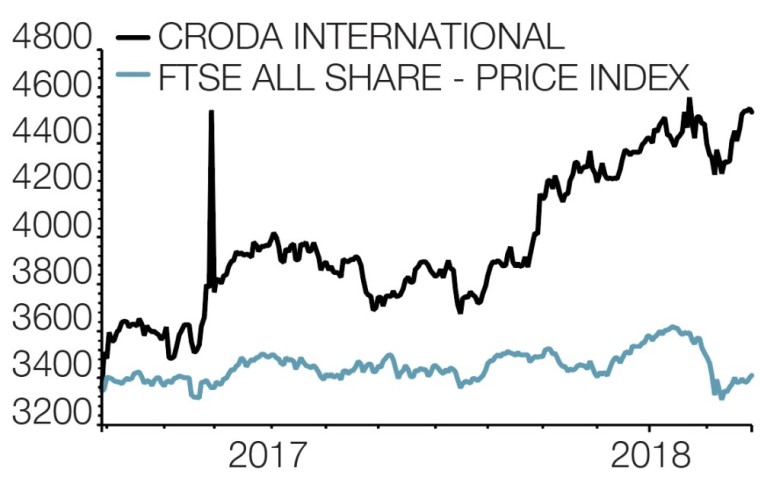

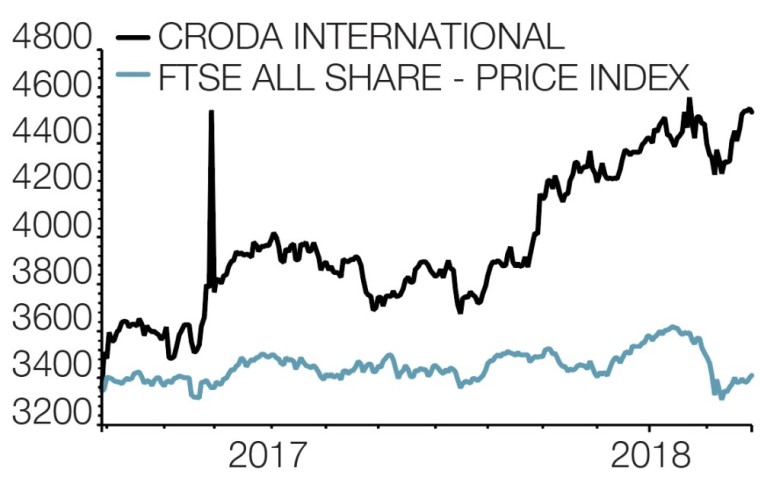

Croda (CRDA) £45.05

Gain to date: 3.8%

Chemicals specialist Croda (CRDA) has the right formula for success, delivering a record adjusted pre-tax profit of £320.3m in the year to 31 December 2017.

Croda’s focus on premium, faster growth niches in personal care, life sciences and performance technologies drove sales 10.4% higher to £1.37bn.

In the two weeks since we flagged Croda as a high quality investment, shares in the company have advanced 3.8% to £45.05 (27 Feb).

Some investors may have been disappointed by the lack of a special dividend, as previously mooted by some analysts.

In January, Berenberg analyst Rikin Patel argued a special dividend could be paid if leverage fell below 1 to 1.5 times. He forecast net debt/earnings before interest, tax and depreciation and amortisation of 0.9 times in 2017, but Croda narrowly missed this target.

Investors can still expect some form of income after the dividend per share was hiked by 9.5% to 81p.

UBS analyst Andrew Stott says 2018 will be another healthy year of growth for Croda despite currency headwinds.

He flags savings from a newly commissioned US bioethanol plant, a small uplift from US tax cuts and organic growth in personal care and life sciences as growth drivers, as well as potential M&A. (LMJ)

‹ Previous2018-03-01Next ›

magazine

magazine