Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Stock and bond markets are welcoming the Bank of England’s three-pronged monetary package, launched last week (4 August) in response to (as yet unfounded) fears the UK may suffer an economic slowdown, or even a recession.

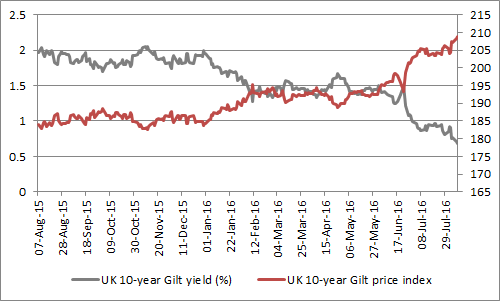

Bond prices are rising (and yields falling) as the cut to interest rates on cash leaves investors looking for alternative sources of income, including the fixed-income asset class. However, with yields on Government paper in particular looking skinny, there may well be a school of thought that buying bonds is still a good idea, because the extra £60 billion in Quantitative Easing (QE) means it is possible to buy Gilts for capital gains, because there is a price insensitive buyer in the market. This can be seen as the ‘greater fool’ theory, with the Bank of England volunteering to play the role of the fool. Shrinking yields on UK government debt may also drive investors to investment-grade corporate debt, junk (sub-investment-grade) corporate paper or emerging market government bonds.

UK 10-year Gilt yield is grinding ever lower as yields tumble ...

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

- Stocks are responding positively as the package is designed to bolster growth and ultimately stoke inflation toward (or even beyond) the central bank’s 2% inflation target. In addition, the 3.5% dividend yield available on the FTSE 100 may appeal to some relative to the returns available on cash or bonds, albeit in the knowledge equities bring extra risk, as their value can do gown as well as up.

.... while the FTSE All-Share is grinding higher, helped by its premium yield

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Yet for all of this optimism, it is easy to pick holes in this brave new world, should you wish to try. Only six months ago, stock markets in particular were wobbling as they worried about economic and corporate profit growth prospects, taking the view central bank policy was not working.

Little has changed since, other than the Bank of England, Bank of Japan and European Central Bank have all cut rates and reviewed their QE schemes, while the US Federal Reserve has backed away from any rate hikes. Inflation is still subdued, as are GDP growth numbers.

Policies which have singularly failed to generate a sustained acceleration in growth or inflation since 2009 are now being lauded again, in the view that they will work this time. Only time will tell.

- If the policies fail and a downturn, recession or even deflation take hold, then history suggests stock prices may slide, while bonds would do well and cash potentially become a valuable bolt-hole.

- If the policies succeed then it would be logical to expect inflation. Even the attainment of central banks’ 2% target would make most Government bond (and some corporate bond) yields look pretty sick and anyone buying a UK 10-year Gilt on a yield to maturity of 0.59% would lock in a real-term loss if inflation reaches that threshold. In this scenario, history suggests equities could do relatively well – though they did badly in real terms during the galloping inflation of the 1970s. Gold excelled itself during that decade as a shield against soaring price rises and Government profligacy (President Nixon withdrew the US from the gold standard in August 1971 to help fund the Vietnam war effort). Some investors may look towards the precious metal as a protection against the current round of money printing, borrowing and possible Government profligacy – after all, politicians may go for broke in the fight against deflation and add fiscal stimulus to monetary tools, if only to save their own skins.

Logic therefore suggests bonds and stocks are unlikely to go up in lock-step forever, as we are faced by two opposing possible outcomes, even if they having a good go at it right now, with gold bubbling along happily enough in the background after its recent return to favour, helped (in sterling terms) by the pound’s recent drop.

Gold has returned to favour in 2016 with some investors

Source: Thomson Reuters Datastream

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Bear in mind that just three years ago Bank of England Governor Mark Carney outlined “forward guidance” to help explain when he might raise interest rates. That experiment did not last long, to show that the Governor’s crystal ball is no better than that of anyone else.

This reaffirms that ultimately no-one knows what it going to happen – not even the would-be central planners at our central banks. That is why they are still throwing more money at our low-growth, low-inflation world, even after several years of ultra-loose policy.

As such it may be worth researching how to design a portfolio to weather a range of economic and financial market outcomes, to protect wealth as well as try to create it.

A few years ago, market strategist Dylan Grice devised a portfolio with the aim of doing just that, when he was at French investment bank Société Générale. This column has analysed his ideas before and it may now be appropriate to do so again.

Survival instinct

Inspired by the apparently indestructible nature of the cockroach, Grice looked at how to build an investment portfolio that would be just as durable as the doughty insect. He argued a pot split into four even parts between cash, high-quality bonds, income-generating equities and gold would have done the trick.

Given the prevailing uncertainty, and the potential for diametrically opposing economic and therefore financial market end-games, this column has revisited this concept and tried to recreate the cockroach portfolio, going back to 1991.

To keep it simple, the equity income portion is represented by the Invesco Perpetual High Income fund, which has a good pedigree and a long-enough history. The 10-year Gilt is used for bonds, the spot gold price has been used in sterling terms, while the fourth element is covered by the Royal London Cash Plus fund.

The results over the past year are perfectly respectable: a 15.0% return (before any dealing costs, levies or taxes). Given the events of the past year – China’s currency devaluation, a Federal Reserve rate hike, an oil price meltdown, terrorism attacks across Europe, the UK’s vote to leave the EU and a couple of vicious equity market sell-offs – such a number is not to be sniffed at.

A version of Dylan Grice’s “cockroach” portfolio has performed steadily amid volatile markets over the last 12 months

Source: Thomson Reuters Datastream, with thanks to and inspired by Dylan Grice’s November 2012 piece for Société Générale The Last Popular Delusions

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

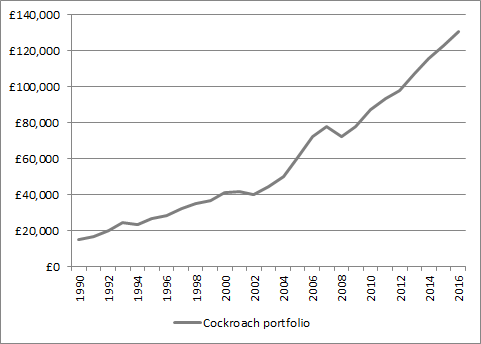

However, a year is hardly an adequate test for any portfolio. The next test is therefore to go back to 1991, again splitting a hypothetical £15,240 pot equally across the four portfolio constituents. This time the cash element is represented by the Bank of England base rate.

The end result, again before dealing costs, fees or taxes, is a pot worth £130,819 for a 9.0% compound annual return, a figure which beats inflation hands down.

A version of Dylan Grice’s “cockroach” portfolio has performed steadily amid volatile markets over the last 25 years

Source: Thomson Reuters Datastream, with thanks to and inspired by Dylan Grice’s November 2012 piece for Société Générale The Last Popular Delusions

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Better still, perhaps, from the perspective of investors is the limited volatility of returns. The portfolio shows just three down years, 1994, 2002 and 2008, as this graphic showing year-by-year returns makes clear.

That compares to four, eight and nine annual declines from the equity, gold and bond portions on an individual basis:

A version of Dylan Grice’s “cockroach” portfolio has had just three down years in the last 25 years

Source: Thomson Reuters Datastream, with thanks to and inspired by Dylan Grice’s November 2012 piece for Société Générale The Last Popular Delusions

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Balanced approach

The above calculations do not, however, feature any portfolio rebalancing. Since the point of Grice’s construct is to avoid second guessing markets and let the discipline of the four equal pots take the strain, the next step is to rebalance every year, dividing the available resource at the end of each year equally once more.

This exercise assumes the rebalance takes place at the very start of each year. Before dealing costs, fees and taxes, the result after 25 years is a pot of £93,397 for a 7.5% compound annual return.

Annual rebalancing has an impact on returns from the “cockroach” portfolio ...

Source: Thomson Reuters Datastream, with thanks to and inspired by Dylan Grice’s November 2012 piece for Société Générale The Last Popular Delusions

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Again, there are only two individual down years in 25, namely 1994 (when bonds collapsed after an unexpected US Federal Reserve rate rise) and 2013 (when gold fell out of favour as markets began to anticipate interest rate hikes on both sides of the Atlantic).

... but if also further reduces volatility

Source: Thomson Reuters Datastream, with thanks to and inspired by Dylan Grice’s November 2012 piece for Société Générale The Last Popular Delusions

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

Final analysis

Solid returns with limited volatility sounds like a potentially attractive recipe, but clearly some caveats must be applied.

Past returns are no guarantee for the future and the chances of cash generating the returns it did between 1991 and 2008 (when average annual base rates ranged from 3.% to 13.9%) look pretty slim, while bond yields are now at record lows and the UK equity market creeping back toward record highs.

In addition, the bulk of 2016’s returns have come from gold, an asset class which may not appeal to all. Master investor Warren Buffett for one has long since railed against the precious metal, arguing it has no intrinsic value, since it is inert and does not generate cash.

However, the emotionless discipline of the four-pot approach may give some investors pause for thought, especially as the historic returns have shown low volatility – and good investing is all about sleeping soundly at night and harvesting returns in exchange for what the investor believes are tolerable levels of risk.

The “cockroach” strategy will not suit everyone’s goals, target returns, time horizons and risk appetites. But it could provide a framework, with there being scope for perhaps replacing one of the four asset classes with something the investor feels is more suitable for them, at a time when central banks are trying more of the policies which are, thus far, unproven in terms of their ability to have the desired effect, even after seven years of trying.

Russ Mould

AJ Bell Investment Director.

Ways to help you invest your money

Put your money to work with our range of investment accounts. Choose from ISAs, pensions, and more.

Let us give you a hand choosing investments. From managed funds to favourite picks, we’re here to help.

Our investment experts share their knowledge on how to keep your money working hard.

Related content

- Mon, 16/06/2025 - 10:53

- Fri, 13/06/2025 - 10:47

- Fri, 13/06/2025 - 10:25

- Wed, 11/06/2025 - 09:38