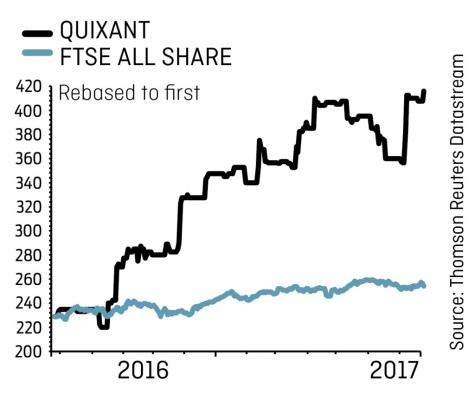

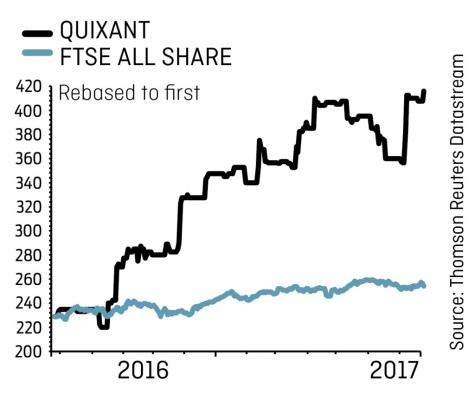

QUIXANT (QXT:AIM) 416p

Gain to date: 46.0%

Original entry point:

Buy at 285p, 20 October 2016

Another knockout update from gaming technology supplier Quixant (QXT:AIM) pushes the shares beyond the 400p level we suggested was attainable in our original feature. Yet we continue to see value upside here, and analysts agree.

Canaccord believes 500p is on the cards in its initiation note this week. A brief announcement on 24 July spelled out how trading has been ‘stronger than previously anticipated,’ always music to the ears of investors.

There may be a bit of contract timing here from the gaming machines black box designer. Perhaps it will even out a bit through the second half. One-off projects are running with most of the half dozen or so large gaming machine manufacturers.

If you believe Canaccord’s initiation estimates, which call for earnings per share of $0.239, $0.279 and $0.319 (Quixant reports in dollars), the shares retain plenty of upside. Based on a 2019 price earnings multiple of 23 investors could be looking at a 560p-odd share price over the next year-and-a-half.

We see no reason to sell this high-quality growth stock.

‹ Previous2017-07-27Next ›

magazine

magazine