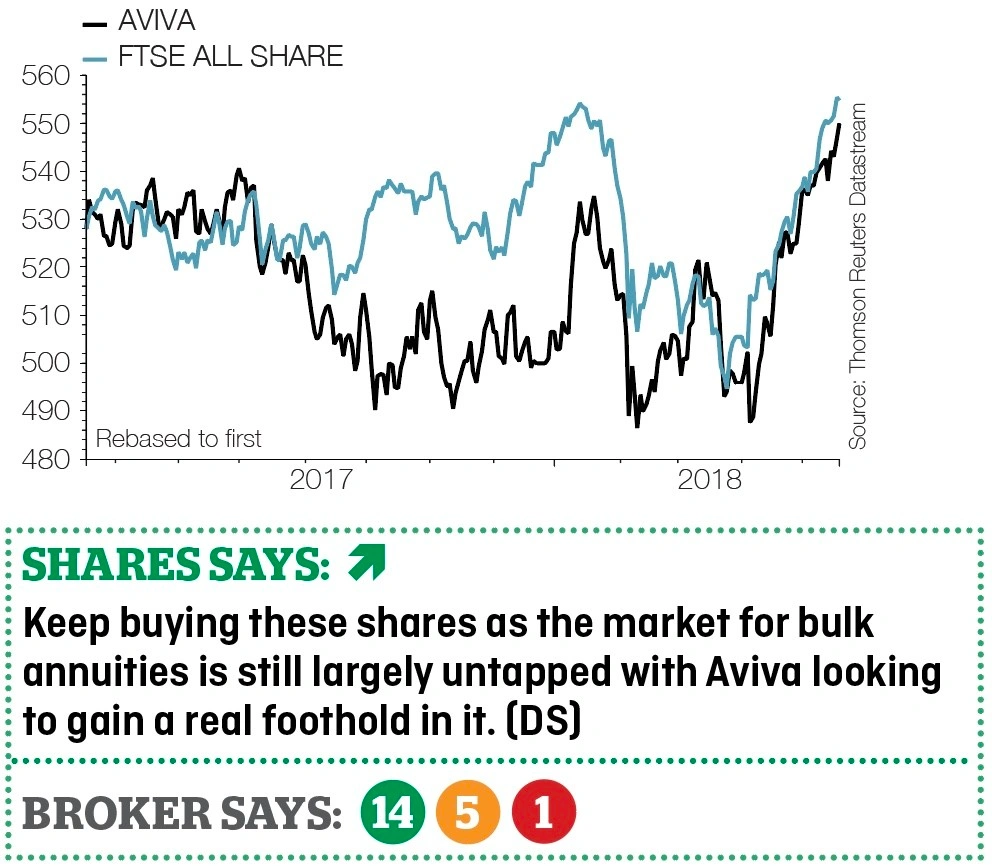

Aviva (AV.) 550p

Gains to date: 8.1%

Life insurance giant Aviva (AV.) has an advantage when it comes to rivals in the purchasing of large books of annuity business. Given the company is a conglomerate; it already has relationships with some of its targets.

For example, take the recent headline-grabbing £925m purchase of Marks & Spencer‘s (MKS) bulk annuity, a deal more than 50% larger than its next biggest transaction, the Pearson Pension Plan which cost £600m last October.

Aviva already provided health and general insurance cover for M&S employees, as well as travel insurance to M&S Bank’s retail customers.

Credit quality is paramount for annuity deals, as any mischief when it comes to pensions brings the wrath of the Government and the media alike. This is an area in which Aviva shines, having an AA credit rating.

This makes a huge difference when it comes to persuading the pension trustees as to which institution is the most financially sound to handle the assets. Peter Kett, analyst at investment bank Jefferies, says this status gives Aviva an advantage over its unrated and unlisted peers Rothesay and PIC.

‹ Previous2018-05-24Next ›

magazine

magazine