Many economists believe the time is not yet right for UK interest rates to increase but City analysts disagree, calling for the first base rate rise in more than a decade. Number crunchers at investment bank Berenberg claim that monetary policy ‘has done its job,’ and called for ‘policy to begin to normalise.’

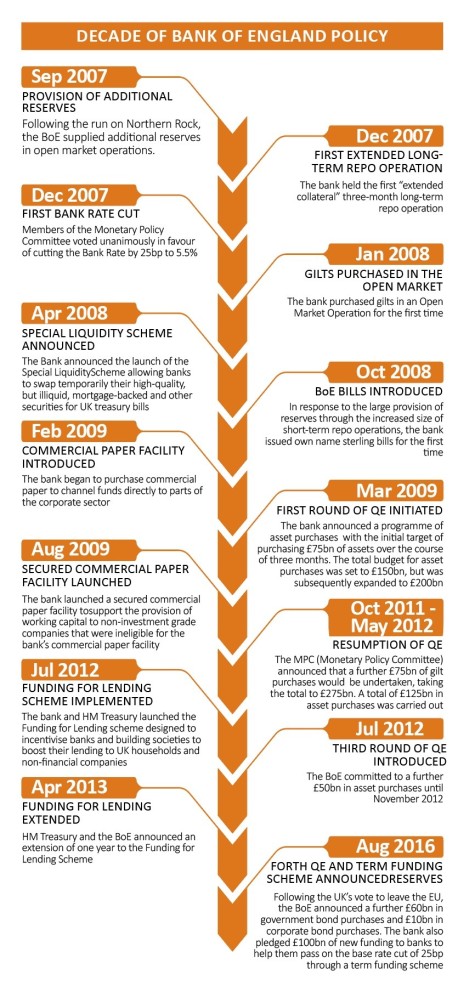

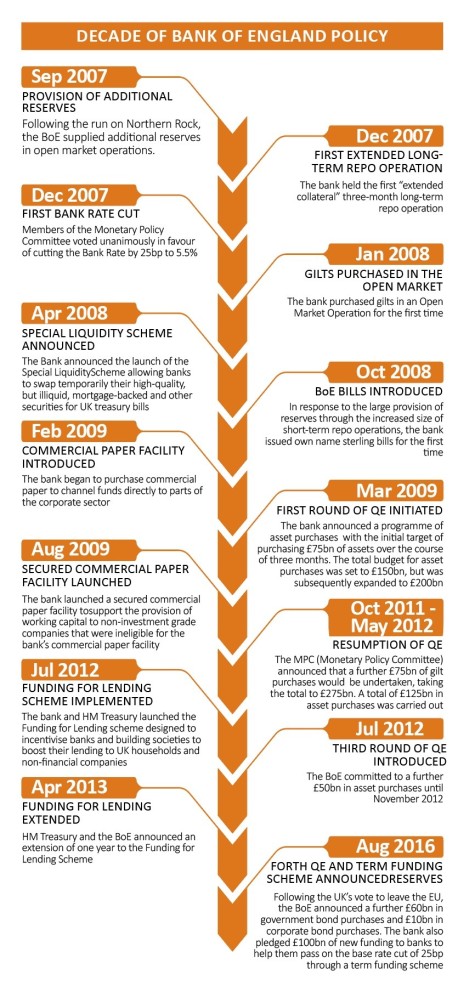

Berenberg’s analysis shows the Bank of England used interest rate manipulation to meet four objectives following the financial crisis. These were to sustainably return inflation to 2%, support asset prices and aid balance sheet repair, increase the flow of credit to the real economy, and return the economy to full employment.

‘Monetary policy has achieved all of these aims,’ Berenberg’s

team say.

Berenberg speculates that a rate rise could come as soon as November’s meeting of the Bank of England’s Monetary Policy Committee (MPC). The MPC’s last gathering in early August saw a vote of six to two to maintain rates at 0.25%.

The headline base rate last increased in July 2007, going from 5.5% to 5.75%. The global financial crisis a year later saw the Bank of England slash rates to 0.5% where they stayed until August 2016, before being cut to the current historic low of 0.25%.

‹ Previous2017-09-07Next ›

magazine

magazine