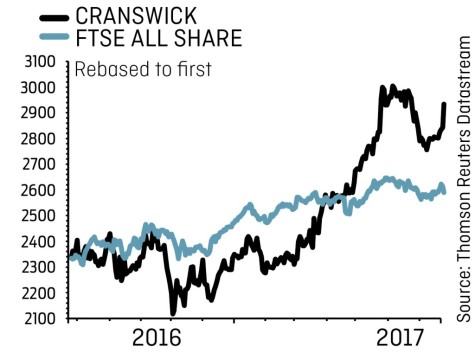

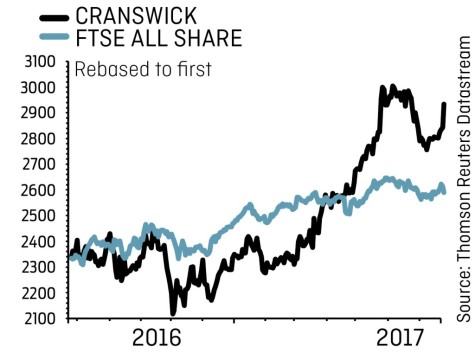

CRANSWICK (CWK) £29.32

Gain to date: 32.3%

Original entry point:

Buy at £22.16, 17 Nov 2016

Our bullish call on gourmet sausages-to-gammon supplier Cranswick (CWK) is now 32.3% in the money. The £1.48bn cap’s first quarter trading update (24 Jul) highlighted outperformance in a difficult UK grocery market over the three months to 30 June.

Total sales were up 27% and like-for-like revenue rocketed 21% higher, driven by strong domestic volume growth with all product categories making positive contributions.

Cranswick benefitted from the return of inflation in the pork category as well as from a new pastry contract and a new poultry contract, while the impact of rising pig prices was ‘partially mitigated during the period’.

With strong volume momentum continuing and new business wins expected to support growth in the second quarter and beyond, Shore Capital has upgraded its pre-tax profit forecast for the year to March 2018 by 2.2% to £83.3m.

The broker’s 2019 pre-tax profit estimate rises from £86.2m to £87.8m. Cranswick, a high-quality food producer whose dividend growth track record is formidable, is forecast to hike the payout to 48.9p (2017: 44.1p) this year ahead of 51.6p next.

We remain bullish about the high-quality food producer’s growth and income prospects.

‹ Previous2017-07-27Next ›

magazine

magazine