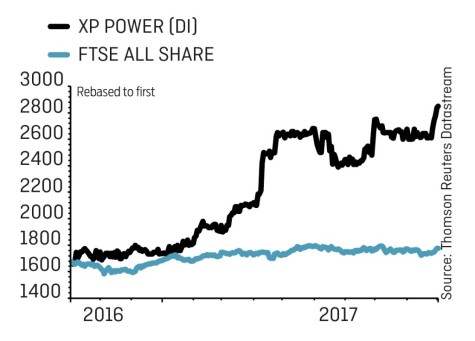

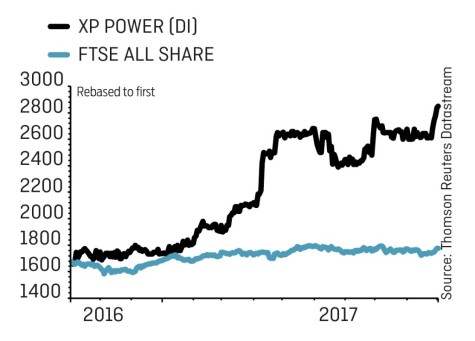

XP Power (XPP) £28.38

Gain to date: 17.7%

Original entry point: Buy at £24.11, 6 July 2017

The power switching tools designer has returned to the acquisition trail nearly two years after its last foray. The $23m (£17m) purchase of US-based radio frequency (RF) power supplies business Comdel looks like a sensible move, in our view.

The acquisition opens up a new market segment for XP Power (XPP), with typical applications in plasma-welding and both dielectric and induction heating.

Research group Edison says the Comdel acquisition will increase XP Power’s exposure to the semiconductor manufacturing industry. It says there is some customer overlap between XP and Comdel but no product overlap.

Comdel will add about 8% to XP’s group revenues in 2018 and 2019, according to forecasts from investment bank Investec, and mid-single digits to earnings. That implies earnings per share of 144.4p next year to 31 December 2018, putting the shares on a forward price to earnings multiple of 19.7.

Shares in the company have enjoyed a firm run since our original feature in early July, although we also remind readers of the stock’s attractive 2.9% yielding dividend (2018), paid quarterly.

‹ Previous2017-10-05Next ›

magazine

magazine