The markets kicked off the week with a bang following the long Easter weekend. News of a surprise UK general election in June and heightened geopolitical tensions in Syria and North Korea all served to push and pull at equity valuations.

What’s interesting is that stock markets didn’t go into full-on panic mode, as one might have initially expected given the news backdrop. That’s positive for equity markets longer term.

Michael Stanes, investment director at Heartwood Investment Management, earlier this week said investors’ expectations had previously moved too quickly and were now being scaled back to more realistic levels.

Indeed, we note that certain sectors and stocks buoyed by expectations of rising inflation and Trump’s grandiose promises are already starting to reverse.

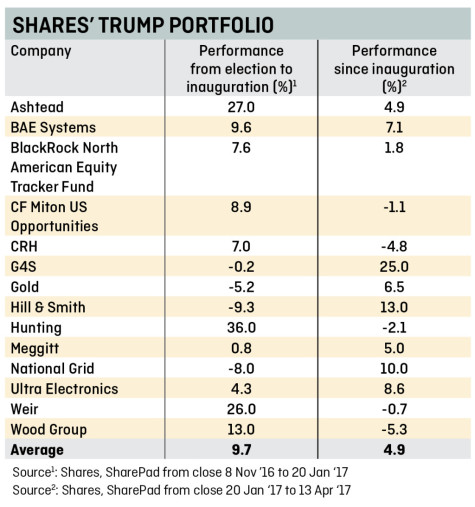

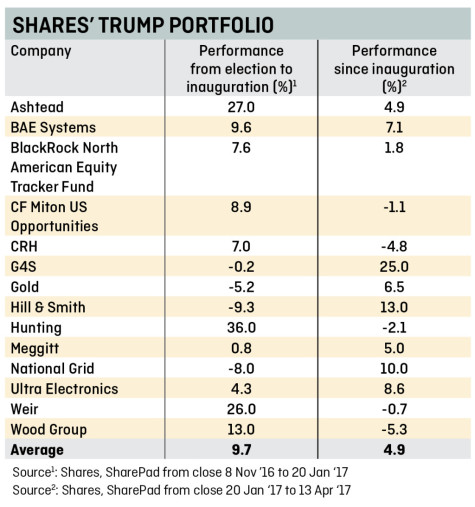

This is particularly evident in our portfolio of Trump trades. These were identified before he defied the odds to capture the White House last November.

The table shows how they performed from election in the run up to his inauguration in late January and the next column shows their subsequent performance.

With some variation, the portfolio has performed around half as well since Trump assumed office as it did during his period as President-elect. (TS)

‹ Previous2017-04-20Next ›

magazine

magazine