Medica (MGP) 200.7p

Loss to date: 8.4%

Original entry point: Buy at 219.2p, 7 September 2017

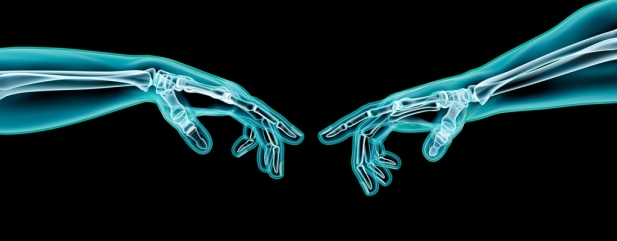

We remain positive on teleradiology business Medica (MGP) as slower sales growth is expected to be a temporary blip for the company. Encouragingly it has declared a maiden interim dividend of 0.55p.

The company aims to diagnose various diseases earlier through its team of consultant radiologists who interpret computerised tomography (CT) and magnetic resonance imaging (MRI) scans.

In the first half of 2017, revenue rose 17% to £15.7m thanks to significant growth in out-of-hours reporting service Nighthawk and radiology reporting service Cross Sectional.

Unfortunately, overall sales were slower than expected as sluggish recruitment in the first quarter of 2017 impacted sales, triggering a 5% decline in the shares to 200.7p (18 Sep).

Investec analyst Cora McCallum says the performance in the second half is traditionally stronger and believes higher recruitment from June should drive ‘necessary growth’ to meet full year sales estimates of £35.6m.

Medica currently has 291 radiologists and hopes to have more than 300 by the end of 2017.

Volumes in the plain film division have declined 8.3% to £1.8m, but this is a knock-on effect of the company’s focus on Cross Sectional and Nighthawk, representing 49% and 37% of sales, respectively.

‹ Previous2017-09-21Next ›

magazine

magazine