The minimum SIPP pension age is currently 55, though the age when you can access your pensions is rising to 57 from 6 April 2028.

If you reach the minimum SIPP withdrawal age and don’t need to access it yet, you can leave your SIPP invested. That way it can keep growing free of tax.

But if you’re looking to access your pension for the first time, SIPP withdrawal rules give you plenty of flexibility. You don’t have to use all your pension fund in one go, so you can choose one option for a SIPP withdrawal now and decide about the rest later.

How can I access my SIPP?

Your main options are the following.

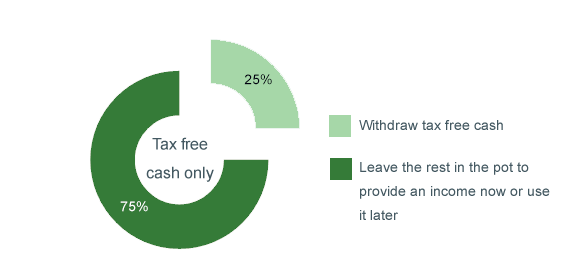

1. Tax-free cash and SIPP drawdown: Take up to 25% of your SIPP as a tax-free lump sum, and leave the rest invested in your SIPP as a drawdown fund. This can give you a flexible income regularly, or as and when you need it.

Example: let’s say you have a SIPP worth £200,000. You could take up to £50,000 tax-free, and move the rest to drawdown where it can stay invested in your SIPP.

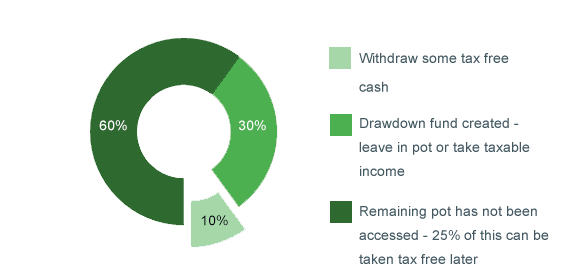

Or, you could convert your pension in stages. This could be a good option if you need some cash but not as much as 25% of the whole fund.

Each time you convert part of your SIPP, you withdraw up to 25% of that amount tax-free, with the other 75% staying invested and moving into drawdown. You can take 25% tax-free cash from what you don’t convert in the future.

Example: of your £200,000 SIPP, you convert £80,000 and withdraw £20,000 as tax-free cash. You create a drawdown fund for the other £60,000, from which you can take a taxable income at any time. The amount you don’t withdraw is also left in the pot to benefit from investment growth and income, and you can take 25% tax-free from it in the future.

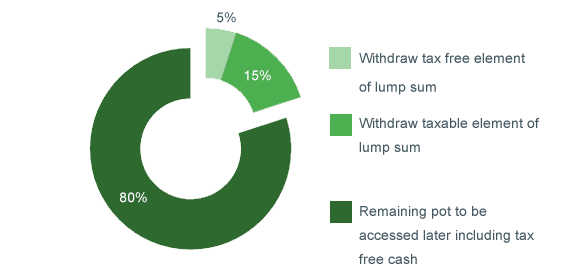

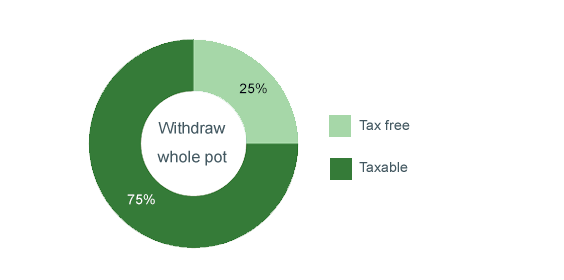

2. Pension lump sums: A single payment where 25% is tax free, and the remaining 75% is taxable. This option lets you take a series of smaller amounts, while leaving the rest invested to access more of in the future. Or you can even withdraw the whole pot.

Smaller amount

Whole pot

Learn what you should think about if you’re considering withdrawing your whole SIPP.

3. Tax-free cash and annuity: Take up to 25% of your SIPP as a tax-free lump sum, and give the rest to an insurance company to pay you a guaranteed income for the rest of your life.

The government's Pension Wise service offers free, impartial guidance to help you understand the options at retirement.

You can make an appointment to speak to a Pension Wise specialist online or by telephone on either 0800 138 3944, or +44 20 3733 3495 if you live outside the UK.

Can I take money out of a SIPP before age 55?

Normally, no – the earliest SIPP access age is 55 (rising to 57 from 6 April 2028).

There are exceptions, though – if you're in ill health and can't work, are terminally ill with a life expectancy of 12 months or less, or if you've inherited from someone who has died.

Do I pay tax on SIPP withdrawals?

Drawdown income

After taking up to 25% tax-free cash, you can choose to keep the rest of your fund invested by going into drawdown. When you want to take any income, we’ll deduct income tax from your SIPP withdrawal for you.

SIPP withdrawal rules mean it’s likely that an emergency tax code will be used on your first drawdown income payment. You’ll need to reclaim any overpaid tax directly from HMRC unless regular income is being taken.

If you have other taxable income, it’s possible that your drawdown income pushes you into a higher-rate tax band – meaning you could end up paying more tax on the withdrawal than you thought.

Annuity income

When you choose an annuity, you take 25% tax-free cash, then pay your remaining pension to your chosen annuity provider (an insurance company) in exchange for a guaranteed income for life. The annuity provider will deduct tax from your regular income payments.

Pension lump sums

25% of each lump sum you take is tax free, and the rest is taxed as income.

If you take a pension lump sum from your SIPP, we’ll deduct tax for you. If this is the first withdrawal from your fund, it's likely that an emergency tax code will be used. You’ll need to reclaim any overpaid tax directly from HMRC.

If you have other sources of taxable income, it's possible that the lump sum might push you into a higher tax band and you could end up paying more tax on the withdrawal than you thought.

Learn more about tax on pension withdrawals

Future pension contributions

When you take drawdown income or a pension lump sum, you’ll trigger something called the money purchase annual allowance (MPAA).

This limits your annual allowance for defined contribution pensions (which includes a SIPP) to £10,000 per year. If you go over this, you'll face a tax charge.

You won’t trigger the MPAA if you use your pension to buy an annuity

Important information: Remember that the value of investments can change, and you could lose money as well as make it. We don't offer advice, so it's important you understand the risks. If you're not sure, please speak to a financial adviser. These articles are for information purposes only and are not a personal recommendation or advice. Tax treatment depends on your individual circumstances and rules may change. Pension rules apply

The flexible way to access your pension – you choose how to invest it, what income to take and when.

You've saved hard for your retirement, but once you get there, what are your options?

Related content

- Fri, 30/05/2025 - 10:58

- Tue, 08/04/2025 - 11:51

- Fri, 14/03/2025 - 17:42

- Fri, 14/03/2025 - 17:11

- Fri, 14/03/2025 - 16:53