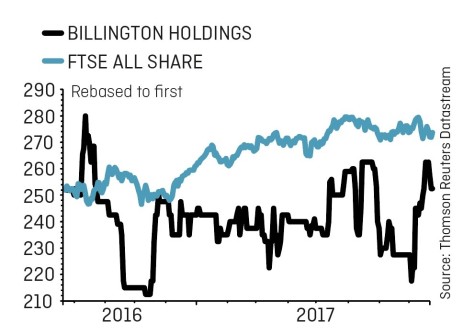

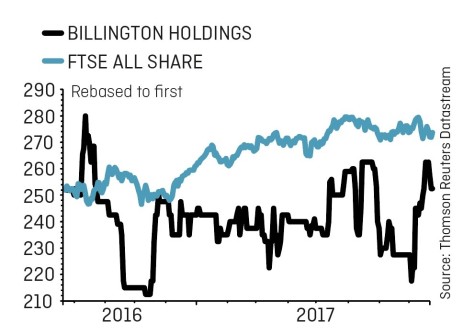

Billington (BILN:AIM) 280p

Gain to date: 11%

Original entry price: Buy at 252.2p, 24 August 2017

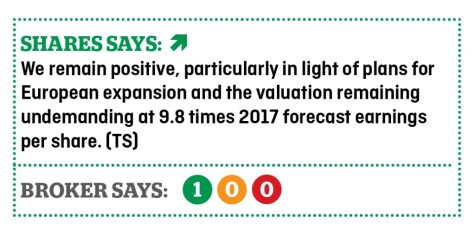

Barnsley-headquartered structural steel business Billington (BILN:AIM) is off to a good start as a constituent of our Great Ideas portfolio as first half results (19 Sep) get a positive reception.

We correctly flagged those numbers as a potential catalyst for the shares in our original article on 24 August.

Pre-tax profit is up 29% to £2.2m for the first six months of the year. There are encouraging signs in terms of visibility on future profit with chief executive Mark Smith indicating consumption of structural steel will remain consistent through to 2020.

‘The group has a strong forward order book and the second half of the year looks to be equally as busy as the first,’ he adds.

An increase in capacity is allowing the company to deliver larger, more significant projects. Examples this year include IKEA’s store in Sheffield and an office in Lombard Street in London.

A further boost to capacity is likely when the Shafton steel processing site, acquired in late 2015, becomes fully operational by January 2018.

‹ Previous2017-09-21Next ›

magazine

magazine