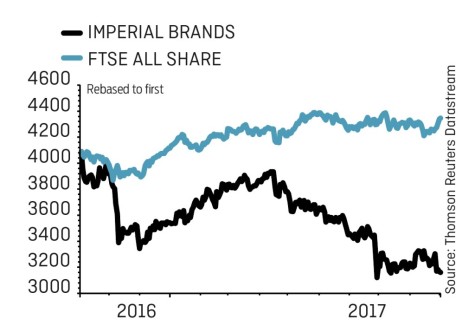

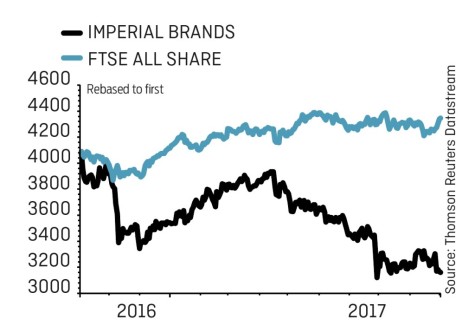

Imperial Brands (IMB) £31.55

Loss to date: 17.7%

Original entry point: Buy at £38.33, 27 April 2017

Our bullish call on Imperial Brands (IMB) may be 17.7% in the red, but we’re staying positive on the tobacco multinational for its resilient earnings and robust cash flows, which stem from strong brands such as Davidoff, Gauloises Blondes and JPS cigarettes and Montecristo cigars.

Sentiment towards the £30.25bn cap is presently poor. Investors are fretting over regulatory changes in the US and a relative lack of presence in certain Next Generation Product (NGP) segments.

But our enthusiasm has been reinforced by research from Investec Securities. The broker is a buyer with a £43.60 price target which implies 38.2% upside for one of its top consumer staples picks.

Imperial’s pre-close trading update (28 Sep) confirmed the tobacco titan is on track to meet full year expectations and is gearing up for new NGP launches in full year 2018.

Investec believes ‘these will remain focused on e-vapour and the blu brand, but the company could yet surprise with launches in other areas. We think Imperial, if it so wished, could launch a heat-not-burn product within one year and at an easily manageable cost.’

Imperial is rebounding from several weaker years as it migrated smokers to fewer, stronger brands.

‹ Previous2017-10-05Next ›

magazine

magazine