Market falls will often hit the headlines and can be a cause of stress for investors, but they should make sure they don’t panic at the news, to avoid locking in losses.

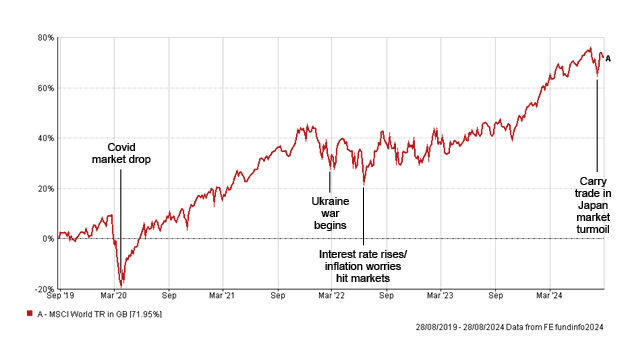

There have been lots of times when markets have dropped, either small blips that last a day or longer periods of falls that take time to recover. It can be easy for investors to react emotionally to markets, panic and sell their investments for fear of losing money. But history shows us that that can be a mistake.

Emotional reactions

When you invest money in the markets, you do so on the understanding that prices can go up and down. Stocks and shares have historically delivered a better return than cash in the bank, but there is also a chance you could lose money. People accept that risk in exchange for potentially higher rewards over the long term.

Running away at the first sign of difficult times isn’t a good move. You will lock in your losses if you sell after markets have fallen and you risk being out of the market when share prices bounce back. This isn’t guaranteed to happen, but history would suggest a lot of markets recover quickly from times of turmoil.

Example of a market drop

Let’s look at a recent market fall, when Russia invaded Ukraine. The FTSE 100 index in the UK dropped by nearly 4% in a day. Many share prices fell by an even greater amount. However, the following day, the FTSE 100 recovered most of that lost territory as sanctions were put on Russia by the West.

And while it might feel like a big event, market falls are a normal part of investing. According to Citi strategists, historically, the S&P 500 index of companies in the US has on average fallen by more than 5% three times a year since the 1930s, with larger drops occurring less frequently. So, while it’s not very fun for investors, it’s certainly not unusual.

Don’t tinker

Constant tinkering with your portfolio should be avoided. It is tempting to keep dumping any positions that aren’t rallying - firstly for fear they will never make you money, and secondly because you want to use the proceeds to buy more of what’s already doing well.

You might be better off looking at laggard holdings and seeing if something has changed to the investment case - if the answer is no, don’t sell it unless you really need the cash.

In general, a diversified portfolio should always have something that isn’t doing as well as other positions. The whole point is to spread your risks in different areas of the market. If you put all your money in one part of the market, you would really feel the pain when that area goes out of favour.

Even though investing during times of turmoil can be uncomfortable, it’s important to hold your nerve and wait out the market volatility. Just ask those who sat tight through the Covid sell-off in February 2020, global financial crisis in 2008, and countless other difficult times that saw share prices fall and then rebound. Investing is all about patience and hopefully the rewards will come in time.

Important information: These articles are for information purposes only and are not a personal recommendation or advice. Remember that the value of investments can change, and you could lose money as well as make it.

Market volatility can be a tricky time for investors, but here's how to stay on track.

Diversifying your investment portfolio can help to spread risk.

Related content

- Tue, 08/04/2025 - 11:51

- Fri, 14/03/2025 - 17:42

- Fri, 14/03/2025 - 17:11

- Fri, 14/03/2025 - 16:53

- Wed, 12/03/2025 - 17:53