Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

No sooner have the markets decided there will be no interest rate hike from the US Federal Reserve this year (or the Bank of England, for that matter) after a very dovish commentary from chairwoman Janet Yellen than a gaggle of officials from the US central bank pop up and say that the next increase in American headline borrowing costs could come as early as June or July.

This leaves investors once more in the grip of central bankers and pondering what the latest policy decisions may mean for portfolios, so this column will address whether a rate rise really is imminent in the US (or the UK) and how stock markets have responded during prior hiking cycles, to provide some light on what we can perhaps expect in the event of tighter monetary policy.

Case for a rate increase in the USA

The US Federal Reserve has a dual mandate – inflation and employment. The minutes from its past few meetings have also sometimes referenced global market volatility. To judge whether the central banks feel able to push through a second-quarter point interest rate increase, to follow that of December 2015, investors must therefore assess these three factors.

First, US unemployment has rattled down to 5% from its 2009 peak of 10%. This gives grounds to believe a rate rise is justified, possibly this summer.

US unemployment has fallen sharply

Source: US Bureau of Labor Statistics, www.bls.gov

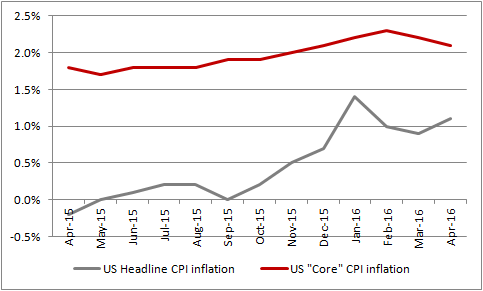

Second, the headline consumer price index is showing year-on-year inflation of just 1.1%, well below the Fed’s 2.0% target. But the “core” inflation rate (which oddly excludes food, energy and a lot of other things relevant to every day life) has been at around that mark for six months, to again suggest the Fed has ample grounds to tighten.

There are some signs that US inflation is creeping higher

Source: US Bureau of Labor Statistics, www.bls.gov

The influence of financial markets on Fed thinking is harder to divine, though Yellen and her colleagues on the Federal Open Markets Committee seem to believe they can create a wealth effect, using QE and low rates to force investors out of cash and into bonds and stocks prices, boosting valuations and investment income.

This chart may give some indication of how the Fed operates – if the S&P 500 is near prior highs the FOMC may be sanguine. If it has stumbled (again), it may not.

A big thank you (and well done) to Albert Edwards, strategist at Société Générale for spotting this one.

The Fed does seem to take heed of market action

Source: Bear Traps Report, Société Générale, Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

This chart suggests the Fed could be easily spooked out of a rate rise by any market volatility, unemployment and “core” inflation have been around 5% and 2% respectively for some time, so the Fed has had plenty of chances to raise rates since December and elected not to do so.

The case against a rate rise in the USA

A move to 0.75% is therefore not clear cut and the markets are still only pricing in roughly a one in three chance for a second, quarter-point hike in this cycle, even though the Fed initially targeted four hikes for this year, up to 1.5%.

It is still possible to argue the Fed will prove to be all talk and no action, just as it did in January, March and April, and even leave a rate rise on the back burner for some time to come.

First, unemployment may be low, but the labour participation rate – the number of people in the workforce and seeking gainful work – stands at a multi-decade low of 62.8%. In addition, many of the new jobs created have been lowly-paid service industry positions or part-time posts.

Weak Labour participation rates suggest the US jobs market may not be as strong as it seems

Source: US Bureau of Labor Statistics, www.bls.gov

Second, the purchasing managers indices sentiment surveys are soggy, especially the manufacturing one, which continues to flirt with the 50 mark, which divides growth from contraction.

US industrial sentiment surveys look patchy

Source: Thomson Reuters Datastream, ISM Report

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Third, Inventories, wholesale and for business overall, are at uncomfortable levels. Any cuts in production to control levels of unsold stock could further hurt already soft manufacturing output data

High inventories raise the risk of a marked manufacturing slowdown

Source: FRED, St. Louis Federal Reserve database

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Finally, whenever the Fed talks about rate rises, the dollar soars and US firms promptly squawk about the hit to their competitiveness and margins. Earnings from the S&P 500’s members fell between 5% and 10% year-on-year in the first quarter so they are already under pressure.

Prior cycles

Note that the US bond market does not seem unduly convinced. The US 10-year yield barely flickered during all of this hawkish talk, rising by 11 basis points to 1.88% before easing back again

US Treasuries have yet to be convinced a Fed rate rise is coming

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Still, the bond market could be wrong. It’s happened before and it will happen again, so investors will need to do their own research, but the following data may at least provide a useful context for any portfolio allocation decision-making.

This column has looked into US interest rate cycles back to 1970 – eight lower, seven higher – to assess how America’s headline S&P index fared during each one.

The first conclusion is that stocks do better on average when rates are falling, not rising. The average gain from first rate cut to last is 19.8% while the average gain from first hike to last is 10.3%.

US stocks have done better on average when rates have been falling, not rising

| Average | |||

| Duration of cycle (days) | Shift in rates | S&P 500 move | |

| Lower | 737 | -5.25% | 19.9% |

| Higher | 742 | 5.39% | 10.3% |

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

The second takeaway could be that a series of rate rises is not a total disaster, as the S&P 500 fell just one time in seven across a complete tightening cycle (from first hike to last) although returns have become progressively patchy even as the degree of tightening has become less severe in time, perhaps as valuations have gone higher relative to long-term market history.

There has been a wide range of US equity market performance during rate-hike cycles

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Note that the rate cycle trends are pretty similar in the UK, although the market is not pricing in a first hike under Bank of England Governor Mark Carney until 2018.

First, stocks have historically done better during down-cycles than up-cycles since 1970:

UK stocks have done better on average when rates have been falling, not rising

| Average | |||

| Duration of cycle (days) | Shift in rates | FTSE All-Share move | |

| Lower | 788 | -4.91% | 25.1% |

| Higher | 434 | 4.76% | 11.4% |

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Second, the range of performance during rate-hike cycles is wider than in the US, with 4 drops and 7 gains though two of the last three were good for share owners, albeit with the proviso that the economy was tanking along and corporate profits growth was good, something that is harder to assert in the current environment:

UK stocks did well during rate-rise cycles when the underlying economy and corporate earnings were strong

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Rate of interest

Ultimately, investors have two options when it comes to the 14-15 June and 26-27 July Fed meetings, as well as those held by the European Central Bank, Bank of Japan and Bank of England:

- Ignore them and adopt the line followed by legendary investor Warren Buffett that economics and policy are unforecastable. This would lead investors to target fund managers who build portfolios bottom-up, focussing on individual securities to try and identify those whose competitive position mean they have the pricing power that in turn translates into predictable cash flows and dividend growth or safe coupons over the long term. Alternatively they could do this research for themselves.

- Pay attention. Interest rate and interest rate expectations are an important part of equity valuations, especially for discounted cash flow (DCF) calculations, and higher returns on cash and rising bond yields tend to suck fund flows away from equities. In this case investors may wish to research multi-asset, macro-driven funds or flexible bond funds, which seek to be nimble and take a view on the direction of interest rates, to maximise returns and minimise risk. Alternatively, they can again research firms whose share prices have historically been sensitive to interest rate increases. The past is no guarantee for the future but higher rates have historically been tricky for bond proxies like utilities, though they could help insurers and banks’ profits and in theory rising rates should follow a strong economy, an environment that could potentially favour cyclicals.

Russ Mould,

AJ Bell Investment Director

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Fri, 13/06/2025 - 11:30

- Mon, 09/06/2025 - 10:43

- Fri, 06/06/2025 - 11:25

- Fri, 30/05/2025 - 13:55