We’re generally cautious about companies with high dividend yields, as it tends to represent disbelief by the market that the money will be paid. One exception, in our view, is building products business Epwin (EPWN:AIM) which has a handsome 6.5% prospective dividend yield.

We view Epwin as having a resilient business and note it has limited debt and excellent cash generation.

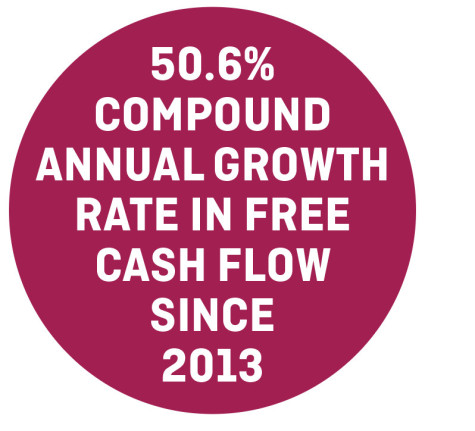

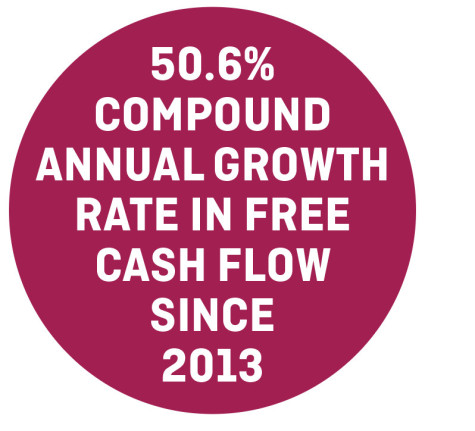

Panmure Gordon analyst Adrian Kearsey says investors have overlooked positive progression in free cash flow. As a reminder, dividends are paid out of free cash flow, so strength in the latter is good for the former.

Operational efficiencies and smart acquisitions have helped boost free cash flow from £6m in 2013 to £20.5m in 2016. The company now has plenty of cash to fund organic investment, dividends and further deals in a fragmented market.

UK-focused Epwin specialises in extrusions, mouldings and fabricated low maintenance building products. In the last 18 months it has acquired three businesses for a combined initial consideration of £42.2m.

The business derives around 70% of its business from the renovation, maintenance and improvement (RMI) market and the rest from new build and social housing.

Chief executive Jon Bednall notes the company has grown the bottom line every year since he joined in 2008. More recently Epwin has been able to manage an increase in cost inputs due to the devaluation of sterling.

Panmure has a price target of 185p which implies 63% upside from the 113.25p price at the time of writing.

‹ Previous2017-04-20Next ›

magazine

magazine