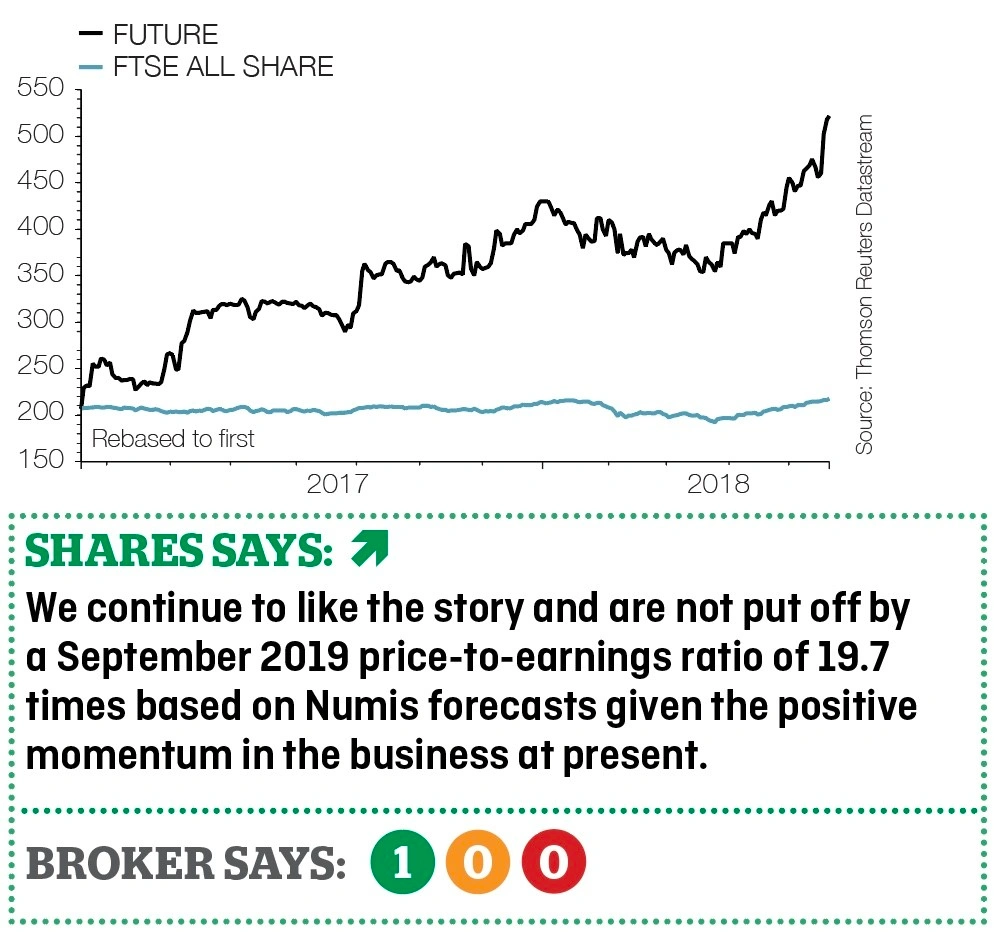

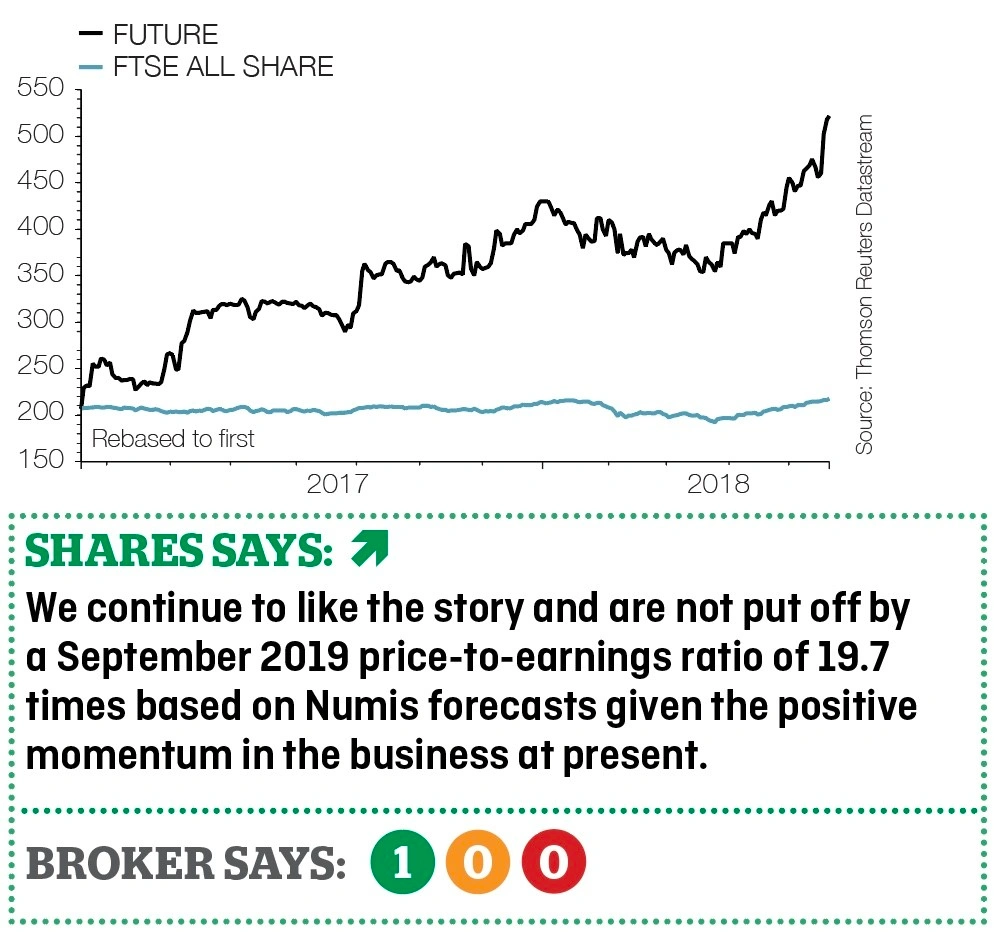

Future (FUTR) 520p

Gain to date: 31.7%

The continuing transformation of specialist media outfit Future (FUTR) is reflected in an impressive set of first half results (17 May).

Well-known titles in Future’s portfolio include Techradar and Total Film. Having developed a transferable platform, the company’s strategy under chief executive Zillah Byng-Thorne has been to monetise its specialist content through e-commerce, licensing and digital advertising.

The company is looking to make acquisitions of other publishing assets which can be fed into this model.

Revenue in the Media division was up 62% to £26.2m, taking it to over 50% of total group revenue.

Research group Edison says Future’s opportunity for growth in the US is ‘particularly attractive’. It adds: ‘Monetisation of the US audience is improving, but is still a long way below that of the UK. (The recent acquisition of) Newbay Media adds further diversification of the revenue base, introducing B2B opportunities in information and events.’

Finance director Penny Ladkin-Brand confirmed to Shares that the business will still consider a dividend payment for the September 2018 financial year.

‹ Previous2018-05-24Next ›

magazine

magazine