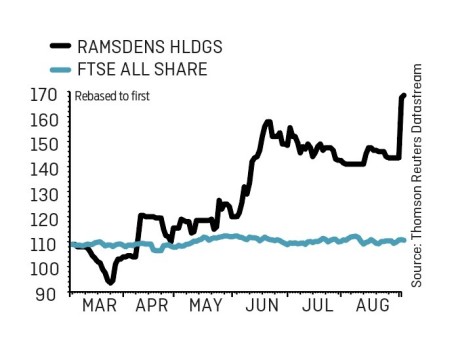

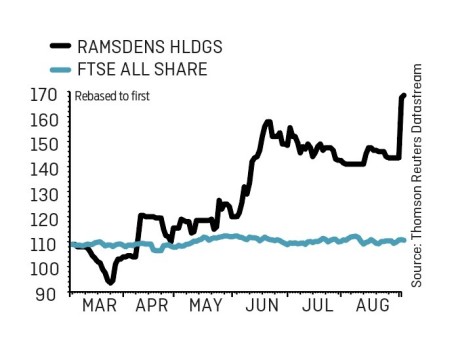

Ramsdens (RFX:AIM) 168.5p

Gain to date: 17.3%

Original entry point: Buy at 142p, 15 June 2017

A bullish trading update from Ramsdens (RFX:AIM) on 1 September reaffirms our belief that this a great stock. It said ‘we expect our interim and full year profit before tax to be significantly ahead of market expectations’.

This has been helped by decent foreign exchange results through the traditional peak periods of July and August aiding its offering in this area.

The sustained strong gold price has also been a boon for the company’s precious metal retail business as well as its pawnbroking activities.

Looking forward, Justin Bates, analyst at Liberum, says that Ramsdens’ competitors exiting the high street bodes well for the business, both in terms of organic and acquisitive opportunities.

This has led Bates to upgrade Ramsdens’ adjusted pre-tax profit for the year by 22% to £5.9m.

The shares are trading on 11 times 2018’s forecasted 15.3p per share of earnings based on Liberum’s estimates. The broker has also put a 190p price target on the shares, implying 12.8% upside.

‹ Previous2017-09-07Next ›

magazine

magazine