.68% | *** | Synthetic |

| Source MSCI Emerging Markets UCITS ETF (USD) | MXFS | 80.6 | -2.4% | n/a | 0.45% | *** | Synthetic |

| PowerShares FTSE RAFI Emerging Markets UCITS ETF (GBP) | PRSM | 4.8 | -7.5% | n/a | 0.65% | * | Physical |

Source: Morningstar, for Global Emerging Markets Equity category. Where more than one class of fund features only the best performer is listed. NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Best performing Global Emerging Market Bond OEICs over the past five years

| OEIC | ISIN | Fund size £ million | Annualised 5-year performance | 12-month yield | Ongoing charge | Morningstar rating |

| Goldman Sachs Growth & Emerging Markets Debt I (Inc) | LU0129914015 | £3,565.9 | 7.8% | 5.52% | 0.92% | ***** |

| Wellington Opportunistic Emerging Markets Debt S (Dis) USD | IE00B3DJG15 | £974.7 | 7.6% | 5.78% | 0.64% | ***** |

| MFS Meridian Emerging Markets Debt I1 (Acc) GBP | LU0219434957 | £2,178.6 | 7.0% | n/a | 0.87% | ***** |

| Morgan Stanley Emerging Markets Debt Z | LU0360479504 | £150.2 | 6.2% | n/a | 1.09% | *** |

| M&G Emerging Markets Bond | GB00B4TL2D89 | £128.2 | 6.2% | 5.00% | 0.95% | **** |

Source: Morningstar, for Global Emerging Markets Bond category. Where more than one class of fund features only the best performer is listed. NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Emerging from the dark

Given everything that has gone wrong over the last year it is no wonder Emerging Market stocks, bonds and currencies have been put through the mill. Commodity prices have plunged to hurt nations like Chile, Russia and Brazil; inflation has kept on galloping higher in Argentina, which has been joined by Egypt and Kazakhstan in devaluing its currency; currencies such as South African rand have crumbled against the dollar; longed-for reforms have run into the sand in India; and Mexico, South Africa and others have had to jack up interest rates to defend their currencies, beat off inflation or both, even as their economies have slowed.

This litany of woe helps to explain why EM assets performed terribly during 2013-15 – but note the past tense. All of this is already known and potentially discounted by the market, so at least some of the bad news is already baked into valuations. EM equities, for example, are staging a rally in 2016 as if to say things have got so bad they can only get better. The key questions now are why they think this, whether this can be sustained – and of course whether things will indeed get better.

Potential reasons for the re-emergence of EM include:

- China

According to some valuable, in-depth reports in the Financial Times, central bank Zhou Xiaochuan has given three major press conferences in the past month to offer soothing words about growth and the currency, besides cutting the bank’s reserve requirement ratio so they can pump more credit into the economy, while Premier Li Keqiang laid down a target of 6.5% to 7% growth for 2016 – lower than in 2015, but better than the bears had expected. In addition, China has not devalued the renminbi to ease concerns it would try to export its way out of problem and send a wave of deflation around the world.

Chinese renminbi has not fallen as hard as many had feared

Source: Thomson Reuters Datastream NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

The dollar

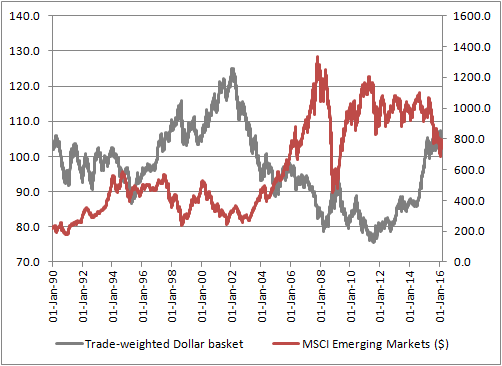

The US Federal Reserve’s original plan to push through four, one-quarter point interest rate hikes in 2016 looks to have gone astray, with markets having at one stage price in no change at all, before reverting to a 0.25% or 0.5% net increment this year. That has checked the dollar’s rise and allowed currencies like the Real to rally from nearly BRL4.2 to BRL 3.6 against the buck. That gives a lift to the value of EM assets and many a fund manager will tell you the time to buy EMs is when the currency is cheap. This is backed up by the historic inverse correlation between the dollar and EM equities, a chart to which this column has referred before:

The dollar and EM equities have historically had an inverse correlation

Source: Thomson Reuters Datastream NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

M&G Emerging Markets Bond Fund’s Claudia Calich reminds that one good time to buy EM can be when the currencies are cheap. At a February presentation, she suggested the Malaysia ringgit, Brazilian real, Colombia peso and Russian rouble all looked cheap (a view which has been borne out by subsequent events, at least so far). She did however preach selectivity, arguing the Indonesia rupiah, Peruvian peso and Filipino peso looked less attractive, relative to their 10-year histories.

- Commodities

Weak copper, oil, iron ore, diamond and gold prices – to name but five – have all done varying degrees of harm to some emerging markets’ economic prospects, including Brazil, Chile, Russia and most of the Middle East. Granted, India and China are potential beneficiaries of these price declines, as they are net importers, but the boost to overall sentiment from a rally in raw materials prices is tangible. Correlation is by no means indicative of causation but EM stocks do seem to have ridden the recent bounce, having slavishly followed the Bloomberg Commodities index lower.

Emerging market equities and the Bloomberg Commodities index appear to be tracking each other

Source: Thomson Reuters Datastream NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

- Growth

Less tangibly, markets worldwide appear to be regaining their confidence after a full-blown growth and deflation scare in January and February. The Bank of Japan has cut interest rates, the European Central Bank cut rates and enhanced its QE scheme, the Fed has held off from hiking borrowing costs and the People’s Bank of China has acted. In addition certain nations are following self-help programmes, notably Argentina, where new President Mauricio Macri has embarked upon a wide range of pro-market reforms.

Risks still lurk

None of this means EM assets are in the clear just yet and there are still plenty of doubters, as issues like substantial corporate debts remain potentially unresolved.

A Reuters report has noted there are $1.6 trillion of EM debts due for repayment over the next five years, with corporate borrowings representing around 75% of that figure. Firms have been able to borrow easily as low rates in the rest of the world have persuaded yield-starved clients to seek out new sources of coupons and dividends but the volume of repayments could make things more difficult for EM firms if interest rates ever start to rise.

Russell Napier, whose Electronic Research Interchange is looking to address the challenge posed to investment banks by the unbundling of research is in no doubt that tougher times lie ahead for EM investors. And his views are not to be taken lightly, since he witnessed the 1997-98 Asian debt crisis at first hand and 2010 has persistently warned of a deflationary shock.

In his blog The Wriston’s Ghost Crosses 19th Street Napier points out Nigeria, Suriname, Angola and Azerbaijan have already asked the World Bank or International Monetary Fund for financial assistance and since it is the weakest links that always show stress first such events should not be taken lightly. “Some emerging markets are going bankrupt and it’s never just the first $1 billion you need to worry about,” Napier asserts. He flags that $1.2 trillion in EM debt is held in open-ended funds and questions what would happen to bond prices (and yields) were Western investors decide to get their money back in a hurry.

Price must be right

All of this acts as a reminder that EM equities and bonds are not for the faint-hearted investors, but again cheap valuations tend to come with bad news, not good.

M&G’s Rob Secker suggests EM stocks offer potentially good value, as a price/book value ratio of 1.4 times stands toward the bottom of a 20-year range and way below the peak of 3.0 seen in 2007 (although this measure did trough at barely 1.0 times in 2008).

The question then is what catalysts may appear to change perception and crystallise this value. He notes a decline in the dollar would help, as would a stabilisation of corporate margins and a greater focus on corporate efficiency, as returns on equity are well below their prior peaks.

In the short term, the dollar is the easiest of these to follow and the next US Federal Reserve meetings, slated for 26-27 April and then 14-15 June will help to set the tone here.

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55