Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

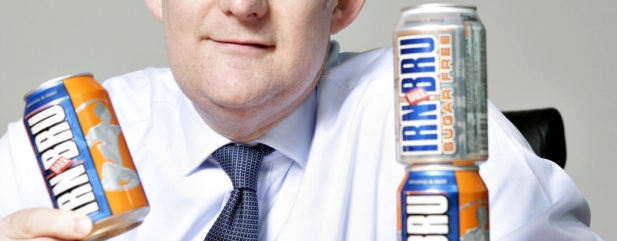

A.G. Barr’s resilient BRU

Ade-rating of soft drinks maker A.G. Barr (BAG) represents a buying opportunity in a high quality company.

The recent absence of share price fizz reflects testing market conditions and worries over the government’s proposed soft drinks sugar tax, now in the consultation phase.

However Cumbernauld-headquartered A.G. Barr has a strong track record and an excellent portfolio of brands - IRN-BRU, Rubicon, Strathmore and cocktail solutions business Funkin – to see it through uncertain times.

Interims (27 Sep) reflected deflationary, promotional market conditions and poor early summer weather. Total sales softened to £125.6m (2015: £130.3m) and like-for-like sales fell 2.8%, though pre-tax profit before exceptional items edged up to £17m (2015: £16.9m) on improved operating margins. Return on capital employed (ROCE) grew 110 basis points to 20%, underscoring management’s shareholder value creation credentials.

The £599m cap is having to adjust to the consumer’s increasing demand for lower and no sugar products. The good news is A.G. Barr’s business is resilient, soft drinks being low ticket items, leading brands IRN-BRU and Rubicon have runway for growth in the UK and A.G. Barr also has an increasing international presence.

CEO Roger White insists A.G. Barr is making good progress across its longer term reformulation and innovation programme. Recent launches IRN-BRU XTRA and Rubicon Spring, both containing no added sugar, ‘are both performing well at this early stage’.

Sweet strategy

White, who argues the levy is ‘a punitive and unnecessary distortion to competition in the UK market’, stresses ‘we have continued to reformulate and reduce sugar across our portfolio, as well as bringing new lower and no sugar products to the market’. More specifically, A.G. Barr remains on track to reformulate its portfolio such that two thirds of it will be low or no sugar by 2018.

Sterling weakness will lead to higher input costs, yet a business reorganisation drive will help A.G. Barr mitigate the impact and leave it better structured to improve service levels and speed to market. Interim free cash flow of £19.6m helped reduce net debt to £6.6m to give a lowly net debt/EBITDA ratio of 0.3 times.

This strong balance sheet gives A.G. Barr the firepower to invest in its asset base, brands and new product development as well as further acquisitions. Recent weakness leaves A.G. Barr trading on 17.5 times forward earnings, which is cheap relative to the historical average, while Investec Securities’ 640p price target implies 26% upside. (JC)

A.G. Barr(BAG) 508.5p

Stop loss: 406.8p

Market value: £599m

Prospective PE January 2017: 17.5

Prospective PE January 2018: 16.6

Prospective dividend yield January 2017: 2.7%

Bid/offer spread: 508p-509p

Analyst price target: *640p

*Investec Securities, 27 September 2016

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine