Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The Treasury seemed to resemble a colander rather than a Government department in the run up to this year’s Budget, at least judging by the number of apparent leaks on the big decisions running up the opening of that famous red box, but Chancellor of the Exchequer George Osborne still came up with a few big surprises.

From a personal finance point of view, three things stand out:

- First, an increase in the annual ISA contribution allowance to £20,000 from 6 April 2017

- Second, the launch of the new Lifetime ISA for the under 40s from April 2017

- Third, a decision to cut capital gains tax to 20% from 28% for higher and additional rate payers and to 10% from 18% for basic rate payers

From a stock market and investment perspective:

- The big winners look to be asset managers and administrators, while bookmakers, junior oil explorers and house builders’ share prices are rising too. The big losers could be fizzy drinks firms given the imposition of a new sugar tax.

New flavours of ISA

To take the three key personal finance issues in order:

First, the annual ISA allowance. From 6 April 2017, you will be able to put a maximum of £20,000 a year into your ISA, up from the £15,240 limit which applies to the tax years that are just about to end and about to begin.

Second, the new Lifetime ISA. This will be available to those aged 18 to 40 from April 2017. You can put in a maximum of £4,000 a year and for every £4 you contribute the Government will add £1 more, up to the age of 50. This money can be put into stocks and shares or kept in cash and can be used for one of two things: either buying your first home (up to a limit of £450,000) or your retirement, from the age of 60 onwards.

You can access and withdraw the cash before you need it but there are some big costs if you do so. You lose the Government top-ups and any capital growth on the bonus and pay a 5% penalty too. You will be able to roll your Help to Buy ISA into your Lifetime ISA – but you can’t have the Government bonus paid into both of these ISAs at the same time. The Help to Buy ISA will stop being available to new savers as of 2019, as previously planned.

Third, the change in Capital Gains Tax. This will drop to 20% for higher and additional rate payers and 10% for basic rate payers, though the old, higher rates will still apply to residential property.

Then we come to pensions. The nation’s savers were spared radical changes but there are some points of which we all need to be aware. The rules on salary sacrifice look set to be tightened up, though pensions look likely to be given a specific exemption from this. The Government is going to consider limiting the range of other benefits that attract income tax and national insurance contributions when it comes to salary sacrifice schemes. The only really tangible shift was on redundancy payments. The first £30,000 of any such payment will remain tax-free but there will now be National Insurance contributions payable on the excess.

In addition, a new body will replace both the Money Advice Service and the recently-created Pension Wise.

In sum, rather than making pensions simpler, it is possible the Chancellor has made ISAs more complex as he adds a Lifetime ISA to the current menu of Junior ISA, Help to Buy ISA, Innovative Finance ISA as well as the standard Stocks and Shares ISA and Cash ISA.

Personal allowances

In many ways, Mr. Osborne’s tenure in 11 Downing Street has seen life get harder for savers and investors, as well as more complex:

- Interest rates have been held at a rock-bottom 0.5% for 85 straight months

- The Lifetime Allowance and annual contribution limit for SIPPs have been reduced, penalising those who save diligently or enjoy investment success

- A change in dividend taxation was designed to generate more revenue for the Treasury, to the potential detriment of equity investors

- Tax reliefs for Help to Buy properties have been cut and stamp duty for these dwellings increased

Yet there have been some sweeteners too, besides that huge increase in the maximum ISA contribution allowance

- The income tax personal allowance continues to rise and from April 2017 will reach £11,500, up from £11,000 for the tax year about to begin

- The higher rate income tax threshold will rise to £45,000 from £42,385, also from April 2017

- The new £1,000 tax-exempt threshold for interest income starts on 6 April 2016

- And also from 6 April 2016 the first £5,000 of your dividend income will be tax-free, although thereafter you will pay 7.5%, 32.5% or 38.1%, depending on your income tax band

- In addition, from no later than April 2018 the Government will introduce its new Help to Save accounts for those who receive the new universal tax credit. Eligible savers will be able to tuck away a maximum of £50 a month and receive a 50% bonus – or up to £600 – after two years. The scheme will then run for two more years under the same terms.

Stock market swings

Now with regard to the investments that may be held within SIPPs and ISAs there are three themes that quickly emerged in the stock market once the Chancellor stopped speaking:

- The big winners look to be asset gatherers, managers and administrators, such as Hargreaves Lansdown and St James’s Place, who will doubtless welcome the higher ISA limit and the creation of the new Lifetime ISA

- Bookmakers were up on the absence of new betting levies, junior oil explorers welcomed lower supplemental taxes and house builders rise on the back of that new Lifetime ISA, which is designed to help first-time buyers

- The losers were fizzy drinks firms, as Mr Osborne has introduced a sugary drinks tax, although companies like Britvic, Nichols and AG Barr have until 2018 to adapt their recipes before the levy kicks in.

The big picture

On a macro level, the Office for Budget Responsibility cut its GDP growth and inflation forecasts for the next 2 to 5 years.

Source: Office for Budget Responsibility

Source: Office for Budget Responsibility

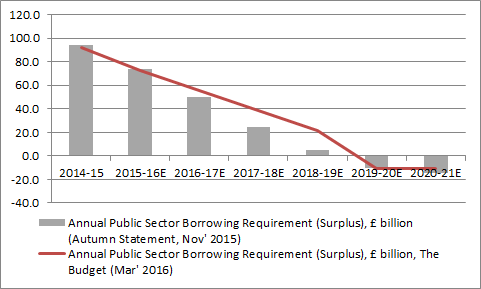

As a result of the slower growth, Mr Osborne therefore had to acknowledge that debt as a percentage of GDP could come in higher than he had anticipated last November when he delivered the Autumn Statement. This next graphic looks at both the annual deficit and how the Chancellor’s estimates have changed.

Source: HM Treasury

Despite this, the Chancellor stuck to his plan of achieving a budget surplus of around £10 billion for the fiscal year 2019-20. However, the swing from a bigger-than-previously forecast deficit in 2018-19 means Mr Osborne is finding himself with less and less wiggle room. If the economic forecasts worsen any further, more tax hikes or spending cuts could be on the agenda at some stage, especially as some jigging around with inflation and interest rate estimates magically created £27 billion of cash for the Chancellor in last November’s Autumn Statement.

Source: HM Treasury

As a result it does not seem likely that UK interest rates will go shooting up any time soon. This helps the Chancellor service the national debt and balance his books but it makes life harder for savers who want a decent return on their cash.

This could therefore place a continued premium on income, but as always you will need to do your own research and make sure you are not taking any more risk than you want to in search of those precious share dividends or bond coupons.

Russ Mould

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Tue, 17/06/2025 - 13:45

- Mon, 16/06/2025 - 10:53

- Fri, 13/06/2025 - 10:47

- Fri, 13/06/2025 - 10:25