Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

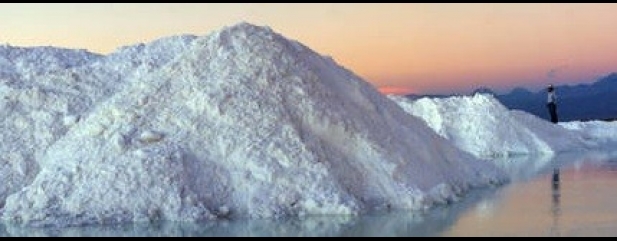

Lithium miner Bacanora prepares for substantial fundraise

Aspiring lithium producer Bacanora Minerals (BCN:AIM) is hoping to raise $450m which is more than two and a half times its current market valuation. The money will be used to build its Sonora lithium mine in Mexico.

Bacanora is currently valued at £125m ($174m). The mine will cost $419m to build, yet it is good practice for a miner to have a bit of extra cash in case of issues during construction.

Chief executive Peter Secker says $200m of the $450m target will come from debt financing. The remaining $250m will come from issuing new shares to investors in exchange for cash.

Secker is confident that half of the equity component will come from existing major shareholders including Igneous Capital, BlackRock, M&G and Japanese commodities trader Hanwa.

‘The rest of the money should come from investors in the US, London and the Far East,’ he says.

Chinese fund management group NextView was due to take a near-20% stake in the business in January in exchange for £31.1m cash. It also agreed to buy some production in the future. The financial transaction has yet to happen and Secker insists NextView’s involvement isn’t critical to Sonora’s near term development.

‘We were looking at them for stage two production; other parties have expressed an interest so we don’t see a problem if the NextView deal doesn’t happen,’ he adds.

Bacanora hopes to build Sonora’s plant by the end of 2019 and start testing equipment in early 2020 ahead of maiden production that year. (DC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Virgin Money results beat forecasts but doubts over ability to perform

- Lithium miner Bacanora prepares for substantial fundraise

- Greggs’ nourishing performance

- How did investors react to the latest batch of FTSE 100 results?

- Will there be a bidding war for Sky?

- RIT Capital Partners reveals stellar gains since 1988’s flotation

- Triple Point eyes listing upgrade and £200m new cash

- IntegraFin to be valued at c£650m at IPO

- Threads expert Coats impresses on margins and profit guidance

- Productivity growth hits its highest rate since the financial crisis

magazine

magazine